Chief Economist Scott Brown discusses current economic conditions.

No surprise, the Federal Open Market Committee left short-term interest rates unchanged and did not alter its monthly pace of asset purchases. Financial market participants did react to a shift in the dot plot and some Fed observers are already speculating that the central bank may have lost its nerve regarding the new policy framework. A shift forward in the expected lift-off of rates should have been expected, given the outlook for growth and inflation. At the same time, the economic outlook is highly uncertain. The correct answer regarding questions of Fed policy remains: “it depends.”

Fed officials have mixed feelings about the dot plot, most of them (including Chair Powell) don’t like it. It provides useful information, but is subject to misinterpretation. The dot plot shows individual projections of the appropriate year-end federal funds rate target for each of the 18 senior Fed officials. In March, most (11 of 18) did not foresee an increase in short-term interest rates through 2023. As of the June meeting, a majority (13 of 18) expect a hike by the end of 2023 and some (7 of 18) see an increase in 2022 (none see a hike this year). There was a wide range of expectations for the federal funds target rate at the end of 2023 (some as high as 1.625%). Bear in mind that not all of the dots vote on policy and the district bank presidents tend to be more hawkish. In his press conference, Powell said that the dots are “individual projects, not a Committee forecast, and not a plan.” Officials are not debating when to raise rates, “because discussing lift-off now would be highly premature – it wouldn’t make any sense.” Yet, that is not what many market participants nor many in the financial press believe. Headlines suggesting that the Fed is forecasting two rate increases in 2023 are absurd. Take it from Chairman Powell, “dots need to be taken with a big grain of salt.”

June 16 Summary of Economic Projections (source: Federal Reserve)

In its Summary of Economic Projects, Fed officials increased their projections for GDP growth for this year. At 3.4% (4Q21/4Q20), inflation is expected to be higher than what was expected in March (+2.4%). Yet, inflation is still expected to moderate in 2022.

Part of the increase in inflation “reflects the very low reading from early in the pandemic falling out of the (year-over-year) calculation as well the pass-through of past increases in oil prices to consumer energy prices,” but “we’re also seeing upward pressure on prices from the rebound in spending as the economy continues to reopen.” Supply bottlenecks have limited how quickly production in some sectors can respond in the near term, and “these bottleneck pressures have been larger than anticipated.” Fed officials have revised their 2021 inflation projections higher accordingly. As these transitory supply effects abate, “inflation is expected to drop back” toward the 2% long-term goal. Still, the process of reopening the economy is unprecedented. “Shifts in demand can be large and rapid,” noted Powell. Bottlenecks, hiring constraints, and other constraints could limit how quickly supply adjusts, “raising the possibility that inflation could turn out to be higher and more persistent than we expect.”

Powell stressed that, “if we saw signs that the path of inflation or longer-term inflation expectations were moving materially and persistently beyond levels consistent with our goal, we would be prepared to adjust the stance of monetary policy.”

In the meantime, the Fed has moved beyond talking about talking about tapering the monthly pace of asset purchases, but tapering depends on when the Fed will see “substantial further progress” and “is still a long way off.”

The FOMC Decision and Summary of Economic Projections

As expected, the Federal Open Market Committee left short-term interest rates unchanged (federal funds target range of 0-0.25%) and did not alter the monthly pace of asset purchases ($120 billion per month).

The revised dot plot showed that most (13 of 18) senior Fed officials expect an increase in the overnight lending rate by the end of 2023 (vs. 5 of 18 in March).

The median projection of real GDP growth for this year rose to 7.0% (4Q21/4Q20), up from 6.5% in March. In his press conference, Chair Powell cited “widespread vaccinations” and “unprecedented fiscal policy actions,” in addition to accommodative monetary policy.

The unemployment rate outlook held steady at 4.5% (4Q21), same as in March. Chair Powell noted that the figure “understates the shortfall in employment,” and said that labor force participation is lagging due to pandemic-related issues (caregiver needs, ongoing fear of the virus, and unemployment insurance benefits). The Fed expects more rapid job growth as these factors fade.

The PCE Price Index is expected to exceed 2% this year (median projection: +3.4% 4Q21/4Q20, up from a

+2.4% projection in March). Higher inflation is due to base effects (a rebound in prices that were depressed a year ago) and larger-than-expected supply chain bottleneck effects. Officials expect inflation to moderate in 2022 (median forecast: +2.1% 4Q22/4Q21), but Powell noted that “inflation could turn out to be higher and more persistent than we expect,” and emphasized the role of inflation expectations.

