Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

“What’s the best bond available right now?” Questions along these lines are very common and appear very straightforward, but unfortunately, the answer is not so clear. There is no “best” bond, because no two investors are identical. The best bond for one investor might not be appropriate for someone else. Determining your purpose or objective for purchasing fixed income will help guide your decision on what the “best” bond is for you. Depending on what this purpose is will determine which characteristics of a specific bond are most important and which are likely secondary.

In a perfect world, we would all be able to buy AAA rated bonds, yielding 10%, and priced at par. Unfortunately we live in the real world and have to take a look at what the market is giving us and decide as to what qualities are most important to us when choosing the “best available” investment. Below are a few of the more common reasons that investors allocate money to fixed income, with a brief discussion underlining what is likely most important for each objective.

Cash Flow

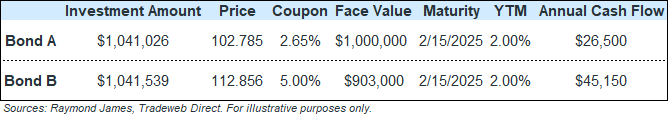

For investors with a top priority of cash flow, coupon is likely one of the most important features when looking at bond offerings. The coupon tells an investor how much cash flow a bond will produce (coupon x face value = annual cash flow). For example, the two bonds below both yield the exact same thing, meaning that an investor will earn the same amount of income in each bond. The difference between the two is the coupon, meaning the main differentiator is timing of cash flows. Bond B, which has a 5% coupon distributes more cash along the way ($45,150 in annual cash flow) and less at maturity ($903,000), while Bond A, with a 2.65% coupon, has considerably lower annual cash flow ($26,500) but distributes more at maturity ($1,000,000). For an investor that needs cash flow to fund a retirement lifestyle, Bond B is going to support that fixed income need much better than Bond A.

Click here to enlarge

Sources: TradeWeb Direct, Raymond James.

Income

Not to be confused with cash flow, which is cash distributed, income is money earned on an investment. With individual bonds, the yield tells an investor how much they will earn annually if they purchase a bond and hold it until maturity. For an investor who simply wants to “earn” the most money, yield should be a primary focus. Whether a bond has a high coupon and is priced at a high dollar price or a bond has a low coupon and is priced at a low dollar price, it is the yield that determines income. Remember that price and coupon are both “inputs” into the yield equation, so analyzing the yield is already factoring in the price and coupon of a bond. Maximizing yield by increasing risks may not be something that most investors will want to do with their fixed income allocation, so staying within your risk parameters is of utmost importance. Be careful not to set arbitrary restrictions on dollar price or coupon levels, as these limitations may not reduce risk but oftentimes eliminate a large percentage of viable options.

Principal Preservation

An investor with a primary objective for their fixed income allocation of preserving their principal is going to focus first and foremost on credit quality. Credit quality should take precedence over yield. In determining the goals of your fixed income allocation, never sacrifice a primary objective for a secondary objective. For example, if principal preservation is the primary concern and earning income is secondary, reaching into lower credit quality bonds simply because you are not satisfied with the yield in higher quality offerings is counter to what you determined your objectives are. You are putting the principal preservation goal at risk to achieve higher income. Always remember why you are putting this portion of your portfolio into fixed income and make sure your priorities remain intact.

Total Return

If total return is your primary objective, you are likely an outlier in the fixed income space. Most investors’ money is allocated to fixed income with some combination of the prior three objectives, while total return money is generally allocated to traditional growth assets classes, such as equities. That being said, fixed income total return strategies are not uncommon for investors who want to allocate some of their “growth dollars” to the fixed income market. Total return fixed income allocations involve a market timing strategy. In trying to time the market, an investor will purchase a bond based on some reasoning that the price will appreciate and they will be able to sell at a profit. This could be based on any number of hypotheses, ranging from general interest rate or spread movement to sector outlooks to M&A speculation. In looking for offerings to fit a total return strategy, there is no single thing to focus on, as it really comes down to an individual investor’s theory on what could make a specific bond appreciate in price.

Whatever your fixed income objective is, there is no single data point that is going to provide all of the answers. All investment options should be analyzed holistically to make sure that it fits both the objective and the risk-tolerance for each unique investor. A primary benefit of a portfolio of individual bonds is that it can be customized specifically to each investor to help them achieve their goals. Ask your advisor for a customized fixed income portfolio tailored to your needs.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...