Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Whether it’s a personal health issue or financial adversity, the worst part of any crisis is the unknown. We have a medical crisis that has led to financial consequences and both are packed with unknowns. We have doomsday articles on one side and over the top optimism on the other. The discrepancy and subsequent uncertainty is displayed with the day-to-day and intra-day market volatility.

If we can agree that no one has all the answers and no one can predict how this unique time will play out, perhaps we can find some calm in evaluating what we do know.

- Early this morning, the Fed, in an unprecedented move, has basically pledged unlimited asset purchases and new credit and liquidity facilities to alleviate further credit decay and support the economic base. The Fed is throwing all their might in combating this crisis. The markets have preliminarily responded well to the news.

- We cannot pick the bottom of this crisis. As uncertainty abounds, we suggest putting new money and/or cash flow into lower duration, high quality fixed income. Keep your powder dry positioning well for the economic cycle turn.

- The negative medical statistics have not peaked. We are destined for some really bad economic releases over the next quarter, maybe the next 2 quarters. This is fallout from the disruption to normal work flow. This will pass unless we cannot turn the medical implications. It is another reason to consider lowering fixed income durations when putting money to work and remain in high quality credits.

- Spread widening resulted from lack of liquidity. The consequence has been an underwhelming bid market. Widening spreads mean higher yields, so this presents an opportunity. The volatility will result in statement pricing instability, but if issuers meet long-term comfort and individual risk profiles, these opportunities mean providing the portfolio’s fixed income allocation with attractive yields.

- Selling municipal or corporate holdings in a distressed time (gapping spreads) is not ideal. Unless a risk profile dictates an absolute discomfort with a particular credit, ride the volatility out. Remember, barring a default, cash flow and income remain a constant and the time when face value is returned does as well. Price volatility does not affect an investor’s return if held until maturity.

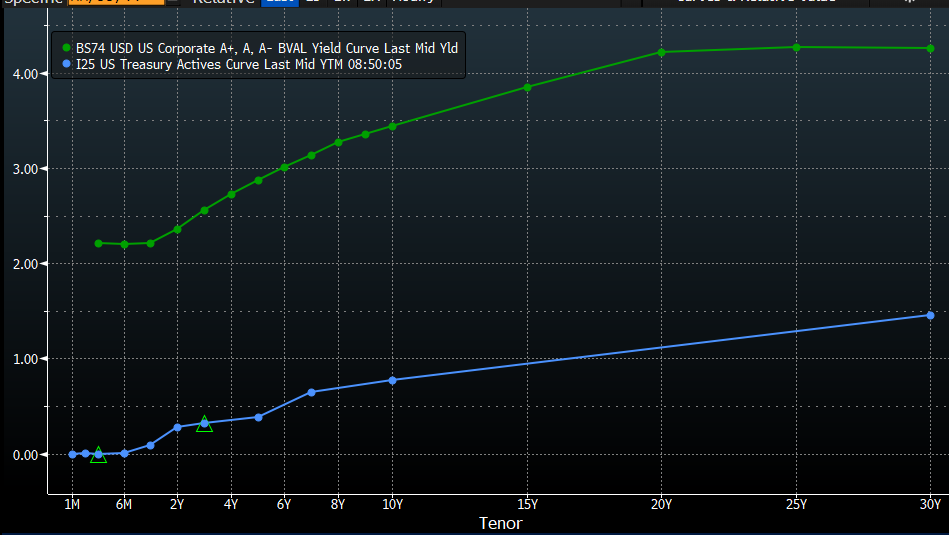

US Corporate (A-rated) BVAL Yield Curve Vs. US Active Treasury Curve (source: Bloomberg LP 3/23/20 8:54)

Municipal (AAA) BVAL Yield Curve Vs. US Active Treasury Curve (source: Bloomberg LP 3/23/20 8:57)

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...