January 22, 2021

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- 4Q20 earnings season is about to be ‘rockin’ n’ rollin’’

- Revisions ‘marching to the beat of their own drum’

- 2021 earnings rebound could ‘soothe’ the market’s ‘soul’

Tomorrow is the 35th Anniversary of the first induction into the Rock and Roll Hall of Fame. The first class was filled with influential artists and producers, including Elvis Presley, James Brown, Ray Charles, Buddy Holly, and Jerry Lee Lewis—all of whom were instrumental in shaping the genre. Coincidently, the Rock and Roll Hall of Fame museum (Cleveland, Ohio) built to honor these music legends was finally able to reopen its doors this past Sunday after closing a second time in November due to the COVID-19 pandemic. While it will still be several months before concert goers can listen to their favorite artists in person, the 4Q20 earnings season is about to be ‘rockin’ n’ rollin’’ over the next two weeks, as 225 companies representing ~68% of the S&P 500’s market capitalization are set to report results. This week, we’ll borrow song titles and lyrics from the first inductees to discuss the trends this earnings season may ‘drum up’ as well as reiterate our earnings outlook for the year ahead.

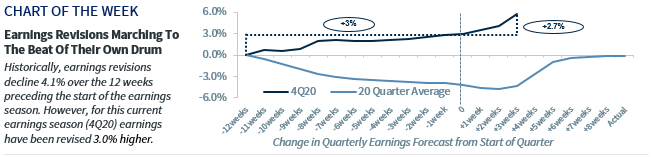

- Great Balls Of Fire! Earnings Revisions Break From Traditional Path | Over the last 20 quarters, the trajectory for quarterly earnings forecast revisions have followed a similar path. In the 12 weeks preceding the start of each earnings season, weakening expectations have resulted in a downward revision 85% of the time, with the forecast lowered 4.1%, on average. However, the earnings revision path for the final two quarters of 2020 has ‘marched to the beat of its own drum,’ breaking from the historical norm of trending lower and lowering expectations and instead rising 4.0% and 3.0%, respectively, to raise the bar.

- ‘I Got A Feelin’ Above Average Earnings Beats Will Occur Again | Historically, once earnings season is underway, estimates move higher on a steady stream of ‘beats.’ While we are still early in this 4Q20 earnings season, earnings and sales results have both far exceeded estimates and their respective previous 20-quarter averages. In fact, the aggregate earnings surprise thus far of 20.4% is nearly 3.3x the previous 20-quarter average of 6.3%. This trend of above-average earnings beats began in the second quarter, and while we expect it will hold, it is unlikely the ‘beats’ will exceed that of the 2Q20 earnings season: +23.6%—the best quarter on record. If a record is to be broken this earnings season, it may be the percentage of companies that exceed estimates on both the top and bottom line. Currently, 87% of companies have beat earnings estimates and 80% of companies have beat sales estimates, both of which are at the highest levels on record and well above their previous 20-quarter averages of 74% and 63%, respectively. Given the strength that we’ve seen thus far, we expect the current S&P 500 4Q20 earnings estimate of an 8% decline to improve and get closer to the flattish level (just modestly negative).

- COVID-19 Caused ‘A Whole Lotta Shakin’ To Corporate Earnings | The COVID-19 pandemic resulted in the worst quarter of economic growth since the Great Recession (2Q20: -32% year-over-year) and likely four consecutive quarters of negative earnings growth—the longest streak since 2002. With consensus estimates indicating a rebound starting with the first quarter of this year, 4Q20 earnings should be the final quarter of negative growth. Between the ramp up in vaccine dissemination and the 7-day average of new COVID-19 cases seemingly on the decline, there is optimism for the year ahead. However, the fourth quarter encompassed the worst days for the virus yet (e.g., peak in daily cases, hospitalizations, and deaths) and we anticipate the vast levels of sector and industry dispersion to remain during 4Q20. In fact, the difference between the earnings estimates for the best and worst performing sector this season is nearly 120% (Financials +10.4% versus Energy -107.6%, year-over-year basis).

- Doubtful Tech & Health Care Earnings Cause ‘A Mess Of Blues’ | Some of the largest Big Tech and Health Care companies (e.g., Microsoft, Apple, Johnson & Johnson, Pfizer) will release earnings in the next two weeks. These two sectors are critical to our earnings outlook, as the combined earnings from the Info Tech and Health Care sectors are projected to make up ~45% of total S&P 500 earnings in 4Q20. Both these sectors typically beat EPS estimates on aggregate by a greater magnitude than the overall index (Tech and Health Care tend to beat by an average of 7% and 6%, respectively over the last 20 quarters) so continued ‘beats’ by these sectors will continue to increase our confidence in our above consensus 27% earnings growth ($175) forecast for 2021.

- ‘That’ll Be The Day’ When Earnings Reach Record Highs | The previous S&P 500 record earnings level (on a 4-quarter trailing basis) was $162, as of 3Q19. We believe that S&P 500 earnings are likely to return to record high levels in 3Q of this year on its way to generating $175 for the entire year. It is interesting to note that on a trailing 4Q basis, all sectors are not created equally as only five of the 11 sectors are expected to see earnings rise back to pre-pandemic levels in 2021. More importantly, two of our favorite sectors—Tech and Health Care—are the only two sectors that have continued to notch record earnings through the pandemic in each quarter throughout 2020 and are expected to continue to do so in 2021. This reflects the dynamism, strength and resilience of these sectors, and the positive fundamental backdrop for both.

Video recorded November 13, 2020. All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...