Read the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- A proactive rate cut to keep economy from ‘falling back’

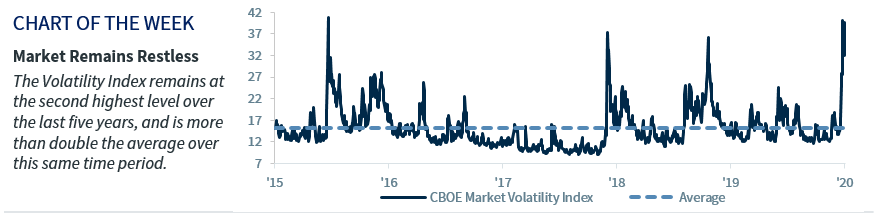

- Equity market still ‘restless’ due to coronavirus fears

- Diversification should help investors ‘sleep soundly’

Daylight Saving Time begins Sunday, and while we gain daylight hours, we lose an hour of sleep – something we need after witnessing four 2%+ daily swings this week. In fact, the Dow’s cumulative point move over the last five days exceeded 4,580 points! Volatility will persist until we get more clarity around the pace of contagion and the potential impact on the US economy – which could take time. Patience, not panic, is essential in order to make well-informed decisions. ‘Rest assured,’ we will ‘work around the clock’ to assess the true economic and financial implications of the coronavirus as they ‘come to light’ and determine the subsequent impact to our outlook. This week, we raised the downside risk to our 2020 GDP forecast (1.8%) and lowered our year-end S&P 500 target (to 3,256 from 3,400). As the situation is fluid, below is some perspective on the week’s events.

- Fed Seeks To Keep The US Economy ‘Awake’ | The Federal Reserve’s surprise inter-meeting interest rate cut substantiated our belief that it would be proactive in extending the longest US economic expansion in history. The move caught investors off guard, as it was the first emergency rate cut since 2008, and it was larger than expected, 50 basis points versus 25. Since much of the recent US economic data is from prior to the escalation of the virus headlines, a deterioration in economic data from other countries (e.g., China’s Manufacturing and Non-Manufacturing PMI Indices at historic lows) and the continued rise in cases inside and outside of China was evidenceenough for the Fed to justify preemptively acting now rather than being late and falling behind the curve. While the Fed and other global central banks (e.g., China, Australia, Canada, etc.) have taken actions to keep their economies from ‘falling back,’ policymakers remain ‘alert’ that the next phase of stimulus may very well have to be fiscal stimulus in the form of tax cuts or spending initiatives. Policymakers are in a ‘race against the clock’ to shore up consumer and business confidence to avoid a self-fulfilling recession.

- The Equity Market Is ‘Tossing And Turning’ | We wish we could ‘spring forward’ and pinpoint when the coronavirus-related volatility will become more subdued, but our expectation is that the peak of the virus impact will occur in the first half of this year. Due to prolonged global supply chains disruptions, demand destruction around the globe as fears intensify, and the fact that ~40% of S&P 500 revenues are derived overseas, we lowered our full-year 2020 earnings estimate to $167 (from $174) with the reductions weighted specifically to H120 results. Based on our belief that a recovery will occur in the latter half of the year our 19.5x P/E trailing multiple is unchanged, resulting in a revised 2020 S&P 500 price target of 3,256. One factor that should help ‘spring’ equities to this target is more attractive valuations, especially on a relative basis. The current P/E of 18.1x is slightly below the 5-year average of 18.3x. With record low US Treasury yields, 76% of S&P 500 companies now have a higher dividend yield than that of the 10-year Treasury (0.75%). These dynamics should support the continuation of the second longest US bull market that celebrates its eleventh anniversary Monday (March 9). Incidentally, the recent 11% pullback in the S&P 500 is a small fraction of the performance earned since 2009 (462% cumulative total return).

- Yields ‘Losing Sleep’ Over Possible Pullback | The uncomfortable, speedy decline in the equity market from recent highs (S&P 500 down 11% as of March 5) is not dissimilar from the average peak to trough decline of 14% experienced by the S&P 500 over the last 40 years, but the precipitous decline in bond yields is. The ~90 bps decline in the 10-year Treasury yield to record lows is the largest 15 day decline since 2008. This reflects a market pricing in mounting pressures of a recession, a severe one at that. The US should be able to weather the storm, but should a recession occur we expect it would be brief and lead to a robust 2nd half rebound. If our scenario is accurate, yields at current levels may be overestimating the slowdown.

- Democratic Sweep A ‘Sleeping Giant?’ | Politics could also be weighing on markets. Joe Biden’s strong Super Tuesday performance combined with concerns over how the Trump Administration has handled the coronavirus situation has led the probability of a Democratic sweep in Congress to shoot higher in betting markets. This could be a headwind for equities if the proposed roll back of corporate tax cuts were implemented, as future corporate earnings and margins would be hampered.

- Solid Financial Plan Isn’t Just Something To ‘Dream About’| Just as there is no replacement for a good night’s sleep, there is no replacement for proper asset allocation. Periods of heightened volatility like now should make investors who maintain a balanced portfolio grateful for their discipline. Since the initial outbreak of the coronavirus (January 17), the Barclays US Aggregate Bond Index has rallied 4.1% (versus the S&P 500 -8.9%).

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...