Chief Economist Scott Brown discusses current economic conditions.

In contrast to expectations of further deterioration, the May Employment Report suggested significant improvement in labor market conditions. No doubt, the economy has turned the corner as states have re-opened. However, the report was sharply at odds with the number of individuals receiving unemployment benefits. Even with the May job gains, we still have a long way to go for a full recovery. For the financial markets, the direction of change is what matters.

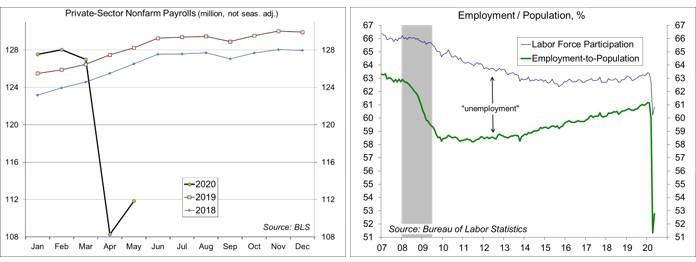

The headline data on jobless claims are for regular state programs. They don’t include separate programs for government workers, newly discharged veterans, pandemic assistance, and others. The number of individuals receiving unemployment benefits in all programs totaled about 30 million for the week ending May 16, a little more than 11 million more than in mid-April (corresponding to the timing of the payroll surveys). The Bureau of Labor Statistics reported that nonfarm payrolls rose by 2.5 million (median estimate: -8.0 million) in the initial estimate for May (3.1 million in private-sector payrolls). Payrolls fell 19.5 million from February to May. So how can 30 million be collecting unemployment benefits? What to believe? Jobless claims data are actual counts for the most part. Payrolls are an estimate, subject to statistical error. Still, most economists were expecting very sharp payroll gains for June (reflecting a re-opening in state economies) – maybe some of that showed up a little early. The jobless claims data still bear watching closely. Drilling down into the report, dentist offices accounted for 8% of the gain in nonfarm payrolls. Leisure and hospitality accounted for half.

The unemployment rate fell to 13.3% in May (median forecast: 19.8%), vs. 14.7% in April. The May figure was understated by about three percentage points due to a classification problem (April was understated by about five percentage points). The “insured unemployment rate” from the jobless claims report is continuing claims as a percent of nonfarm payrolls (from the end of the previous quarter) – 12.9% for the week ending May 16 (not seasonally adjusted). That reflects claimants for the regular state programs. Adding in the other programs, the insured unemployment rate would have been 20.6% – again a sharp contrast to the BLS’s figure.

The ISM surveys remained in contraction in May, with the headline figures inflated by an increase in supplier delivery times (which reflect pandemic disruptions rather than underlying strength in demand). In manufacturing, new orders, production, and employment continued to contract sharply. In the non-manufacturing survey, business activity, new orders, and employment continued to decline, but not as much as in April. Unit motor vehicle sales rose to a 12.2 million seasonally adjusted annual rate, up from 8.7 million in April (but still down 30% from a year earlier).

While the May employment figures appear suspect, the economy has turned the corner. Looking ahead, economic reports are likely to indicate strong growth in May, June and July, but that’s coming from sharp lows in April, and activity is expected to remain below trend for some time. For financial market participants, the direction is more important than the level of activity. (M20-3115991)

Gauging the Recovery

Jobless Claims fell to 1.877 million in the week ending May 30, trending down, but still very high. Continuing Claims rose by 437,000 in the week ending May 23, to 19.295 million (not seasonally adjusted), but the figures are for regular state unemployment insurance programs and do not include pandemic assistance and other programs. Total continuing claims, including all programs, were 29.965 million for the week ending May 16 (down from 30.957 million in the week ending May 9).

The New York Fed’s Weekly Economic Index fell to -10.08 for the week of May 30, down from -9.36 in the previous week and a low of -10.90 at the beginning of May. The WEI is scaled to four-quarter GDP growth.

Reported last week, the University of Michigan’s Consumer Sentiment Index rose to 72.3 in the full-month reading for May. Expectations remained weak. The report noted that “the CARES relief checks and higher unemployment payments have helped to stem economic hardship, but those programs have not acted to stimulate discretionary spending due to uncertainty about the future course of the pandemic.”

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...