Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Retailers will discount to deplete the inventory glut

- Higher prices may hamper the consumer’s ability to travel

- Mismatch between rental price beliefs and reality

This week’s inflation releases are testing investor patience once again. While the September reports for both the Producer and Consumer Price Indices were hotter-than-expected, these prints have not altered our expectation for what lies ahead. If anything, the categories with notable, still rising price increases (e.g., rents) were not unexpected as they tend to be a lagging component. It is difficult to pinpoint exactly when the ‘official’ government-released inflation statistics will reflect the on-the-ground improvements we are detecting, but we still believe that a more consistent inflation easing will occur in the final months of 2022 and early months of 2023. We have outlined a five-step timeline that charted the path of how inflation would cool – an insight we shared during the summer – and revisit and update below.

- Commodities | Many commodity prices rose when Russia invaded Ukraine. However, since the initial invasion, commodity prices, more specifically energy prices, have eased as global growth concerns have mounted. In fact, the decline in oil (28%) and gasoline (22%) prices not only provided consumers with some much-needed relief but also contributed to inflation decelerating from its June peak. There is concern for the upcoming winter, as higher utility bills are likely. While the 25% increase in natural gas isn’t good news for consumers, the near double weighting in CPI for oil and gasoline should offset further natural gas gains.

- Goods | COVID-induced supply chain disruptions resulted in empty shelves and higher prices. As the economy achieved a sustainable reopening, many retailers misjudged how quickly demand for goods would shift to demand for services, resulting in an inventory glut. A prime example of how supply chains have improved? A year ago, the number of ships backed up at the ports off the coast of California was over 100. Today, there are only 6! It’s no wonder that retailers promoted summer sales and are kicking off the holiday shopping season even earlier. This week, Amazon hosted its second Prime Day, and the early results were rather lackluster — especially when compared to the July event. What does this mean for goods pricing? With consumers more price conscious and retailers remaining saddled with excess inventories, more discounting will likely be needed to entice spending. This is a positive not only for the consumer, but for reduced ‘goods’ inflation in the months ahead.

- Services | While headline inflation peaked in June, the pricing for services, particularly travel, was expected to accelerate until the ‘Summer of Revenge Travel’ came to an end. While many travelers desire to take additional trips in the next 12 months, some are balking at higher prices. In fact, a recent survey shows that a third of respondents had to cancel an upcoming trip due to higher costs. Even though many travel-oriented companies are expecting a robust holiday travel season, the uptick in prices for airfare, at hotels, and in restaurants may dim the ability and willingness to travel and lead to services prices decelerating.

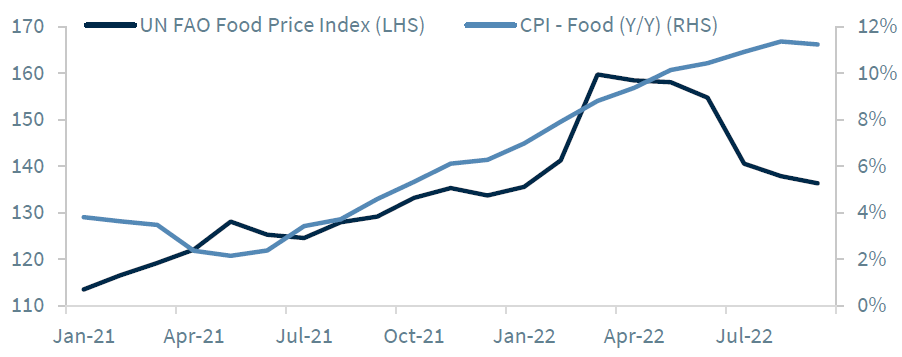

- Food | Despite CPI’s food inflation remaining stubbornly high, the good news is that the UN Food Price Index has declined for six consecutive months. There have been price improvements for beef, chicken, oils, and milk, but headlines surrounding droughts and continued fallout from the war have kept others elevated. Where will the reprieve come from? The UN is looking to fast-track inspections for Ukraine’s grain shipments. American farmers are judiciously adjusting or substituting crop choices to benefit from supply constraints. As a result, supply and demand should begin to normalize, and at a minimum, slow the pace of food price increases and favorably impact grocery bills and restaurant costs in the fourth quarter and early part of 2023.

- Rents | CPI’s Owner Equivalent Rent growth posted its largest monthly increase since August 1990. However, given that rent prices typically lag the move in housing prices by approximately one year, the recent housing market weakness should be reflected in rents by mid-2023. Already, real-time Redfin data shows the year-over-year pace of rent growth halving (9% in September vs 18% in March). What is the disconnect? The CPI survey asks homeowners how much they believe they can rent their home for (personally something most of us do not keep accurate tabs on!) versus Redfin’s actual current asking price for rentals.

Bottom Line – Asynchronous Easing Of Pricing Pressures | Inflation is likely to decelerate, but it will occur in a multi-stage process. On a positive note, the next two months are likely to see the year-over-year pace decline. Why? Favorable comparables. For example, the headline CPI index will ‘roll-off’ the two hot monthly inflation prints seen in October (+0.9%) and November (+0.7%) of last year. Hopefully, that will be the start to a consistent downward trend in inflationary pressures. Fingers crossed!

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...