Chief Economist Scott Brown discusses current economic conditions.

The economy added more than 6.4 million jobs in 2021, but December nonfarm payrolls were still 3.6 million below the pre-pandemic level. At the same time, the unemployment rate fell from 6.7% in December 2020 to 3.9% in December 2021, close to where it had averaged in 4Q19. The takeaway is that the labor market looks a lot different than before the pandemic and appears to be a lot closer to the Fed’s definition of full employment. Combine this with the view of a more persistent inflation problem, and it’s not a surprise that Federal reserve officials have already been contemplating an earlier lift-off in short-term interest rates and a potential run-off of the Fed’s balance sheet.

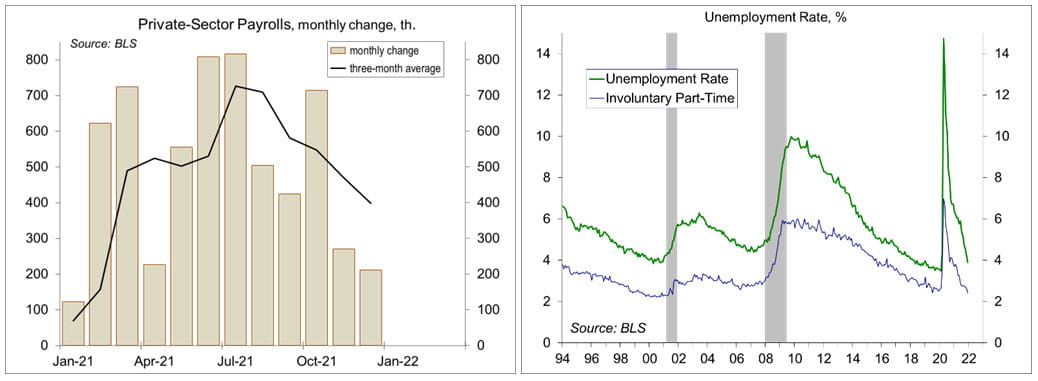

Nonfarm payrolls rose by 199,000 in the initial estimate for December well below market expectations (+450,000 or more) and far short of the 807,000 gain in private-sector payrolls estimated by ADP. Figures for the two previous months were revised higher, a pattern repeated over the last several months (which is typically seen in a strong job market). The monthly payroll figures are subject to statistical noise and seasonal adjustment can add uncertainty. The three-month average, at +365,000, was very strong by historical standards, but has been trending lower since the middle of the year, likely reflecting the increased difficulty that firms are having in finding new workers, especially in entry-level positions.

Average hourly earnings rose 0.6%, more than expected and up 4.7% year-over-year. Average hourly earnings are often unreliable, as compositional issues can distort (for example, faster or slower jobs gains in lower-paying industries). The Employment Cost Index, due January 28, is a more reliable measure (but should reflecting rising labor costs through December). There is some research that suggests that, prior to the pandemic, low-wage workers were generally unaware of opportunities outside of the firms they worked for. Pandemic disruptions have made them aware that there are better-paying jobs out there. As such, the anecdotal information indicates that percentage wage increases are much more pronounced for entry-level workers, in some cases 20-25% higher (this is also more evident in industries hardest hit by the pandemic).

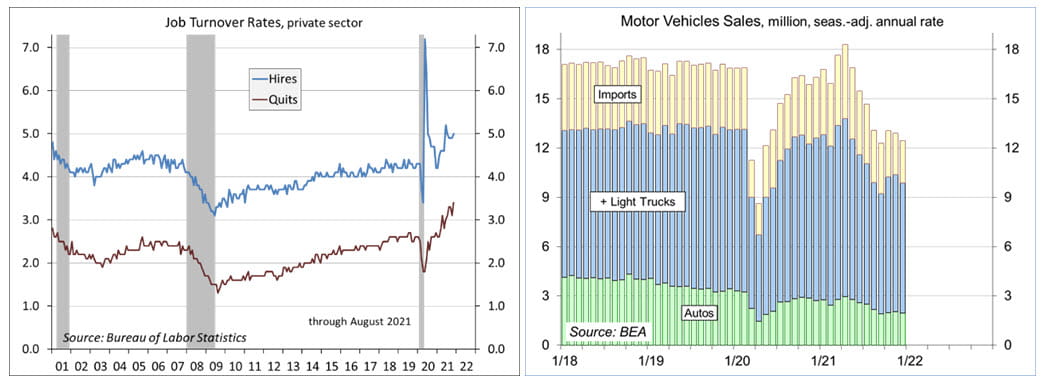

For the rest, annual cost-of-living increases are generally not keeping pace with inflation. The drop in real earnings should be a restraint on consumer spending growth. Job quits hit another record high in November and are likely to remain elevated in the new year. Labor reallocation is expected to remain a major headache for many firms in 2022, but others will be able to cast a wider net in looking for talent.

While nonfarm payrolls remain far short of where they were before the pandemic, the unemployment rate is close to fully recovered. Labor force participation was unchanged from November, but is probably not going to return to its pre-pandemic level. Price increases have broadened in recent months. As supply chains improve, we may see some retreat in goods price inflation, but supply chains are still under pressure and higher inflation in services, especially rents, is on the way. With employment appearing close to the Fed’s objective and inflation well above the Fed’s goal, monetary policy is much too accommodative.

At the mid-December Fed policy meeting, officials discussed the timing of rate increases and the potential unwinding of the Fed’s balance sheet. Rates could be raised as soon as the tapering is finished in March (the federal funds futures indicate about a 74% change of a March rate hike). Balance sheet run-off (a reduction in the size of the balance sheet) would help to lift long-term interest rates, keeping the yield curve from flattening as the short end rises. That run-off would likely be achieved naturally, as the Fed limits the reinvestment of maturing assets (rather than outright selling) – an orderly unwinding.

Recent Economic Data

Nonfarm payrolls rose by 199,000 (median forecast: +400,000, but market expectations much higher), with upward revisions to October and November (the three-month average gain was +365,000).

The unemployment rate fell to 3.9% (from 4.2%) – it was 6.7% a year earlier and a 3.6% average in 4Q19 (that is, before the pandemic). Labor force participation held steady at 61.9% (vs. 63.3% before the pandemic).

The ADP estimate of private-sector payrolls rose by 807,000 in December, with broad-based gains across industries. Leisure and hospitality rose by 246,000 (still 10.3% below the pre-pandemic level).

Job openings fell to 10.6 million in November (it hit a record 11.0 million in July). The hiring rate rose to 5.0%. The quit rate rose to a record 3.0% — 4.5 million quit their jobs.

December unit motor vehicle sales fell 21.0% from a year earlier, reflecting production issues.

The ISM Manufacturing Index rose to 58.7 in December (from 61.1 in November). The ISM Services Index fell to 62.0 (from 69.1). Details of both reports remained relatively strong by historical standards and each showed ongoing supply chain issues (materials shortages, transportation bottlenecks, long lead times).

Factory orders rose 1.6% in December (durable goods orders up 2.6%), reflecting a 34.0% rise in orders for civilian aircraft. Orders for nondefense capital goods ex-aircraft were unchanged, but up 11.7% y/y.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...