Chief Economist Scott Brown discusses current economic conditions.

The pandemic had a significant impact on household spending in March and April, with a sharp contraction in consumer services (basically anything where people come into close contact with each other). The relaxation of social distancing guidelines has contributed to a sharp-but-partial rebound in May and June. However, that relaxation appears to have gone too fast. COVID-19 cases are up sharply in recent weeks. Some states have moved to re-impose social distancing, but it’s unlikely that we’ll return to a full lockdown. While many of the unemployed have returned to work, most haven’t, and newly laid-off workers have continued to join the ranks of the unemployed. The need for further fiscal support is apparent.

The pandemic has had a mixed impact across the income scale. Job losses were more concentrated at the bottom of the income scale. The loss of wage income was offset by “recovery rebate” checks and deposits and by the extension of unemployment insurance benefits. Some are making more than they did working, and others have fallen through the cracks, but fiscal support has helped to shore up spending at the low end. At the other end of the income scale, job losses were more moderate. White collar workers are better able to work from home. The top 20% of income earners account for more than half of household income and more than half of consumer spending. Yet, spending fell at the high end, largely because these households couldn’t spend. Forced savings should provide fuel for the recovery from the coronavirus, but we’re not even close to being through the pandemic. For many in the middle, they too have been constrained in their ability to spending and savings have increased. Banks have reported increases in the average size of checking and savings accounts.

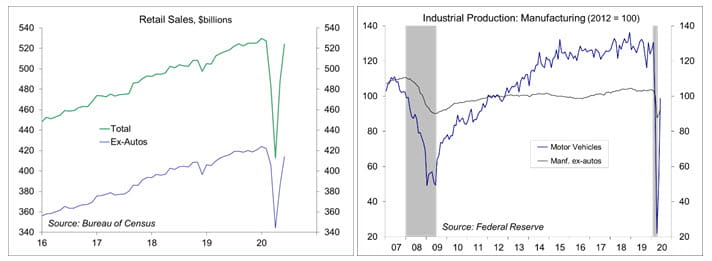

Retail sales rose more than expected in June, following a strong gain in May. Sales at motor vehicle dealerships in June were more than 4% higher than in February, fueled by pent-up demand (as consumers postponed purchases in March and April). The forced increase in savings and recovery rebates likely helped to fuel down payments. Families may be looking to drive somewhere for vacation this summer rather than fly, which is often a good excuse to purchase a new car. While retail sales of vehicles have more than recovered, fleet sales are expected to lag considerably. Carmakers normally sell a lot of vehicles to rental agencies and to state and local governments, but that’s restrained currently. While retail sales improved significantly in May and June, about 70% of consumer spending (prior to the pandemic) has been services. Proprietary weekly data show a decrease in retail sales in early July.

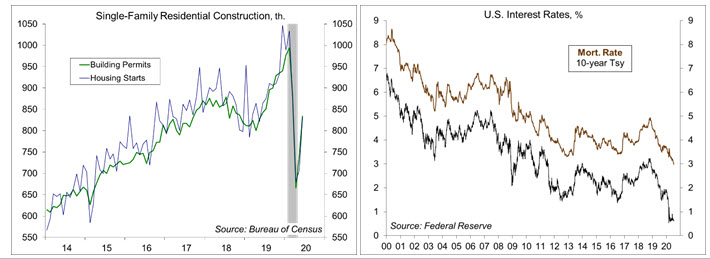

Forced savings may have also helped families to pull together a down payment for a house. Existing home sales are expected to have improved further in June, although supply constraints (a limited number of homes on the market) may be a restraint. Home mortgage rates are low (below 3%), but prices remain elevated. Residential homebuilding continued to recover in June.

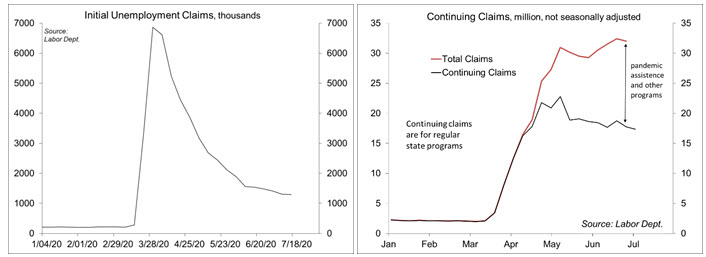

Weekly claims for unemployment benefits have continued to trend above 1.3 million. The pace of improvement has slowed. This suggests that, as the overall economy remains weak, firms are shedding workers. Many businesses are facing lower revenues and are likely to reduce payrolls in the months ahead (barring a full recovery, which will depend on a vaccine). A retreat in states’ re-opening directives will likely have a dampening impact on the recovery and may push consumer spending lower. Risks to the economic growth outlook remain weighted to the downside.

