Chief Economist Scott Brown discusses current economic conditions.

Nonfarm payrolls rose about as expected in the initial estimate for July, even as economists’ forecasts were widespread and risks to their job outlooks were generally seen to the downside. The unemployment rate fell a bit more than anticipated, but labor force participation stalled. While the report was essentially a snapshot of the first half of July, as COVID-19 cases were rising, details were consistent with the view that the pace of the economic recovery has moderated. Fiscal support played a key role in the initial rebound in May and June. More will be needed to prevent the economy from relapsing in the near term.

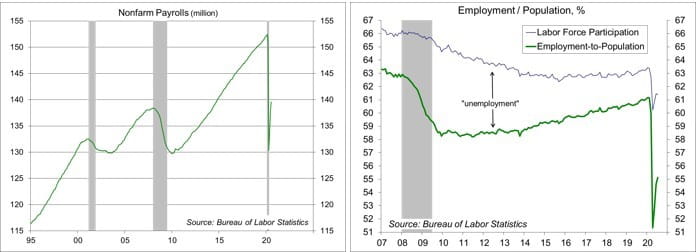

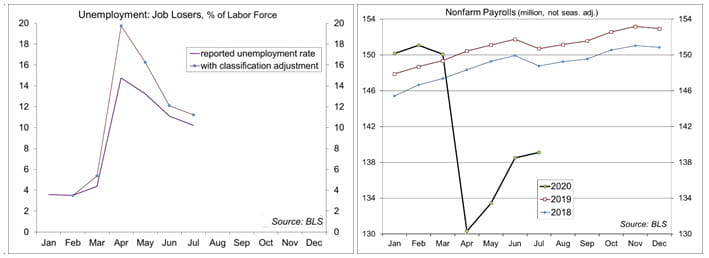

Nonfarm payrolls rose by 1.763 million in the initial estimate for July, up 591,000 before seasonal adjustment. Unadjusted, payrolls fell by 1.040 million in July 2019, reflecting the end of the school year. Some education jobs that would have shown up in July occurred earlier this year, resulting in a seasonally adjusted gain of 268,000. Beyond this quirk, payroll gains were relatively broad-based in July, although improvement was more moderate than in May and June. Nonfarm payrolls fell by 22.1 million in March and April. We’ve added 9.3 million jobs back in May, June, and July. Unadjusted payrolls are down 11.6 million (7.7%) from July 2019.

The unemployment rate fell to 10.2% in July. The classification issue, which led to an under-reporting of the unemployment rate in recent months, remained more limited (at most one percentage point in June and July, vs. five percentage points in April. Labor force participation edged a bit lower in July. There’s a fair amount of noise in the household survey data even in the best of times, but the July figures point to more gradual improvement in labor market conditions. Summer jobs for teenagers and young adults were less prevalent. The employment/population ratio rose to 55.1%, from 54.6% in June and a low of 51.3% in April.

There appear to be a number of forces at work here. The economy has recovered more than a third of the jobs lost due to extreme social distancing in March and April. Some of those returned workers have been laid off again. That may be blamed on a retreat in state re-opening efforts, but there’s evidence that fear of the virus is a more important factor than social distancing directives. Some new jobs have been created (grocery stores, delivery services). Most of the jobs lost in the spring will not be coming back soon. More worrisome, lingering economic weakness will weigh on company earnings, likely leading to further job cuts in the months ahead.

Job weakness has been more pronounced at the lower end of the income scale, where households have limited resources to deal with extended unemployment. Government support has been key, helping to shore up consumer spending. Without that support, spending will weaken, leading to further job losses and a more protracted recovery or a double-dip recession.

While there is some optimism about a possible vaccine, hope is not a plan. Fiscal support can easily be tied to economic conditions, such as the unemployment rate. So if economic weakness were to last a lot longer, government support would prevent things from getting worse. And if the economy were to recover more quickly, support will fade sooner. Yet, there has long been resistance to do so on Capitol Hill.

Recent Economic Data

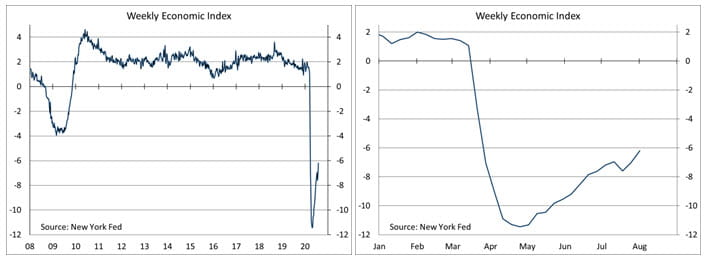

Recent reports have remained consistent with a further recovery in the economy, although the level of activity remains far short of pre-pandemic levels and the pace of improvement appears to have moderated.

The unemployment rate fell to 10.2% in July, from 11.1% in June. The classification issue, which lead to an under-reporting in the unemployment rate of five percentage points in April (the unemployment rate should have been closer to 20%, rather than the 14.7% reported), remained limited (at most one percentage point in June and July). Labor force participation edged down to 61.4%, vs. 63.4% in February.

There has been a focus on schools re-opening. That will show up in the payroll data for August and (mostly) September. The end of the school year leads to job losses in May, June, and (mostly) July. Prior to seasonal adjustment, nonfarm payrolls were 11.6 million (7.7%) lower than in July 2019.

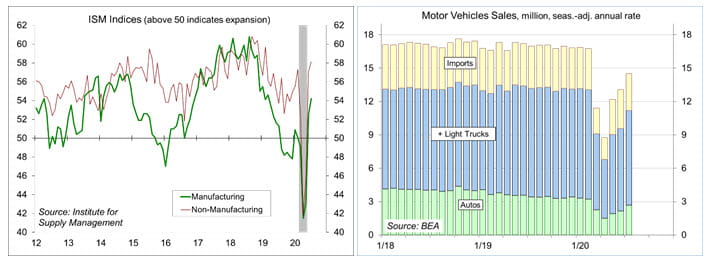

The ISM surveys were stronger than expected in July, but each showed further declines in employment. These are diffusion indices, reflecting direction rather than level. Comments from supply managers were mixed, but continued to reflect concerns about the economic effects of the pandemic.

Unit motor vehicle sales improved further in July. Despite the pandemic, consumer spending on vehicles rose in 2Q20. However, the consumer sector accounts for a little less than half of unit sales. A little more than half shows up in business fixed investment (leasing and rentals).

Gauging the Recovery

Jobless claims fell to 1.186 million in the week ending August 1, the lowest since the week ending March 14, but still very high. Seasonal adjustment is multiplicative and exaggerates the adjusted figure in August and September (when unadjusted claims are at their seasonal lows). Continuing claims fell by 844,000 in the week ending July 25, to 16.107 million. The figures are for regular state unemployment insurance programs and do not include pandemic assistance and other programs. Total recipients, including all programs, were 31.309 million (not seasonally adjusted) for the week ending July 18 (up from 30.816 million in the previous week).

The New York Fed’s Weekly Economic Index rose to -6.20% for the week of August 1, up from -7.01% in the previous week and a low of -11.45% at the end of April. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously).

The University of Michigan’s Consumer Sentiment Index fell to 72.5 in the full-month assessment for July (the survey covered June 24 to July 27), down from 73.2 at mid-month and 78.1 in June. The report noted that “consumer sentiment sank further in late July due to the continued resurgence of the coronavirus” and cautioned that “the lapse of the special jobless benefits will directly hurt the most vulnerable and spread even further by missed rent, mortgage, and other debt payments.”

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...