Read the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Coronavirus continues to ‘power’ market volatility

- Social distancing could deliver a ‘shock’ to the US economy

- Second longest bull market in history ‘blows a fuse’

The 11-year bull market, which ironically celebrated its anniversary on Monday, has ‘short circuited’ due to coronavirus fears. For the first time since 1997, circuit breakers halted equity trading for 15 minutes on Monday morning after the S&P 500 declined 7%. The same occurred on Thursday, bringing the Index into bear market territory. These mechanisms exist to help ‘protect’ investors, allowing them an opportunity to assess market conditions and base decisions on available information rather than on pure emotion. Two unexpected ‘deal breakers’ triggered these circuit breakers: 1) escalating fears of the global spread of the coronavirus and 2) the reignited oil price war between Saudi Arabia and Russia. These developments will likely ‘power’ the ‘surge’ in near-term market volatility as markets attempt to decipher the ultimate economic and earnings impact in the context of significant policy responses from both global central banks and governments. Quickly attempting to recalibrate market expectations without the benefit of historical precedence tends to exacerbate volatility.

- Concerns About The US Consumer Going ‘Off The Grid’ | Perhaps the biggest risk to the US economy is social distancing—activities like restaurants, transportation and spectator events—as consumer spending accounts for ~70% of US GDP. Prior to the coronavirus outbreak, personal consumption was robust, posting 40 straight quarters of growth. But now, the outbreak of the virus has raised concerns that the most resilient, critical component of the US economy will be hampered. Just this week alone, local and state governments limited events above certain capacities, major sports leagues suspended seasons, and College Basketball Tournaments were cancelled. Our Chief Economist Scott Brown estimates that virus-impacted social spending comprises ~8% of consumer spending and ~5% of total GDP. If this spending component declines 10%, it will translate to a -0.5% impact on GDP. If the decline worsens to 20%, the downside risk to our 2020 GDP forecast (1.8%) would likely be more than 1.0% and take us to the cusp of a recession. If it falls meaningfully further a short and shallow recession would likely result. Regardless, pent up consumer demand should lead to a bounce back in growth in 2H20 and 2021.

- ‘Amped Up’ Action By The Fed | The Federal Reserve’s (Fed) ‘electrifying’ moves lately have proven to be amongst the most proactive actions taken by a central bank thus far. Scott Brown expects further easing at the March FOMC meeting next week with a 100 basis point cut which would take rates to zero. In addition, the Fed ‘exercised power’ as it announced $1.5 trillion of liquidity injections. The decision to widen the maturity range for its purchases and undergo significant repo operations helps ensure the proper market functioning for Treasuries, which subsequently impacts the credit markets. As uncertainty plagues the market, the Fed will continue to “act as appropriate” to protect the US economy.

- Trump’s ‘Power Play’ Yet To Come | President Trump’s prime time Oval Office speech essentially disappointed investors who were anticipating a ‘shock and awe’ fiscal response. He escalated his verbiage surrounding the severity of the virus, but his proposals seemed to not be broad or far-reaching (e.g., travel ban for passengers from Europe) or seemed politically challenging given a lack of congressional support (e.g., a tax holiday through Election Day which would cost $312-334 billion). Ed Mills, Equity Research Washington Policy Analyst, expects that more targeted efforts such as tax relief for specific industries or democratic proposed priorities (e.g., medical care and testing coverage, unemployment insurance) are more likely fiscal stimulus outcomes in the near term. With the magnitude and duration of the coronavirus outbreak in the US still relatively unknown, large scale measures (e.g., delayed tax payments) will be implemented in the later stages of what will be a multi-step process.

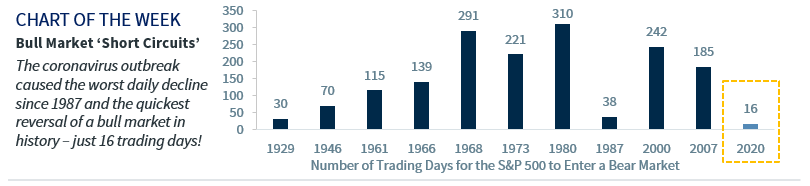

- ‘Plug Pulled’ On The Bull Market | With the S&P 500 down ~27% from its February 19 record high, the coronavirus has resulted in the worst daily decline since 1987 and the quickest reversal of a bull market in history – just 16 trading days. While the magnitude and duration has been difficult, our models indicate that the current pullback is overestimating the decline in earnings growth (~20% priced in versus our worst case scenario ~7.5%) and dividends (~15% priced in near the Great Recession decline of 20%) for the year. Volatility will persist, but contrarian indicators suggest that a bottom may be approaching. The Volatility Index is at the highest level since 2008, the put/call ratio is rising to multi-year highs, and the percentage of S&P 500 constituents trading above their 10 and 50-day moving averages is near record lows. Our expectation is that over the next 12 and 24 months equities will be meaningfully higher from current levels and that the coronavirus fears will subside, leading to an economic rebound in the second half of this year.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...