Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

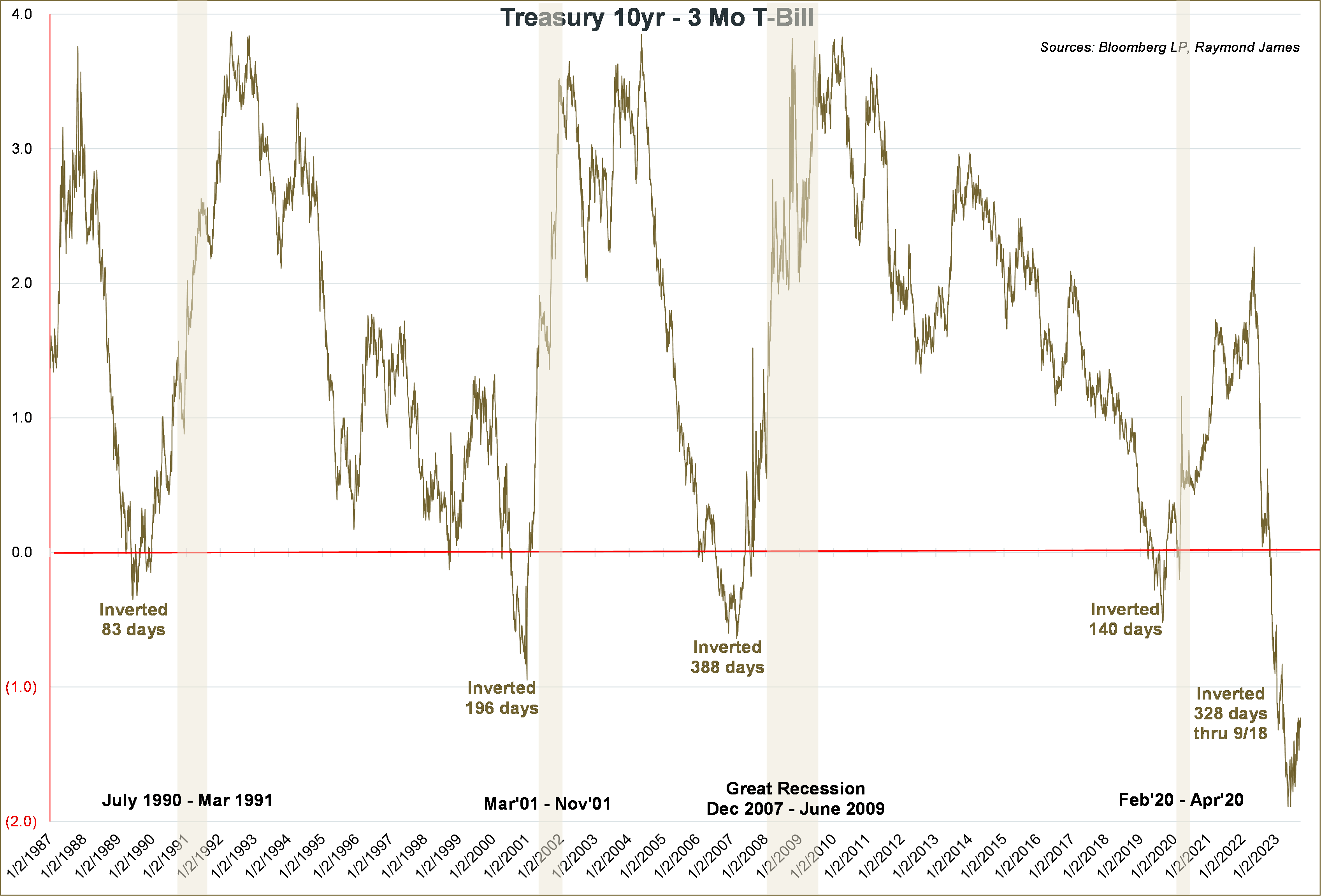

Inverted curves (when the gold line goes below the red line meaning that short maturity yields are higher compared to longer maturity yields) have preceded recessions. The longest period of inversion led to the longest recession. 10-year Treasury rates were inverted to 3-month T-Bills for 388 days prior to the Great Recession. The current inversion is now 328 days long.

The shaded blue area represents the Fed’s favored measure of inflation – Core Personal Consumption Expenditure (PCE). Inflation began its sharp rise in 2021 and peaked in early 2022. The Fed began to raise Fed Fund rates in March 2022 (depicted by the gold line). They have raised an extraordinary 525 basis points in just 18 months. Although inflation has trickled slightly lower from the highs, the dramatic Fed policy seems to have had minimal effect on it.

The national average 30-year fixed-rate mortgage* since 2020 has been 4.55%. It is now 7.59%. The average new car finance rate** has been 5.25% since 2020. It is now 6.6%. Credit card delinquencies** are ticking up when outstanding balances held by consumers are 26% greater than 10-year averages or nearly 35% greater than 20-year averages.