The extension of unemployment benefits ends this month. Congress returns this week and will have to act quickly. The recent surge in COVID-19 cases has added uncertainty. Households and business may become more cautious, reducing spending, new hiring, and capital expenditures. The longer the economic restraint due to the pandemic goes on, the greater chance of permanent scarring. Damage to household and business balance sheets will be more severe and take longer to recover. Unemployed workers will lose skills, making it harder to find new jobs.

It now appears likely that the economy will need some restructuring even after the pandemic has passed. The Federal Reserve’s main goal has been to insure liquidity to the credit markets, but the central bank can do more. Lending and credit facilities are essentially unlimited and can be scaled up if needed. Fiscal support (tax cuts or government spending) has a more immediate effect and should help the economy to transition to the other side of the pandemic. The cost of added government borrowing is not much of an issue currently. The government has no problem borrowing and interest rates are expected to remain low for a long time.

It’s still all about the pandemic. Things would be a lot easier now if we had done a better job in containing the virus. The sacrifices of the last four months have not been entirely in vain, but the failure to better control the spread of the coronavirus means that the economy will need more support now than it would have needed otherwise.

Recent Economic Data

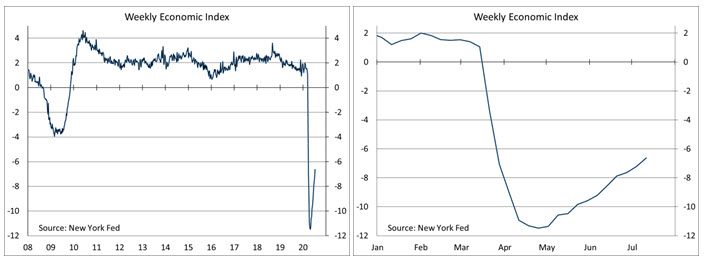

The mid-month economic data reports remained consistent with a strong-but-partial rebound in activity as state economies re-opened. The Fed’s Beige Book noted that “economic activity increased in almost all Districts, but remained well below where it was prior to the COVID-19 pandemic.” The Consumer Price Index rose 0.6% in June (+0.6% y/y), led by a 0.7% increase in food at home (+5.6% y/y) and a 12.3% rise in gasoline prices (-23.4% y/y). Ex-food & energy, the CPI rose 0.2% (+1.2% y/y).

Retail sales rose 7.5% in June, following a record 18.2% gain in May. Motor vehicle sales rose 8.2%, up 4.8% from February (reflecting pent-up demand from the shutdown, and likely fueled by increased savings). Ex- autos, sales rose 7.3% (down just 1.9% from February). Sales at clothing stores and restaurants, which had been hard hit in March and April, rose sharply again, but remained well below pre-pandemic levels.

Industrial production rose 5.4% in June (-10.8% y/y), held back by an 18.0% decline in oil and gas well drilling. Manufacturing output jumped 7.4% (-11.0% y/y), led by a 105% increase in motor vehicles (still down 24.6% y/y). Ex-autos, factory output rose 3.9% (-10.1% y/y), with widespread improvement across industries.

Single-family building permits rose 11.8% in June, following a 12.0% rise in May (although still down 16.1% from the spike in February). Single-family starts rose 17.2% (-4.0% y/y).

The Freddie Mac 30-year mortgage commitment rate fell below 3% for the first time.

Gauging the Recovery

Jobless claims edged down to 1.300 million in the week ending July 11, trending down, but more slowly, and still very high. Continuing claims fell by 422,000 in the week ending July 4, to 17.338 million (seasonally adjusted). The figures are for regular state unemployment insurance programs and do not include pandemic assistance and other programs. Total recipients, including all programs, were 32.003 million (not seasonally adjusted) for the week ending June 27 (down from 32.425 million in the previous week). Pandemic assistance includes self-employed and part-time workers (who normally wouldn’t qualify for benefits), as well as individuals who had previously exhausted their unemployment benefits. While some of the unemployed have returned to work, some have transitioned to pandemic assistance, and others have more recently lost their jobs.

The New York Fed’s Weekly Economic Index rose to -6.63% for the week of July 11, up from -7.21% in the previous week and a low of -11.48% at the end of April. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously).

The University of Michigan’s Consumer Sentiment Index fell to 73.2 in the mid assessment for July (the survey covered June 24 to July 15), down from 78.1 in June. The report noted that “consumer sentiment retreated in the first half of July due to the widespread resurgence of the coronavirus” and “declines are more likely in the months ahead as the coronavirus spreads and causes continued economic harm, social disruptions, and permanent scarring.”

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...