Read the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- ‘Jazzed up’ stimulus seeks to save small businesses

- US consumers will not go ‘parading’ back into crowds

- Info Tech & Health Care poised to ‘hit a high note’

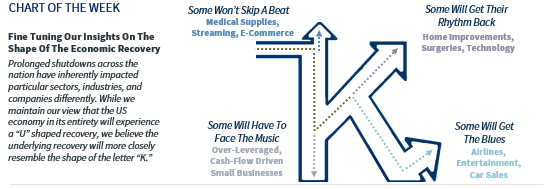

If it were not for the COVID-19 outbreak, the city of New Orleans would be in the midst of celebrating its 50th Jazz & Heritage Festival. It takes something extraordinary to keep the Big Easy from hosting this iconic musical and cultural event; not even the devastation from Hurricane Katrina could cause its postponement. Unfortunately, the economic and human toll that this pandemic has spread has forced the cancellation of this Jazz Fest for the first time in its five decade history. In an ideal world, the eventual reopening of the US economy and global economy will hopefully have all of us cheering “laissez les bon temps rouler” (let the good times roll). However, while we expect the US economy, in aggregate, to experience a “U” shaped recovery, we cannot ignore the fact that this prolonged shutdown has inherently impacted sectors, industries and companies differently. Therefore, as we ‘fine tune’ our insights for the underlying recovery, we believe it will exhibit more of “K” shape.

- Some Will Have To ‘Face The Music’ | Congress and the Federal Reserve have both sought to ease the detrimental impacts felt by small businesses. The Phase 3 stimulus bill was the initial measure taken to launch $350 billion in loans to business owners seeking to meet payrolls and cover overhead expenses. As it became clear the funds would be exhausted, the Fed announced $600 billion in supplementary lending as well as term financing for institutions supporting the Payroll Protection Program (PPP). Even still, it was clear the need far exceeded the aid provided, leading Congress to expedite the passage of a supplemental package that provides an additional $310 billion. Despite this substantial level of relief, some small businesses, particularly those that are highly leveraged, may still have to file for bankruptcy. Across the ~28 million small businesses, only ~1.7 million loans have been originated, and the average loan size of ~$206,000 suggests that the mom-and-pop shops have not been major recipients. We wish all businesses could outlast the outbreak, but regrettably, not all will be able to ‘hit the right note.’

- Some Will ‘Get The Blues’ | Even after all states have fully reopened, psychological barriers will prevent certain industries from joining the initial rebound parade. With more than 90% of all citizens practicing social distancing since March, not all consumers will be quick to board airplanes, dine in crowded restaurants, or purchase tickets to cheer on sports teams in packed stadiums. This will be especially true in the absence of a vaccine or in the event that therapeutic developments are stalled. After sheltering at home for many weeks, we’d like to think that the bells to reopen would be music to everyone’s ears, but the fears surrounding COVID-19 will remain. There is also the realization that the 26+ million workers that have been forced to file for unemployment will need to return to work before considering major discretionary spending, such as the purchase of a new vehicle. As a result, while these companies will likely see their business recover, it will take some time to develop.

- Some Will ‘Get Their Rhythm Back’ | Sectors of the economy that are not as reliant on consumers being in large crowds or within close proximity of one another will be quick to benefit from pent up demand once restrictions are lifted. Many individuals have postponed expenses such as elective surgeries, and many more will likely seek to ‘jazz up’ their homes after spending so much time there over the last several weeks. This prolonged time away from the workplace has also led people to realize the importance of technological upgrades given the increasing demand for speed, power, storage and applications.

- And Some ‘Won’t Skip A Beat’ | The essential businesses or subsectors of our economy that have remained open during the outbreak have and will continue to grow. E-commerce has allowed households to obtain necessary items while remaining safe at home, streaming services have provided entertainment without the risk of being in a crowd, and videoconferencing has made telework and connecting with friends and loved ones a reality. The need for medical supplies and devices has been well-documented. As a result, these companies should continue to benefit even as we return to more normal economic conditions.

In sum, the collective actions taken by policymakers will position the US economy for a “U” shaped rebound in regard to the overall economy and GDP figures. But in the near term, not all industries and businesses will return to operations at the same pace and magnitude. Given the dichotomy in the rebound potential of companies across the economy, selectivity is important. The upper side of the “K” is biased toward Technology and Health Care, which have been two of our favorite sectors.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...