Recent Economic Data

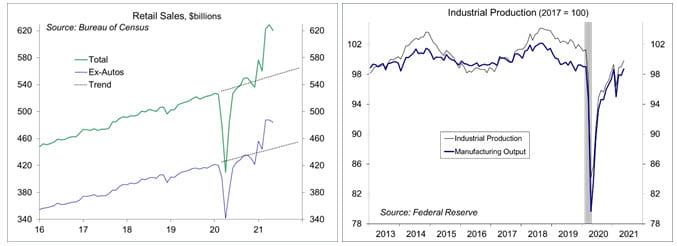

Retail sales fell 1.3% in May (+22.7% y/y), about 12% above the pre-pandemic trend. Ex-autos, sales fell 0.7% (+18.7% y/y), about 9% above the pre-pandemic trend. Ex-autos, building materials and gasoline, sales slipped 0.3% (+18.9% y/y). Sales at restaurants and bars rose 1.8% (+6.1% before seasonal adjustment) — up 4.6% from two years ago. Non-store retailers (internet and mail order) fell 0.8%, up 38.9% from two years ago.

Industrial production rose 0.8% in May (+16.3% y/y). Manufacturing output rose 0.9% (+18.3% y/y), reflecting a 6.7% rebound in the production of motor vehicles (+140.9% y/y).

Import prices rose 1.1% in May (+11.3% y/y), up 1.0% ex-food & fuels (+6.0%). The index for non-fuel industrial supplies and materials rose 4.9% (+33.2% y/y). Inflation in finished goods remained mild (capital equipment and autos up 1.1% y/y, consumer goods up 0.9% y/y).

The Producer Price Index rose 0.8% in May (+6.6% y/y). Ex-food, energy, and trade services, the PPI rose 0.7% (+5.3% y/y). Pipeline inflationary pressures remained elevated. The index for unprocessed intermediate goods rose 8.4% (+57.9% y/y), while the index for processed intermediate goods rose 2.8% (+21.9%y/y).

Single-family building permits fell 1.6% in May, mixed across regions (+50.1% y/y).

Homebuilder sentiment (the NAHB’s Housing Market Index) fell to 81 in June (still strong), from 83 in April and May. Builders cited supply constraints and affordability concerns.

Gauging the Recovery

The New York Fed’s Weekly Economic Index edged up to +10.35% for the week ending June 12, vs. +9.98% a week earlier (revised from +10.01%), signifying strength relative to the depressed level of a year ago. The WEI is scaled to year-over-year GDP growth (GDP was down 9.0% y/y in 2Q20).

Breakeven inflation rates (the spread between inflation-adjusted and fixed-rate Treasuries, not quite the same as inflation expectations, but close enough) continue to suggest a moderately higher near-term inflation outlook. The 5-10-year outlook had crept above the Fed’s long-term goal of 2%, but has since moderated.

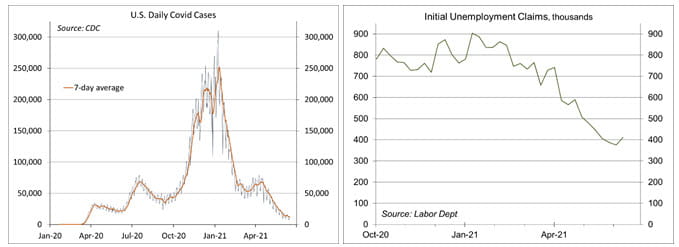

As more people become vaccinated, the number of COVID-19 cases continues to trend lower. We are trending below 2,000 deaths from COVID-19 per week (vs. 4,000 at the end of April and 25,000 in early January).

Jobless claims rose by 37,000, to 412,000 in the week ending June 12. Claims figures are often erratic at the end of the school year, but the trend is clearly lower.

The University of Michigan’s Consumer Sentiment Index rebounded to 86.4 in the mid-month assessment for June (the survey covered May 26 to June 9), vs. 82.9 in May and 88.3 in April. The increase was concentrated among mid- and upper-income household, reflecting greater optimism as the economy re-opens. Inflation concerns remained, but less than in May.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...