Chief Economist Eugenio J. Alemán discusses current economic conditions.

Over history, it has not been easy for markets to understand the Federal Reserve (Fed) or how the Fed understands its role, even if its two most important mandates, which are very clear, are price stability and low unemployment. At some point in time, during the tenure of Alan Greenspan, the communications from the Fed were so convoluted that analysts/economists would call Fed communications ‘Fedspeak,’ which basically meant that they could not understand a word of what Mr. Greenspan was saying!

However, today is different. The Fed has gotten much better at communicating what its thoughts are today and going forward. The only problem is that the Fed is like the family doctor: you call the doctor because you feel bad, and the doctor prescribes a very nasty medicine and says that you must take it all during the next several weeks.

Today, markets have been calling the doctor because they have an inflation problem. However, the medicine the doctors are recommending is too nasty to take, let alone do it for the next several months or even quarters.

We don’t think markets were surprised by the 75 basis point increase in the federal funds rate decided after the September Federal Open Market Committee (FOMC) meeting earlier this week. The Fed chairman, Jerome Powell and other members have been filling the airways with a more certain view of the path ahead. What happened after the FOMC meeting this week was that the Fed put a price or, as many would say today, ‘monetized,’ what Fed officials have been saying since the Jackson Hole meeting.

And markets did not like this monetization because it means higher interest rates for a longer period and probably a deeper recession than what they had already priced in.

On Deflation, Inflation, Stagflation, and Disinflation

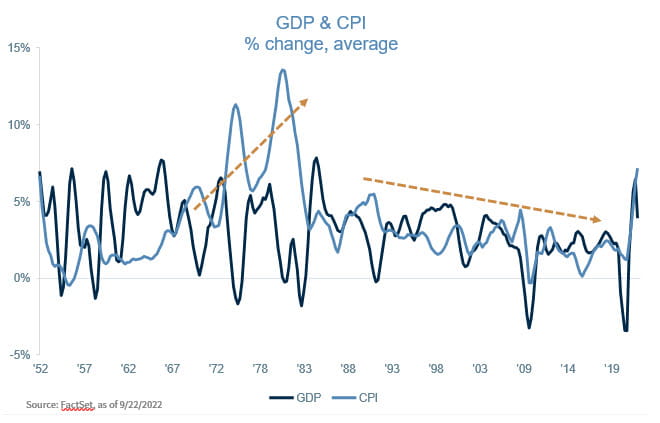

But let’s try to understand why the Fed seems to have changed its mind about the need to move higher and stay higher for longer. First, it believes, and markets have made it clear, that it was behind the curve by not acting immediately to curb inflation after the inflation monster reared its ugly head. However, for an institution that has been fighting deflation for several decades, this is a ‘peccadillo’ that should have been pardoned already, but markets keep blaming the Fed for not acting on it.

Second, it has been hearing some analysts/economists throwing the word ‘stagflation’ out without any regard for the insurmountable differences that exist today compared to the 1960s, 70s, and 80s (See our Weekly Economics for June 10, 2022). If the Fed had bad policies that tended to perpetuate higher inflation for longer, what do we say about the bad, bad, even atrocious (political) policies pushed during the 1970s that worsened the effects of inflation and created a perfect storm for stagflation to take hold? Not saying that some of today’s policies are great, but nothing compared to what was happening then.

Having said this, the Fed is nevertheless concerned that if it does not act forcefully to control inflation today, high inflation will become the norm and inflation expectations will become entrenched at a higher level. So far, this is not happening, as shown by the different measures of inflation expectations, but it has become highly risk-averse regarding inflation.

Thus, the Fed doesn’t want to risk it and be accused of being soft on inflation as was the case with its colleagues of the stagflation period. That is, Powell and company don’t want to act as the Fed did during the 1960s, 70s, and early 80s and allow inflation to get the upper hand. It just wants markets to take the medicine in full rather than allow the ‘infection,’ i.e., inflation, to come back again and with greater force. And you cannot blame it for not wanting to be compared to those folks.

Third, the Fed, as well as many analysts/economists, were expecting inflation to start turning the corner at the end of the first quarter of this year (yes, this was the ‘transitory’ argument) but a new and unexpected external shock changed the timing for inflation to start coming down: the Russia/Ukraine war. Thus, the Fed doesn’t want another potential external shock to further undermine its inflation fighting credibility and has decided that this time around, it is not waiting for things to happen on their own, and it is ok with increasing interest rates further and pushing the US economy into a recession.

Fourth, because of all this, the Fed is expecting inflation to come down at a slower pace than what it was expecting before through a process that is called disinflation. And it is betting the house on its success. This is the reason why the strategy has changed to ‘higher for longer.’ The Fed has put out its worst-case scenario, something that should be music to the markets’ ears.

For the markets, this should be good news even if it is very difficult to see it at this point. Since this is the worst-case scenario for the Fed, any ‘better-than-expected’ news in the inflation front should be a boon for markets.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those Raymond James and are subject to change without notice the information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur last performance may not be indicative of future results.

Consumer Price Index is a measure of inflation compiled by the US Bureau of Labor Studies. Currencies investing are generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

Consumer Sentiment is a consumer confidence index published monthly by the University of Michigan. The index is normalized to have a value of 100 in the first quarter of 1966. Each month at least 500 telephone interviews are conducted of a contiguous United States sample.

The producer price index is a price index that measures the average changes in prices received by domestic producers for their output. Its importance is being undermined by the steady decline in manufactured goods as a share of spending.

Industrial production: Industrial and production engineering is a measure of output of the industrial sector of the economy. The industrial sector includes manufacturing, mining, and utilities.

Personal Consumption Expenditures Price Index (PCE): The PCE is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The change in the PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

FHFA house price index is a quarterly index that measures average changes in housing prices based on sales or refinancing’s of single-family homes whose mortgages have been purchased or securitized by Fannie Mae or Freddie Mac.

Consumer confidence index is an economic indicator published by various organizations in several countries. In simple terms, increased consumer confidence indicates economic growth in which consumers are spending money, indicating higher consumption.

ISM Manufacturing indexes are economic indicators derived from monthly surveys of private sector companies.

ISM Services Index is an economic index based on surveys of more than 400 non-manufacturing (or services) firms’ purchasing and supply executives.

Non-Manufacturing Business Activity Index is a seasonally adjusted index released by the Institute for Supply Management measuring business activity and conditions in the United States service economy as part of the Non-Manufacturing ISM Report on Business.

New orders index measures the value of the orders received in the course of the month by French companies with over 20 employees in the manufacturing industries working on orders.

Source: FactSet, data as of 6/3/2022

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...