Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

This year has brought investor uncertainty and plenty of market volatility. Market volatility can create investor angst when prices bounce around in an extreme manner. Although wealth can be decisively stated, investor attitude or the feeling towards wealth can be influenced by losses or gains as they are reflected on monthly investment statements. I would suggest that investors stay mindful of the differences in product types, asset allocation purposes and the ultimate impact, both short term and long term, of these prices on your real wealth before conceding to changes in portfolio compositions.

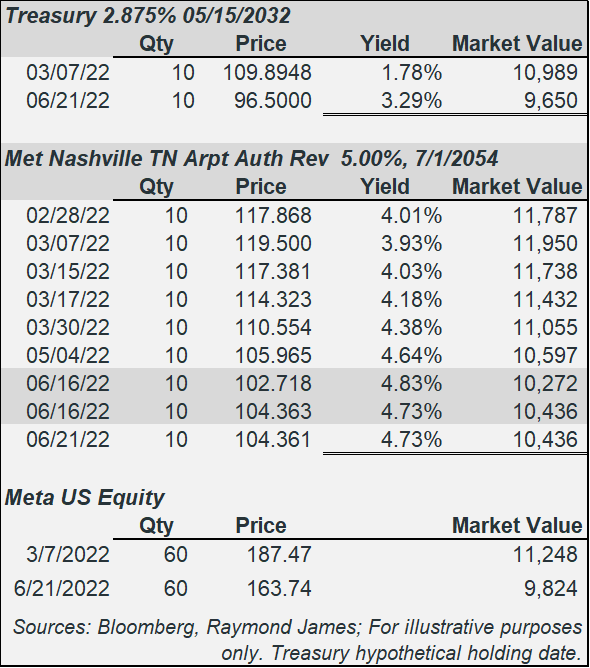

A bond is a very different product than a stock. In the example to the right, META stock lost 12.7% of its market value from March 7 to June 21. Although stocks can obtain income via dividends, dividends are not guaranteed, can fluctuate or be eliminated based on company discretion. Many investors therefore rely on a stock’s appreciation for their return. When a stock price falls, many investors must hope for a market reversal. Returns can be large and grow wealth but they can also fall and lessen wealth.

Individual bonds are not exempt from price volatility. As you can see to the right, 10 year Treasuries lost 12.2% of their market value from March 7 to June 21. The difference is that many investors do not rely on market appreciation for their return on individual bonds. Market prices can fluctuate substantially up and down over the holding period and there is no impact on the cash flow, income or the date that an investor’s face value is returned to them. Individual bonds are insulated from market price fluctuations when they are held to maturity. The stated maturity date provides a protection not offered by many other security types. The only two events that change this are an outright default (unlikely when buying high quality bonds) or selling before the maturity (in which case a bond is subject to the market price at the time of sale whether it is higher or lower).

The municipal bond displayed in the box illustrates how volatile prices have been even on the same day. Human nature may not allow you to ignore these market price fluctuations, nevertheless, they do not impact the bond’s performance when held to maturity. This volatile 2022 start exemplifies the rationale behind blending growth assets (stocks) with individual bonds as an appropriate allocation of each allows the potential for growth and the protection of wealth concurrently.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Securities Industry and Financial Markets Association’s Project Invested website and Investor Guides at www.projectinvested.com/category/investor-guides, FINRA’s Investor section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...