Read the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Economy will get a ‘spring in its step’ once virus is curtailed

- Stimulus measures to help nation ‘weather the storm’

- Earnings season will not be ‘all roses’ due to virus impact

While we still hope “April showers bring May flowers,” more so we are wishing that “April distance will bring May existence”—so continue social distancing! The US quickly became the epicenter of the outbreak, and now more than 315 million Americans across 42 states are sheltering-in-home in hopes of mitigating the COVID-19 spread. Due to the prolonged necessity of social distancing, the likelihood of a quick V-shape recovery for the economy has been ‘swept away’ as the realization sets in that it will take time for citizens to return to work, consumers to feel at ease in public areas again, and businesses to resume normal operations. But just like any other, this COVID-19 storm won’t last forever, and once our standard ways of life are ‘renewed’ we remain optimistic that the US economy will get a ‘spring in its step’ once again. Policymaker action has been supportive of this belief, and forward guidance from this earnings season should provide additional insights.

- Policymakers ‘Planting The Seeds’ For Recovery | A bi-partisan Congress swiftly approved the Phase 3 stimulus package. While these measures were record-setting and substantial in their own right, some of the addressed areas of concern are already in need of additional aid. For example, the Payroll Protection Program (PPP) which seeks to help small businesses cover overhead expenses and retain workers, has seen exorbitant demand. Congress originally funded the program with $350 billion, but within the initial days of its rollout, the Small Business Administration administered over 380,000 loans for a value of ~$100 billion. With the fear of the initial funds being exhausted, the Treasury requested an additional $250 billion (to bring the total to $600 billion) from Congress. Democrats countered with a $500 billion proposal with additional funding for hospitals and state and local governments. Due to the urgency of the matter, we expect accelerated negotiations and a deal to be agreed upon in the next week or so. Separately, the Fed unveiled $2.3 trillion in additional programs to bolster the economy, including a lending program aimed to benefit businesses as well as state and local governments. Our belief is that policymakers will take the necessary actions to help consumers, businesses, frontline responders, and local governments ‘weather the storm’ until the economy can return to some form of normality, which we believe will occur by Memorial Day (40% chance) or July 4th (80% chance).

- Earnings Season Will Not Be In ‘Full Bloom’ | Given the speed and severity of the economic impact, earnings season (which begins next Tuesday with some of the big banks reporting) is set to be very challenging as earnings growth is likely to be negative and near-term visibility for most companies will be clouded or even suspended. The biggest question for investors will be whether this is a temporary COVID-19-induced interruption that should see a sharp rebound after the virus dissipates or if there is permanent damage to the longer-term earnings power of companies. As a result, while current earnings will be important to assess some of the underlying trends, more focus is likely to be placed on the potential for 2021 earnings, a time period that will hopefully have a more normal economic environment. A couple of things we will keep an eye on this quarter include:

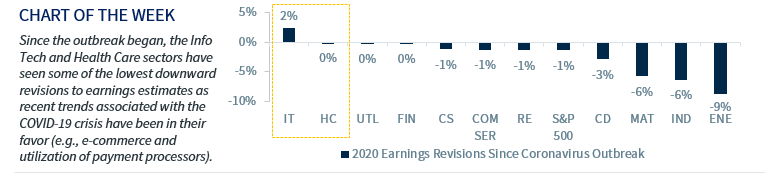

- There will be a bifurcation in earnings growth across sectors and intra-sector. Some sectors like Health Care, Utilities and Consumer Staples have likely had resilient earnings growth given the necessity of their products and services. In comparison, cyclical sectors such as Energy and Materials, will be significantly negatively impacted by the shutdown in economic activity.

- Intra-sector, within the Consumer Discretionary space, e-commerce and home improvement companies are likely to see better results than brick-and-mortar retailers and restaurants which have seen closures.

- Technology and Communication Services will see whether their diversification of services (streaming, gaming, cloud, etc.) can offset some of the weakness in their other product areas. Focus will be on the timing of the 5G rollout later this year.

- In addition, dividends, buybacks, capital expenditures, and margins will be in focus. Attention will also be on the recent interactions with China in regards to supply chains and sales as that country has begun to emerge from its COVID-19 crisis.

- Global Oil Industry Hoping A Truce Will ‘Blossom’ | With OPEC+ leaders meeting today and with G20 oil ministers meeting tomorrow, the global oil industry remains hopeful for a production cut agreement, but a willingness to come to the negotiation table appeared to be the only consensus. The two divergences appeared to be US participation and the baseline level for the cut. Russia was firm that the US should implement its own production cuts, but the US countered that it was unwilling to intervene in the private markets and that its companies have naturally, gradually been reducing output as capex cuts have been announced. Russia also believed that the production levels from the first quarter of this year should provide the baseline for the planned cuts, while the Saudis wanted to use levels from this month, which of course are significantly elevated. Given that current price levels are unsustainable for the industry as a whole, we maintain our view that the price war will come to an end, but acknowledge that continued pressure on the demand side due to the prolonged COVID-19 outbreak will weigh on oil prices in the near term.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...