Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

As a strategist, I work with financial advisors every day creating custom fixed income portfolios based on client’s financial needs and goals – with a keen eye on the importance of a balanced portfolio. Two major roles exist in reviewing those goals and needs: growth assets (equities, MLPs, real estate, businesses, etc.) to expand wealth and conservative/protective assets (fixed income) to keep your wealth intact. This still holds true. This is the constant when everything else may not be constant such as changing interest rates, cash flow projections, demand shifts, economic conditions, etc.

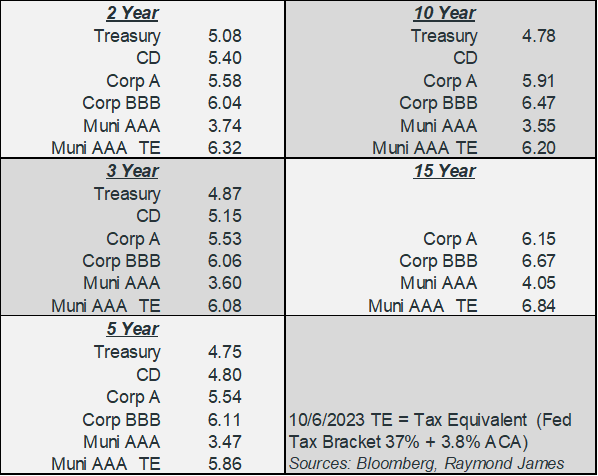

Right now is no different except you get to capture a potential dual benefit. Fixed income continues to serve its purpose protecting your wealth and balancing your growth assets. In addition, individual bonds are providing an income opportunity. Yields are higher than they have been in over 16 years. Investors have the opportunity to lock into “growth-like” yields. For instance, the average annual total return of the S&P Index since the turn of the century (23+ years) is 6.66%.

In addition, should the Fed change direction with monetary policy, and/or the economy slip into a recession, it is likely that interest rates will fall. When interest rates fall, prices go up, thus potentially providing positive price appreciation on fixed income assets added to the portfolio during this high interest rate environment.

Most fixed income portfolios are set up for long term strategic purposes. There is no need to try to time the exact entry moment when this current rate environment is providing growth-like returns. Also, use short term opportunities when short term liquidity needs are there. If there is no need for liquidity, extend out on the curve. Lock into rates for longer. You never know how long it may take for rates to provide these opportunities in hand right now.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...