Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The worst may be priced in for fed tightening

- Sentiment is likely to improve in the second half of the year

- Bear markets have historically provided buying opportunity

Everybody loves a discount. Whether it be an article of clothing, outdoor furniture, tickets to the theatre or your favorite food, a sale is likely to push a consumer to buy. However, whenever equities sell-off, or ‘go on sale’, investors question, and rightfully so, if it is a good time to buy if you have excess cash on the sidelines. This week, equities continued their recent decline, as the S&P 500 fell into bear market territory (a decline of over 20%), ending the shortest bull market (22 months) in the post WWII era. And while this was not our expected path for the equity market coming into this year (due to the Ukraine/Russia conflict, China COVID lockdowns, and aggressive global central bank actions to combat persistent inflation) the question for investors now is whether discounted equities are worth purchasing at current levels. We believe that there are five key reasons to consider:

- The Worst Priced In For The Fed? | The Fed continued its aggressive tightening process this week, as it raised interest rates by 0.75% at the June FOMC meeting—the largest rate increase since 1994.* Powell suggested that inflation developments (namely the May CPI report and an increase in inflation expectations) warranted a 0.75% hike rather than a 0.50% hike, and that the Fed will continue on the path of raising rates (0.50% to 0.75%) until there are sustainable signs that inflation is on a downward path toward its 2% target. As a result, the Fed is now projected to temporarily go above it’s ‘neutral’ rate (e.g., 2.5%) and administer more ‘restrictive’ policy through at least 2024 (2022 and 2023 year-end forecasts: +3.4%, +3.8%). We do not believe the Fed will need to be this aggressive. For growth, the Fed believes it can engineer a soft landing, as it projects near potential growth (+1.8%) through 2024. While the Fed lowered its GDP forecast but also raised its unemployment forecasts, this is not inconsistent with a soft landing as a similar environment occurred in 1994 when the Fed raised rates without pushing the economy into recession. So, if inflation moderates consistent with our forecast, this should allow the Fed to dial back expectations for future Fed rate hikes. One important data point to watch is the Fed’s favorite inflation indicator, PCE, that will be released on June 30th. Because of its composition (e.g., more health care and less rents), there are reasons to believe that it could show inflation decelerating.

- Supportive Earnings | While economic growth concerns dominate the market narrative, consensus earnings estimates have been resilient, and contrary to popular belief, continue to move higher. In fact, consensus estimates for both 2022 and 2023 S&P 500 earnings ($228 and $250, respectively) hit new cyclical highs this week. We expect earnings to remain positive and grow at least 6% in 2022. Equities should also be bolstered by positive shareholder-friendly actions as buybacks are at record highs and dividends are expected to grow 8% YoY in 2022. The 2Q earnings season ‘unofficially’ begins July 14 and thus far, early reports suggest earnings growth could once again be better than expected.

- Valuations Less Of A Headwind | Coming into the year, the S&P 500 traded at 21.5x forward earnings, which was in the 94th percentile over the last 20 years. However, as prices have fallen ~24% amidst a stable earnings environment, the NTM S&P 500 P/E (15.4x) is at the lowest level since March 2020 and below both the five- and 10- year averages.

- Sentiment Likely To Improve | A big threat to our positive economic forecast is depressed sentiment, as near record low consumer, CEO and investor sentiment could make a recession a self-fulfilling prophecy. Consumer sentiment is particularly troubling as it is lower than it was at the depths of both the Great Financial Crisis and dot-com bubble. Record high gasoline prices are overshadowing the nearly record low unemployment rate. As a result, oil prices remain the biggest wildcard and the reason why any potential federal gas tax holiday or US/Saudi oil production hike agreement could serve as a positive catalyst.

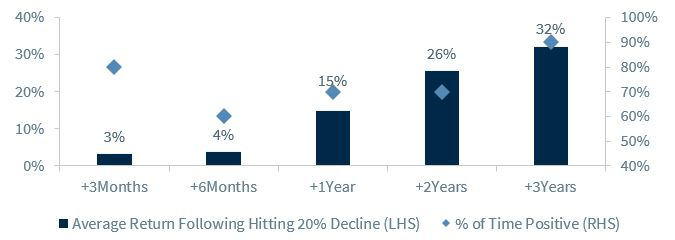

- History Portends Favorable Returns | It may be counterintuitive, but buying into a bear market has been a favorable trade for investors throughout history. In fact, in the 10 ‘bear’ market declines we have seen since 1950, if you bought on the day the S&P 500 crossed over a 20% decline, the S&P 500 has been up ~15%, on average, and has been positive 70% of the time in the one year following; and three years later (the more appropriate holding period for equity investors), the S&P 500 has been up 90% of the time and ~10% annually. The times that this strategy did not work include the dot.com bubble and recession in 2001 and the housing bubble and subsequent recession in 2008—severe recessionary environments that we do not see unfolding today.

Bottom Line | It has been an incredibly challenging environment to begin 2022. But our view is that the equity market has priced in a more pessimistic outlook than what we expect to occur. As a result, while it is impossible to determine a market bottom, with the S&P 500 down more than ~24%, we believe the discount provides a good entry point for long-term investors.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...