Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Anticipating a mild recession in 2023

- The third quarter 2022 earnings season could be better than feared

- Inverted yield curve has us focusing on quality

Are you ready for some football? Not American football, but European football — otherwise known as soccer! For the five billion spectators awaiting the start of the 2022 World Cup in Qatar this November, the sport is the epitome of speed and agility. But for the players on the 32 participating teams, it is so much more. It is years of training to perfect field awareness and anticipation. It is making decisions not only quickly, but under pressure. The World Cup coincides with a time of significant awareness and anticipation in the markets, and investors are questioning their decision making in the midst of so many unknowns. Will the economy enter a recession? How high will the Fed raise interest rates? When will inflation abate? As we enter the final quarter of 2022 and look to the months ahead, navigating these markets will prove to be a time for finesse, and we will borrow from the sport of soccer to articulate why.

- We May Not Want The Fed To Win The Golden Boot | In the World Cup, the top scoring player is awarded with the Golden Boot, and if there was such an award for tallying interest rate hikes, the Federal Reserve (Fed) woulddefinitely be in contention. However, investors want to see the Fed as a well-rounded player — not only scoring rate hikes to tame inflation but also defend against the feared end of the economic expansion. The Fed’s third consecutive 75 basis point interest rate hike lifted rates well into restrictive territory, and the further the Fed moves above the 4% threshold the greater the likelihood of a recession. Since our peak fed funds forecast is 4.5%, we are anticipating a mild recession beginning in the first quarter of next year. However, we do not think the economy will experience a severe recession as there are no ‘excesses’ like the excessive leverage, over hiring (we still have over 10 million job openings!), or bubble-like valuations (e.g., dot.com and housing bubbles).

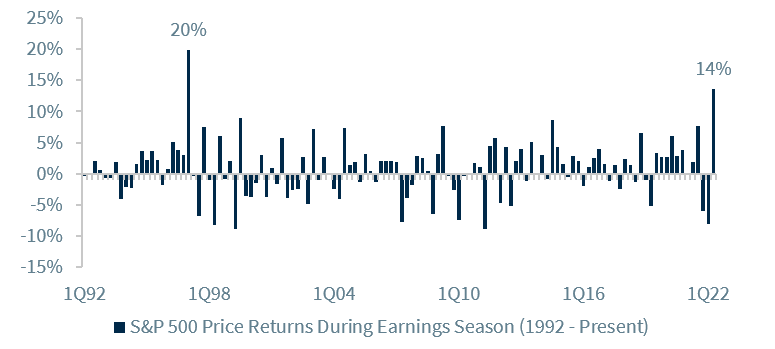

- A Hat Trick Of Catalysts Could Support Equities | It has been a challenging year for equity investors, as the S&P 500 just notched its third consecutive negative quarter for the first time since 2009’s first quarter. While the Index has rallied 4.5% since retreating to the lowest level since November 2020 and setting a new low for this bear market, it still has some lingering injuries to recover from as inflation, higher interest rates, a stronger dollar, and downward earnings growth revisions are all headwinds. However, the good news is that many of these risks are already priced into the market – even the risk of a recession as the equity market is forward-looking. More good news? There are three key factors that could help equities achieve a sustainable rally. First, and perhaps the most desired among investors, inflation could ease and begin to shift the Fed’s aggressive stance. Second, the upcoming third quarter earnings season may be better-than-feared and become a positive spark for the equity market just as the second quarter results were. And lastly, there are some positive seasonal trends, particularly revolving around the midterm elections. In fact, in the last 19 midterm elections, the S&P 500 has been positive every time in the 12 months following and has been up 14% on average. Years such as this test investor patience, but the S&P 500 could very well achieve our 2023 year-end forecast of 4,400.

- A Balanced Defense In Portfolio Management | The equity market is not alone in being penalized this year, as the fixed income market also just notched its third consecutive negative quarter — for the first time since the first quarter of 1980! And the last time that both of these markets did so simultaneously was over four decades ago. However, going forward, bonds ought to provide the intended defensive buffer should the economy begin to struggle, and yields fall. If there is a positive takeaway from the Fed’s recent action, it is that yields are attractive for the first time in years. While the 10-year Treasury has eased from its recent ~4% peak, a yield of 3.75% is quite compelling for investors who have been told there is no alternative to equities for the past several years. Our view is that the 10-year Treasury yield will ease from this peak further (year-end targets — 2022: 3.25% and 2023: 3.0%) as the economy slows and inflationary pressures ease. As tempting as high yield bonds may be with yields near 9%, the recession risk and the inversion of the yield curve has us focusing on quality — whether that be Treasurys, investment grade bonds, or municipals.

- Please join us for our upcoming webinar ‘Quarterly Coordinates – A Time For finesse’ on Monday, October 10, at 4PM ET. This presentation will provide comprehensive coverage of our outlook for the economy and major asset classes (including update targets) as we end 2022 and move into 2023. Click to register: https://go.rjf.com/QC4Q22.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...