March 5, 2021

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- US may achieve inoculation ahead of schedule

- Business confidence may lead to increased capex

- Breadth of fiscal stimulus will support consumer spending

Daylight Saving Time begins Sunday, and while no one likes to lose an hour of sleep, we’re happy to be gaining additional daylight hours. But as the days get longer, and hopefully warmer, it’s hard not to think about what else we’ll be gaining in the not too distant future. President Biden has stated that the US will have enough vaccine supply to inoculate every adult wishing to do so by the end of May. And after reaching the one year anniversary since the World Health Organization declared the virus a pandemic this week, we are hopeful that the resumption of our normal activities will occur sooner rather than later. As it relates to our outlook, the vast improvements made in vaccine dissemination are just one of the reasons why there is substantial upside potential to our 2021 GDP forecast of 5.0%, which would mark the best year of economic growth since 1984. Therefore, we’ll discuss the entirety of our rationale as to why the US economy is poised to ‘spring forward’ in the months ahead.

- Vaccinations Should Put Severe Cases To Rest | The US reached a critical milestone on the vaccination front this week as ~10% of the population is now fully inoculated, and given that nearly 20% of the population has received the first dose, there is reason to believe 20% of the population will be fully vaccinated before month end. The number of vaccinations per day has increased drastically since the start of the year, with the per day count currently averaging ~2.2 million over the last seven days, and with a record 2.9 million vaccinations administered on March 6.* The possibility of additional vaccine candidates, such as Novavax, which may receive EUA as early as May if the FDA is willing to accept UK trial data, would further bolster the US vaccine supply. If the nation’s vaccination resources were not positive enough, Pfizer reported that its vaccine blocked 94% of asymptomatic infections and 97% of symptomatic infections in an Israeli study. We hope to keep celebrating these headline-making scientific feats, and if we are able to inoculate the majority of the at-risk population sooner than July (our original expectation), the achievement of a sustainable reopening ahead of schedule would provide support for economic growth above our base case.

- Mobility Indices Are Still Waking Up | Real-time indicators of economic strength continue to improve as seen by jobless claims (reported weekly) falling to the lowest level since last November.* Just as important, mobility indicators (some reported daily), such as air traffic, restaurant bookings and hotel occupancy, have defied most economists’ expectations that they would fall as new case levels spiked to begin the year. But contrary to expectations, each of these numbers has continued to trend higher. This bodes well for economic growth, as there has been a more resilient resumption of activity. With some states starting to reopen their economies, mobility data should rise further off the depressed levels from last year, resulting in better than expected economic growth. Surging ‘outsized’ growth over the next few quarters (e.g., our economist’s 2Q GDP is expected to be ~10%) is likely to lead to a transitory, modest uptick in inflation and interest rates. But the surge in economic growth that will drive the accompanying rise in inflation and interest rates for the ‘right’ reasons has caused our equity team to raise their 2021 S&P 500 earnings forecast to $190 (from $175) and subsequently lift their year-end equity target to 4,180 (from 4,025).

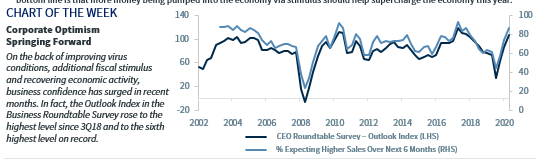

- Businesses No Longer Tossing & Turning Over The Trajectory Of The Economy | Confidence is a momentum builder for the economy as assured individuals and businesses tend to accelerate their spending while those feeling uncertain tend to ration their spending. In the Outlook Index of the CEO Business Roundtable Survey, corporate optimism surged, with the index at the highest level since the third quarter of 2018 and the sixth highest level on record. Expectations for future sales were strong, as 87% of participants expected higher sales over the next six months, well-above the historical average of 72%. Growing business confidence suggests businesses will invest in their futures and lead to a rebound in capital expenditures.

- Won’t Be Losing Sleep Over Expiring Benefits | As expected, President Biden officially signed the $1.9 trillion Rescue stimulus package, bringing the total of COVID-19-related fiscal stimulus to ~$5.5 trillion, which at this juncture, is ~5x the amount of stimulus passed in the midst of the 2008 Great Recession. Between the continued unemployment benefits, increased childcare tax credit, student loan forbearance, and mortgage and rental assistance, there are substantial programs in effect that will support consumer balance sheets and drive spending going forward. We forecast that the amount of disposable income (immediately available to spend) for consumers is going to substantially increase to record levels and provide consumers with an excess $2 trillion dollars to spend. And, as we have seen previously, when consumers have money to spend, they spend it. The bottom line is that more money being pumped into the economy via stimulus should help supercharge the economy this year.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...