Chief Economist Scott Brown discusses current economic conditions.

Job losses in the early stages of the pandemic were more concentrated among low-wage workers. About half of those jobs have come back. For high-wage workers, who have been more able to work from home, job losses were less severe and have rebounded much better. The spring’s fiscal support helped to offset some of the impact, but there are broader concerns about the pandemic’s impact on potential growth.

Harvard’s Opportunity Insights’ Economic Tracker estimates that 35.2% of low-wage workers (earning less than $27,000 per year) had lost jobs by mid-April and 16.1% were still without a job at the end of July. In contrast, 13.2% of high-wage workers (those making more than $60,000 per year) lost jobs by mid-April and just 1.6% were without a job at the end of July. For those in the middle, 22.9% has lost a job by mid-April and 6.8% were still without work in late July. Social distancing, whether state directed or (more likely) self-imposed, had the biggest effect on consumer services, industries where people would come into close contact with others – tourism, air travel, spectator events, and restaurants. These industries aren’t going to recover fully until the pandemic is well behind us (that is, we have an effective, widely available vaccine).

Fiscal support played a key part in sustaining households who lost jobs and income, especially at the low end of the income spectrum. The government broadened eligibility, allowing part-time workers and the self-employed to receive benefits. It also supplemented state unemployment benefits, although the extra $600 per week ended after July.

Recovery rebate checks (or direct bank deposits) went out in April and early May — $1200 per individual ($2400 per married couple) plus $500 per dependent child, phasing out for those earning more than $75,000. Most economists do not recommend sending out tax rebates or stimulus check during a recession. It’s really inefficient. A recent NBER working paper demonstrates that “most respondents report that they primarily saved or paid down debts with their transfers, with only about 15% reporting that they mostly spent it.” While economists generally agree that rebates are poor stimulus, they remain very popular with politicians – and we see both parties providing rebates in every economic downturn. Another round of rebates is a key issue in the current fiscal support discussions. Go figure.

Stimulus checks did play an important part is supporting unemployed low-wage workers. These workers generally do not have much savings and appear to have more difficulty applying for unemployment benefits (you can’t apply online if you don’t own a computer, and life is generally more difficult if you don’t own a phone).

The U.S. Census Household Pulse Survey, based on responses collected September 16-28, showed that 36.6% of adults live in a household where at least one person telecommuted. Working from home is a lot harder, if not impossible, for many low-wage workers. Other results from this survey were more unsettling. About 22.3 million Americans (about 10% of adults) report that they sometimes or often did not have enough to eat in the past week. On housing insecurity, 6.8% were either not current on their rent or mortgage payment, or have little or no confidence in making their next payment on time. Of those not current on rent or mortgage, 32.1% expect an eviction or foreclosure in the next two months. In addition, 31.9% of adults are having difficulty paying usual household expenses.

The pandemic has also had a significant impact on education. The Household Pulse Survey showed that 81.7% of adults with post-secondary educational plans had those plans cancelled or changed significantly this fall. The path to the middle class has become more difficult for those in low-income households, many of which lack the ability to take online classes. Among mid- and high-wage households, childcare and schooling has become a serious concern. Quit rates, normally a sign of a strong job market, have risen, but partly because one spouse has chosen to focus on taking care of the children.

For those able to work from home or to commute to a safe working environment, the pandemic seems mostly an annoyance. You can’t travel, eat at restaurants, or attend sporting events in the same way as in the past. However, the long-term unemployed are experiencing significant hardship. Education is getting harder to attain for those in lower-income households, leaving them with fewer skills as the job market recovers. A lot will depend on the amount of further fiscal support, but there is likely to be more long-term scarring as additional aid is delayed.

Gauging the Recovery

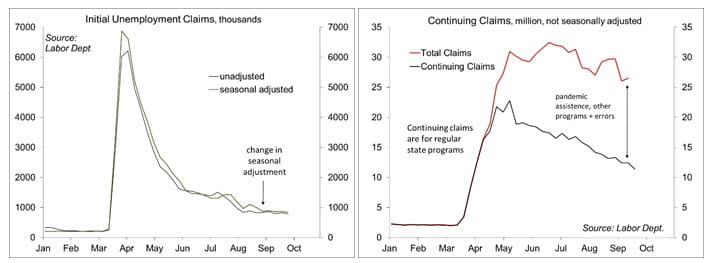

Jobless claims, a leading economic indicator, fell to 840,000 in the week ending October 3. However, California, which had accounted for around 30% of U.S. claims in recent weeks, remained in a two-week pause in processing claims. The four-week average was 857,000 – still an extremely high trend (although less horrific than in March and April). Continuing claims (for regular state unemployment insurance programs), a coincident economic indicator, fell by 1,003,000 (week ending September 26) to 10.976 million.

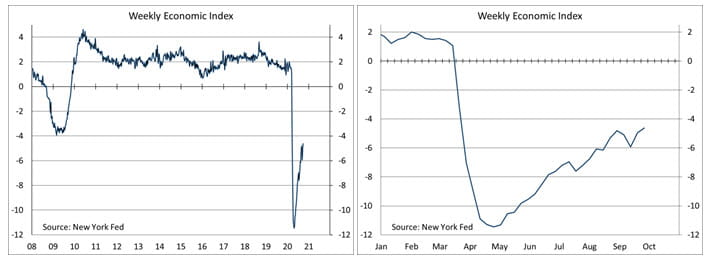

The New York Fed’s Weekly Economic Index rose to -4.18% for the week of October 3, up from -4.40% a week earlier (revised from -4.62%) and a low of -11.45% at the end of April, consistent with a moderation in the pace of the recovery. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously). Note that the weekly figures are subject to revision

The University of Michigan’s Consumer Sentiment Index rose to 80.4 in the full-month assessment for September (the survey covered August 26 to September 28), vs. 78.9 at mid-month and 74.1 in August. The report noted that “the September survey recorded a significant increase in the proportion that expected a reestablishment of good times financially in the overall economy.” However, “the recent gains, while encouraging, were largely due to upper income households.” There are two key non-economic issues that will have an impact on consumer sentiment in the near term. One is the availability and efficacy of a vaccine. The other is the election (the survey was conducted before the first presidential debate).

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...