Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Fed completes the third consecutive 0.75% rate hike

- Increased probability of a recession in 2023

- Recession is not expected to be severe in nature

Since the August Jackson Hole Symposium, the Fed has cautioned that the tightening cycle was far from over and that “some pain” would be ahead for the economy. If that message hadn’t been fully received, Wednesday’s Fed proceedings made it crystal clear. Even though the narrative of the FOMC (Federal Open Market Committee) statement shifted only slightly, it was the increase in the terminal rate (e.g., potential peak) forecasts for 2022 and 2023 from 3.4% and 3.8% to 4.4% and 4.6% respectively that got the markets’ attention. These adjusted projections not only signaled that rates will move well into restrictive territory, but that the rate hike story will extend into 2023. As we stated last week, taking rates to 4.5% or higher would increase the probability of a mild recession next year. Here are our areas of concern:

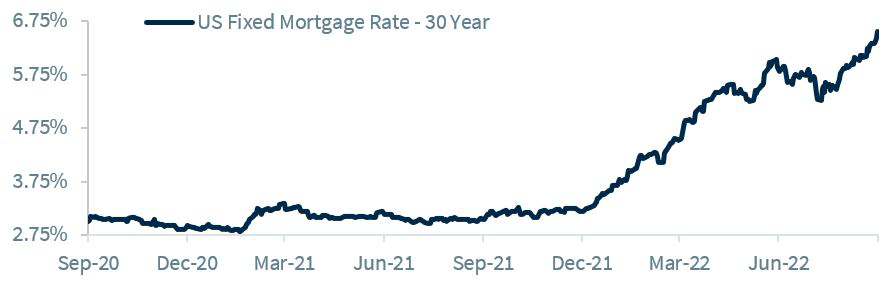

- Housing Market Headed For A Slowdown | In the aggregate, tighter monetary policy typically acts on a lag. But for the more interest-rate sensitive sectors of the economy such as the housing market, signs of a slowdown are already occurring. The days of bidding wars, all cash offers, and purchases of homes sight unseen are fading as the 30-year fixed mortgage rate has soared above 6.5% for the first time since 2008. As interest rates climb, builder sentiment continues to decline. In fact, building permits just experienced the largest decline since the pandemic, reaching the lowest levels since June 2020. From the Fed’s vantage point, some of this bad news is good news, as it shows that higher rates are cooling the once exceedingly hot housing market. Shelter costs, which have been a culprit of persistent inflation and traditionally lag home prices, should ease in the year ahead. But while this may all be welcomed news for the Fed, it is not a positive for GDP. Think about all the spending that accompanies the purchase of a home, or what are called the indirect effects generated by the housing market: realtor costs, repairs, enhancements, furniture, electronics, etc. While we do not foresee a housing correction the likes of the Great Recession due to the higher quality of outstanding mortgages, the contraction in housing activity will likely weigh on the economy.

- Setbacks From A Stronger Dollar | The euro, yen, and pound are at the weakest levels relative to the US dollar since 2002, 1998, and 1985 respectively. For Europe and the UK, this has exacerbated elevated energy costs as key commodities such as oil are priced in dollars. For Japan, its central bank was forced to intervene in the foreign exchange markets to prop up the yen for the first time since the Asian Financial Crisis. But while a stronger dollar complicates economic circumstances for these developed nations, it is not without consequence in the US. Yes, the strength of the dollar greatly reduces the cost of imports, which in turn helps abate inflation. However, it hampers our export activity as our goods become more expensive overseas. It also poses a challenge to multinational corporations, especially those who derive a substantial portion of their revenues overseas. Already, many large tech firms have indicated that earnings would take a greater than previously expected hit due to exchange rates. Since the US economy remains stronger on a relative basis, the dollar’s strength should remain intact in the months ahead.

- Suppressed Sentiment May Curtail Spending | Next week, the September report for Consumer Confidence will be released. Since the survey does not account for the events of this week there may be improvement, but elevated risk of a recession will likely keep confidence depressed in the months ahead. This is an inopportune time for sentiment to be challenged, as the critical holiday shopping season is just around the corner. There are already indications that the holiday season won’t be as impressive as years past, with sales volumes, not the dollar amount, expected to decline on a year-over-year basis and seasonal hiring weaker than the prior year. If sentiment weakens further, consumer spending may be pressured moving forward.

- Higher Heating Bills Hurt The Consumer | While the energy crisis is more acute in energy-dependent Europe, elevated electricity bills are also problematic in the US. Approximately 20 million Americans are currently behind on their energy bills, and as of June the outstanding balance was ~$16 billion in aggregate. That is before the worst of the heat (July and August) and the colder temperatures that will be here before we know it. While commodities fall outside of the Fed’s control, the inflationary impact does not and may force the Fed to continue tightening in an environment where consumers are already strapped.

- Bottom Line – The Makings For A Mild, Not Severe Recession | The last two recessions—the Great Financial Crisis and COVID-19—were severe but caused by ‘Black Swan’ events. However, if we have a recession (75% probability of a mild recession and 20% of a severe recession in 2023), there are two reasons it is likely to be mild. First, there are no ‘excesses’ like a housing or dot.com bubble. Second, the current level of job openings (two per every person unemployed) will reduce the likelihood of significant layoffs. Given that total employment remains below pre-pandemic levels, hiring freezes are the more likely scenario. That is why our base case for the US economy includes a mild recession lasting from the first through the third quarter of next year.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...