March 19, 2021

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The pandemic proved the resiliency of the economy

- Policymaker action avoided the worst case scenario

- Most asset classes have recovered pandemic losses

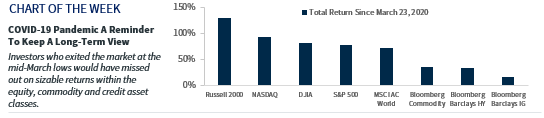

Tomorrow marks one year since California became the first state to declare a stay-at-home COVID mandate, with a majority of states following suit shortly thereafter. While the last 12 months will likely never be reflected upon with fondness, it is quite remarkable to review how the financial markets have rebounded since. The pandemic brought about many challenges, but it has resulted in tremendous knowledge gained too. The four biggest lessons learned during the pandemic are to have faith in policymakers, to not underestimate scientists’ ability to innovate under pressure, to appreciate the resiliency of the economy, and to remain committed to your asset allocation. From a financial perspective, that last lesson has been on full display as all the major asset classes have fully recovered from the pandemic-induced lows. Investors who panicked and exited at the market lows would not have been able to enjoy the many unprecedented rallies that have ensued since.

- The COVID-19 Landscape | The prospects of swiftly containing the spread proved to be unrealistic given the nature of the virus, as our nation has faced nearly 30 million cases, and at the height of the outbreak, the 7-day average of new cases was a stark ~260,000. Thankfully all COVID-19 trends have vastly improved since that juncture due in large part to the development of not one, but three effective vaccines. In fact, with the number of vaccine doses administered almost quadruple the number of COVID-19 cases, the realization of a sustainable reopening is within reach and some states have already started to rollback restrictions.

- The US Economy | The COVID-19 pandemic resulted in the shortest yet steepest recession in the post-World War II era, with GDP declining at an annualized pace of 31.4% in the second quarter alone. The drastic fall in economic activity was accompanied by a historic level of unemployment (14.7%) that the labor market is still in the process of recovering. However, due to policymaker intervention, Fed Chair Powell believes the economy was able to “avoid much of the scarring that we were very, very concerned about at the beginning.” In fact, the US economy ended 2020 only 2.4% below pre-pandemic levels, and the full recovery may be feasible by the end of the second quarter if the current upward trajectory continues. More important, these actions are setting up the US economy to experience the best year of economic growth (Raymond James 2021 GDP estimate: 5%+) since at least 1984.

- Monetary & Fiscal Policy Stance | The need for ongoing monetary and fiscal policy and monitoring has yet to waver, with the Federal Reserve now balancing uncertainty with the overall improving macroeconomic backdrop and with Congress now poised with the task of determining how much additional fiscal stimulus will be passed in an effort to “Build Back Better.” While the role of policymakers is far from over, substantial records have already been set by the actions undertaken thus far. After President Biden signed the $1.9 trillion Rescue stimulus package, the total of COVID-19-related fiscal stimulus increased to ~$5.5 trillion, which at this juncture, is ~5x the amount of stimulus passed in the midst of the 2008 Great Recession. The US budget deficit widened to the highest level since World War II last year, and is expected to remain at ~15% throughout 2021. On the monetary policy side, the Fed’s ongoing bond purchases have resulted in its balance sheet increasing to a historic high of $7.6 trillion.

- The Equity Market | The fastest bear market decline (-34% in 23 days) has been followed by what is on pace to become the largest 12-month rally in the post World War II era, as the S&P 500 has rebounded nearly 80% since the March 23 low. This historic rally has brought all the major indices—the Dow Jones Industrial Average, the NASDAQ, the Russell 2000, and the MSCI World Index to new record highs. While the Info Tech, Health Care, and Consumer Discretionary sectors were among the first to recover their COVID-induced losses, 8 of the 11 S&P 500 sectors have now fully recovered. While much of this rally has been driven by multiple expansion up to this point, our long-term positive view for the equity market is now founded in our expectation for a significant earnings rebound (2021 Earnings Forecast: $190), which should bring the S&P 500 to our year-end target of 4,180.

- The Fixed Income Market | As COVID-panic increased demand for low-risk assets such as Treasuries, the 10-year Treasury yield fell to a historic low of 0.50%, while investment-grade and high-yield spreads rose to 373 and 1,100 basis points respectively, the highest levels since the 2008 Great Recession. Rebounding economic growth and rising inflation pressures have reversed both of those trends. The 10-year Treasury yield has surged in recent weeks back to the pre-pandemic level of 1.72% while investment-grade and high-yield spreads have narrowed to pre-pandemic levels. As the more heavily impacted industries and sectors of the economy recover, the 10-year yield could rise to 2% by year end, where it stood early last year prior to COVID-19 fears emerging.

- Commodities | The Bloomberg Commodity Index has rallied ~35% from the mid-March lows, and recovered its pandemic-induced losses in early February this year as oil prices gradually returned to pre-pandemic levels (e.g., $60+/barrel) after reaching historic lows and even briefly turning negative at the height of the lockdowns. This asset class has also benefited from strength in industrial metals, as a faster than expected economic recovery has led copper prices to the highest level since 2011.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...