Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Senate election may come down to two states

- Gridlock is not necessarily better for equities

- Fundamentals more critical than political composition

Your voice, your vote! There are only four days remaining until Election Day, but more than 33 million voters have already voiced their choice. As the contentious midterm election season enters its final stretch, enthusiasm seems to be apparent from both parties. By this time next week, the outcome will hopefully be known (pending no need for run-off elections), and the months of campaign calls, debates, and rallies will be behind us once again. But even though the nation and investors are anticipating the results, there will still be many unanswered questions even after the outcome is known. Before voters head to the ballot box, here’s our early take on how the election outcome could impact the economy, the performance of the various markets, and the legislative environment in Washington D.C. for the next two years.

- The Results | It appears as though we are heading for gridlock. A close look at the details of the race make it understandable why the betting markets are giving Republicans a healthy 90% probability of winning the House. Of the 435 seats open, 212 are polling solidly Republican which means they only need to secure six of the 33 toss-up seats. Ultimately, we foresee a small Republican majority of 10-to-15 seats. In comparison, the Senate is a toss-up in and of itself and will be a nail-biter. Because there are fewer seats up for election — only 35, candidate selection is critical. Currently, PredictIt gives the Republicans a 73% probability of winning the Senate. If you look at the specifics, either the Republicans or Democrats would need to win three of the battleground states to win. Currently, the polls suggest the Republicans are winning two — Nevada and Wisconsin — and the Democrats are winning one — Arizona. That leaves two — Pennsylvania and Georgia — to once again to decide who controls the Senate.

- The Impact | Investors are anxiously anticipating the midterm election results, but what they really want to know is how the outcome will impact the developments down in Washington D.C. and the financial markets for the next two years.

- What Is The Potential For Policy Risk? | Even if the Republicans only win the House, the probability that some of President Biden’s major legislative agenda items (e.g., tax increases for corporations, individuals, and estates) will be enacted would diminish. While this would reduce policy risk, there could be room for compromise. President Biden is a self-proclaimed negotiator, and if he decides not to run for a second term, he may be more inclined to reach across the aisle to accomplish at least some parts of his agenda and build his legacy rather than let the next two years slip by.

- Could A Debt Ceiling Showdown Lead To A Shutdown? | Given that Republican candidates campaigned on fiscal austerity, the debate over the debt ceiling may become contentious. There is a debt ceiling limit in place, and at the current rate it will be breached in the first quarter of next year. A split government increases the likelihood of a government shutdown, but the good news is that the fear is often short-lived and the equity market quickly rebounds from the initial volatility. In fact, history shows that in the one year following a shutdown, the S&P 500 has been up ~13% on average and has been positive 85% of the time.

- Do The Midterms Matter To The Equity Market? | History suggests they do. In fact, following the 19 midterm elections held since 1945, the S&P 500 has been up ~14% on average in the 12 months following and has been positive 100% of the time! But perhaps more important, these results are regardless of the outcome. Therefore, knowledge truly does seem to be power as just knowing the outcome reduces uncertainty and tends to be a positive catalyst for equities.

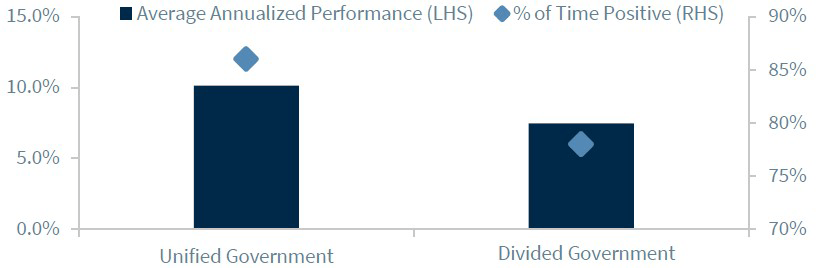

- Is Gridlock Good? | Conventional wisdom suggests that a gridlock scenario is the most beneficial for the equity market as it reduces the potential for major legislative changes such as tax increases. But surprisingly, since 1945, a unified government has actually seen stronger performance than a divided government (10.1% average annualized performance versus 7.5%). However, there is significant dispersion — particularly under a divided government. For example, we saw strong performance under divided government when Democrat Bill Clinton was president with a Republican Congress in the late 1990s. A vibrant expansion and tech run-up led to the S&P 500’s annualized return of ~22%. Conversely, there have been times of weak divided government performance, such as when Republican President Ford and a Democratic Congress oversaw rising energy prices and the mid-1970’s recession. As a result, the S&P 500 saw negative annualized performance (-22%). In our view, there is no debate that long-term investors should focus on the fundamentals. While it is important to look at the political composition of Congress, there are more important factors such as the state of the economy, the Fed’s intended policy path, the trajectory of inflation, and the resiliency of earnings growth when it comes to determining our equity outlook. However, it is natural for investors to question the influence that elections have on the market’s performance.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...