Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Weaker euro compounds pricing pressures

- Energy prices prolonging Europe’s inflation peak

- European economy inching closer to a recession

Traffic signs provide critical information to drivers—indicating what to expect up ahead, creating order on roadways, and hopefully ensuring safety. For much of this year, the global economy has seemed to be at a ‘Recession Crossroad,’ with the weight of inflation and central banks’ responses to escalating price pressures leading many to conclude that a recession was the near-term destination for many developed economies. While we never merged with these expectations when it came to the US economy, recession risks loom in Europe as there are a number of hazards (e.g., weakened euro, still soaring inflation and an ongoing energy crisis) on the region’s route. In light of these challenges, below outlines why investors should exercise caution when investing in European equities in the months ahead.

- The ECB Is Entering A Work Zone | While the Federal Reserve (Fed) has its fair share of challenges, the European Central Bank (ECB) is faced with a different set of dilemmas. In the US, inflation is improving (in aggregate) and likely beyond its peak as recent commentary from corporate earnings suggest that the economic outlook may be better than feared. On the contrary, supply shocks continue to plague the euro zone economy and inflation pressures are showing no signs of abating with nearly half of the EU countries already experiencing double-digit inflation. Rapidly rising inflation caused the ECB to halt its bond buying program, lift interest rates by 50 basis points last month—its first rate hike in over a decade—and launch a crisis tool to counter rapidly rising interest rates and widening sovereign spreads. While the ECB is forecasted to raise rates by a similar magnitude in September, the European economy is inching closer to a recession for the following reasons:

- Currency On A Divided Highway | The euro has broken parity with the dollar, falling ~12% year-to-date to reach its weakest level since 2002. On one hand, the weaker currency makes its goods more competitive in the global market and will likely boost last year’s record ~$400 billions of exports to the US. But on the other hand, it means a higher price paid for imported goods which will continue to pressure inflation to the upside. Just as important, a weaker euro compounds the upward pressure on key imports such as oil—which is priced in dollars. This has caught the attention of the ECB, which has led to further upward pressure on interest rates as the inflation dynamics and outlook for growth take a turn for the worse.

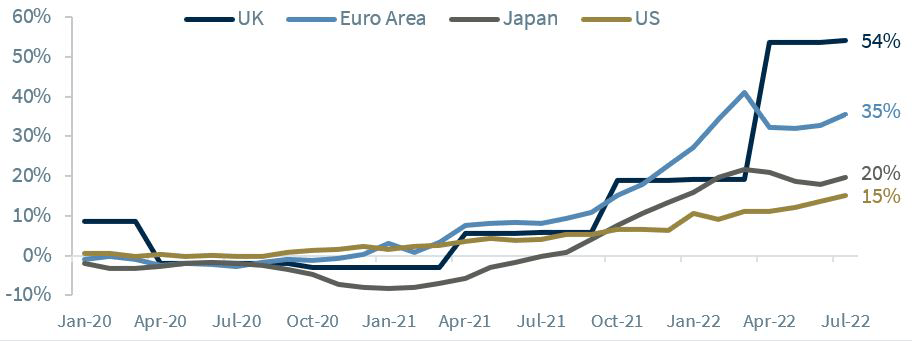

- Energy Prices A Blind Corner | Energy prices in Europe reflect panic. Between Russia constricting supply, the announcement of additional Nord Stream maintenance closures, and heat waves and droughts limiting hydro and nuclear output, it’s not surprising that power prices are now ~13x the seasonal norm. Even before this recent surge, European household energy bills were up 35% year-over-year in July (versus 15% in the US), and these bills are likely to move higher based on recent energy spikes and proposed usage levies. For example, Germany’s new levy allows energy importers, who are working to replace Russian supply, to pass along some of the higher costs. This per kilowatt-hour usage fee for natural gas will cost households, on average, an additional ~500 euros annually. As bills skyrocket, European consumers continue to prepare for the worst-case scenario. Anecdotal evidence confirms that consumers have started to stockpile wood (imagine doing this during the summer heat!) and are purchasing stoves in hopes of staying warm this winter. Even beyond the consumer impact, Europe’s energy-sensitive industries are struggling as well. In fact, aluminum and zinc production have fallen by ~50% in the last year! While much of the focus has been on the consumer impact (both sentiment and spending capabilities), it is important to consider these broader economic and industry level impacts. Last month, the Euro Zone PMI Manufacturing Index entered contraction territory for the first time since June 2020 and the preliminary August report released this week showed further deterioration.

- Bottom Line – There Are Uneven Lanes In The Global Economy | For as much concern that has been voiced over the US economy, the situation is more dire in Europe. Next Wednesday, the euro zone will release economic sentiment, PMI manufacturing, and the all-important inflation report just ahead of the ECB’s next meeting on September 8. With energy prices yet to peak, Europe’s inflation reading is likely to set another multi-decade record and weigh further on consumer sentiment and business outlooks. As such, we continue to favor the US over Europe and other developed regions due to better economic prospects (e.g., a tightening cycle closer to completion, less sensitivity to the energy surge), evidence of corporations that are more resilient in times of distress, favorable profitability metrics, and more visibility in earnings forecasts.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...