Chief Economist Scott Brown discusses current economic conditions.

The broad range of economic data signal that a recession began in March. Real Gross Domestic Product (GDP, the total of final goods and services produced in our economy) is expected to have fallen in the advance estimate for 1Q20. The 2Q20 figures will show an unprecedented decline in activity. Weekly claims for unemployment benefits suggest that the pace of job losses has slowed in the last few weeks, but the pace has remained exceptionally high. One in seven U.S. workers has filed a claim in the last five weeks. Meanwhile, lawmakers in Washington approved another $484 billion in fiscal aid, bringing the total so far to about $3 trillion.

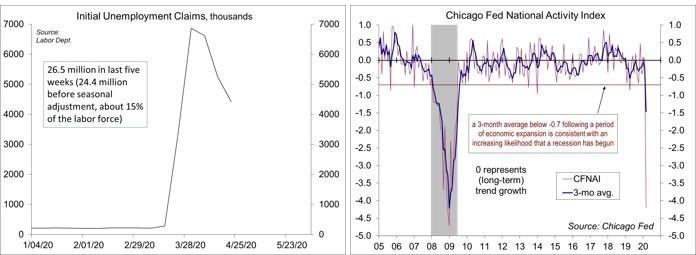

Some 26.5 million workers filed a claim for unemployment benefits in the last five weeks. That figure is inflated a bit by the seasonal adjustment (unadjusted claims normally trend low in the spring). However, we know that not every laid-off worker can file a claim. Still, the magnitude here is gut-wrenching. Prior to seasonal adjustment, 24.4 million people filed in the last 12 weeks. That’s nearly 15% of the labor force or one in every seven workers. The government will provide extended unemployment benefits and expand eligibility, but the loss of income will, in turn, reduce spending – and that spending is someone else’s income. Second- and third-round effects will add to economic weakness in the near term and hinder the recovery process. However, fiscal stimulus will help to counter those effects.

Weakness in retail sales and industrial production in March was severe enough to generate declines in quarterly figures. The Chicago Fed’s National Activity Index, a composite of 85 economic indicators fell sharply, and the three-month average, at -1.47, was well below -0.70, the level associated with an increased chance that a recession has begun. The National Bureau of Economic Research’s Business Cycle Dating Committee (BCDC) defines a recession as “a significant decline in economic activity spreads across the economy, lasting from a few months to more than a year.” There is no set definition of “economic activity,” but the BCDC takes that to mean various measures of broad activity, such as GDP, nonfarm payrolls, and inflation-adjusted personal income. To pinpoint starting and ending dates for a recession, the committee also looks at two indicators that don’t cover the broad economy, inflation-adjusted business sales and industrial production. Payrolls and industrial production have declined. Other indicators are likely to echo that when they are released. Still, while confirmation of a recession should be no surprise, the main concern is how rapidly this downturn has taken place. Moreover, there is no sign of a bottom.

The fourth phase of fiscal stimulus includes more healthcare funding, reloads the payroll protection program (funding for small business loans, which turn into grants if the business holds onto its workers), and provides additional funding for state and local government (more will be needed). To date, that’s a total of about $3 trillion in fiscal support, and comes on top of a $1 trillion annual budget deficit before COVID-19, bring the deficit to about $4 trillion, or 18% of GDP. That’s a lot, but so is the hit to the economy from the virus. Paying for this isn’t much of an issue. The real danger will likely come from belt-tightening as the recovery gets underway.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...