Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

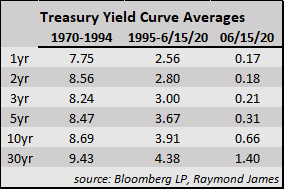

Big Picture View: The economy has evolved over the decades and is different today. The most recent 25 years reflect that average Treasury rates are significantly lower than the 2.5 decades between 1970-1994. Today’s Treasury rates highlight the extreme difference in today’s economy compared to the past 50 years.

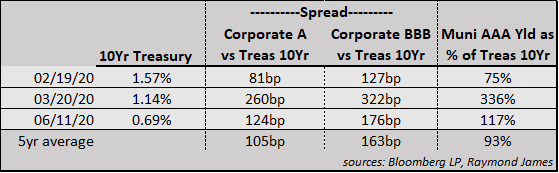

Spreads: Many investors do not use Treasuries as their main fixed income holdings but instead utilize municipal and corporate bonds. Spreads (the difference between municipal and/or corporate yields versus Treasury yields of the same maturity) in both products widened tremendously during the apex of the coronavirus but trading anomalies have dissipated and spreads have gravitated back toward 5 year averages.

Strategic Consideration: Reevaluate the primary purpose of fixed income for many investors: preservation of principal. For years fixed income allocations have benefitted from rising prices (falling yields), thus posting very healthy total returns (price appreciation + income/yield). With interest rates near historic lows across the curve, total return benefits are likely to taper or disappear altogether. This may require the biased expectation of “more” from fixed income to be modified to realistic benefits connected with today’s rates and economic conditions.

New money or reinvestment of money might be employed in shorter duration instruments with the purpose of better positioning for the economic cycle turnaround. Doubling duration in today’s rate environment will not necessarily provide proportional returns. This also might be balanced with the Fed’s pronouncement that they expect to keep the lower bound of Fed Funds near zero through 2022.

The deductive range of interest for corporate holdings coordinates with roughly the 3 to 9 year part of the curve. Municipal bonds purchases can benefit from ~8-15 year maturities with call dates in the 3-9 year range and coupons greater than 3.00%.

In times of economic volatility and dislocation, we may need to remind ourselves to stay within our own risk profile. There are some distinctive opportunities within the investment grade space created by sector dislocation. These spot opportunities will not appeal to all investors as each of us have unique risk profiles and future outlooks. For example, the oil & gas sector is under stress from pricing wars and demand/capacity issues. Oil & gas corporation’s financial situations and business risks can be significantly different although many investors will write them off altogether. The difference of opinions and risk tolerances leads to an exit by some investors but opens up an opportunity for others. Know your own risk profile and comfort before deciding where you sit.

The same distortions exist in the municipal sector. For example, not all hospitals are the same even though they can be categorized as such. A multi-hospital and geographically diverse system may be better equipped to survive a pandemic moment than a small privately-owned rural hospital.

There are many opportunities that arise in both corporate and municipal bonds but not all opportunities are appropriate for every investor. Stressed and/or dislocated markets create opportunities but also come with specific risks. Please talk with your advisor who can share spot opportunities with you or bring Fixed Income Solutions team members in to highlight opportunities that exist within your personal risk profile.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...