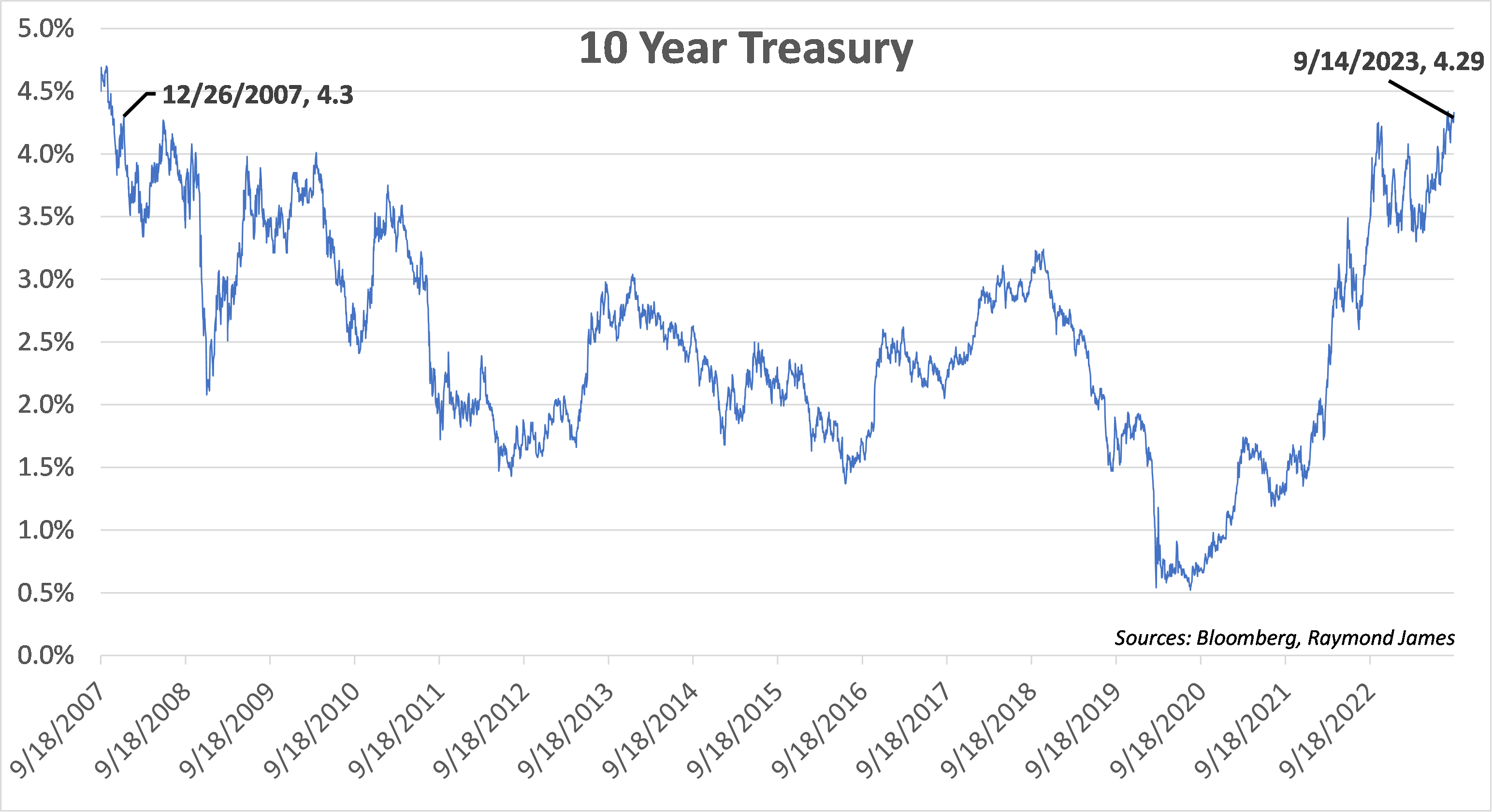

Interest rates are higher today than they have been in nearly 16 years. This graph depicts the 10-year Treasury rate since September 2007.

Conclusion: You need to draw your own but I will share mine.

- The yield curve has been one of the best predictors of the future and recessions over time and although there are no guarantees from past performances, I consider this a strong signal of an upcoming recession. Once the curve returns to a positive slope, it takes about four months on average, for the economy to fall into a recession.

- The length of this inversion is signaling the potential for more than a mild recession.

- Inflation may persist for a long time – lower but far from the Fed’s 2% target level as they need more than just their policy to move the needle.

- Other indicators are revealing a weakening economy including high mortgage rates, high auto rates and credit card balances significantly higher than 10- and 20-year averages.

- With rates at 16+ year highs, there is a definitive window of opportunity in fixed income. Individual bonds are not only providing principal protection, but also significant income opportunities. Since all the indicators are pointing at a nearing Fed policy reversal and/or upcoming recession, the window of opportunity may be short-lived. Make sure your fixed income allocation is solidified under these favorable conditions.

* (Bloomberg/Bankrate.com)

** (Bloomberg/Federal Reserve)

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...