Chief Economist Scott Brown discusses current economic conditions.

The April Employment Report was flawed, reflecting issues with data collection, classification, and methodology. However, results were consistent with an unprecedented, sharp deterioration in labor market conditions, mostly at the lower rungs. Payrolls fell by more than 20 million, nearly erasing the number of jobs gained since the financial crisis. The unemployment rate jumped to 14.7%, but that understated the problem. Correcting for a classification issue, the figure would have been closer to 20%. So many lower-income workers were jettisoned in April, average hourly earnings surged. None of this tells anything about where we’re going. While many are hoping for an economic rebound, recovery will take time and there is going to some permanent job destruction.

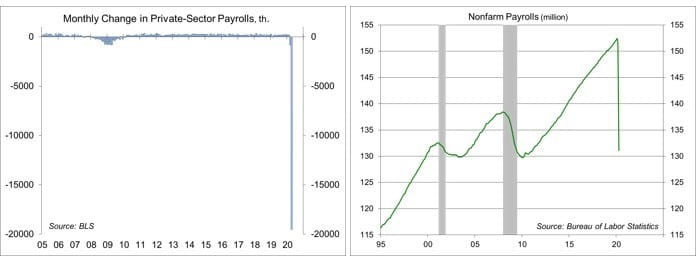

Nonfarm payrolls fell by 20.5 billion in the initial estimate for April, the largest decline on record, dwarfing the amount of job losses during the financial crisis. Private-sector jobs were down 14.5% from a year earlier. Leisure and hospitality lost 7.65 million in April, down 48% in the last two months (5.49 million of that in restaurants). Manufacturing shed 1.3 million jobs. Construction lost 975,000. Retail jobs fell by 2.1 million. Temp- help payrolls fell by 842,000 (-30.9% y/y). State and local government lost 981,000 jobs, about two-thirds in education (in comparison, we lost about 700,000 state and local government jobs in total during the financial crisis).

In a normal April, we would expect to add around one million jobs. Prior to seasonal adjustment, payrolls fell by 19.5 million. The Bureau of Labor Statistics uses a birth/death model to account for business creation and destruction. This model does well in normal circumstances, but tends to miss badly at turning points. The model would have added 246,000 to the unadjusted payroll total, but the BLS adjusted that to -553,000 to account for the effects of COVID-19. Annual benchmark revisions will eventually correct that, but why worry about the nearest million or so at this point.

Weekly jobless claims have been trending lower in recent weeks, but the level remains elevated. Over the seven weeks ending May 2, 33.5 million workers had filed a claim. The Labor Department’s seasonal adjustment is multiplicative, which exaggerates the headline figure. Prior to seasonal adjustment, 30.7 million filed claims (18.7% of the labor force, or more than one in six workers). There may be multiple filings, as some workers get tired of waiting and file again, but that is likely small. On the other hand, a lot of workers can’t file, so the headline figure tends to understate the amount of job losses.

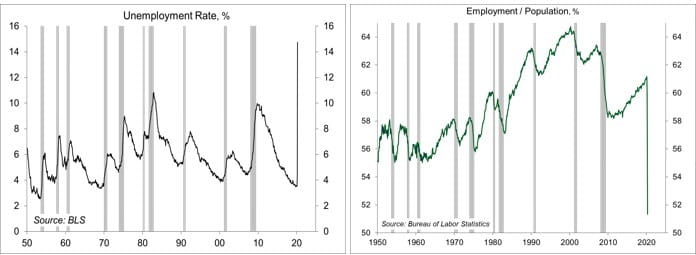

The unemployment rate spiked to 14.7% in April. Furloughed individuals should be tallied as “unemployment on temporary layoff,” but a lot weren’t. Enough, according to the BLS, to reduce the unemployment rate by about five percentage points. In other words, the unemployment rate should have been reported closer to 20%. The unemployment rate for teenagers jumped to 31.9% (from 14.3 in March and 11.0% in February). The rate for young adults (aged 20-24) rose to 25.7% (from 8.7% in March and 6.4% in February). For prime-age workers (25-54), the rate rose to 12.8% (from 3.6% in March and 3.0% in February).

The weakness in the labor market was better reflected in the employment/population ratio, which fell to a record low of 51.3% (vs. 60.0% in March and 61.1% in February).

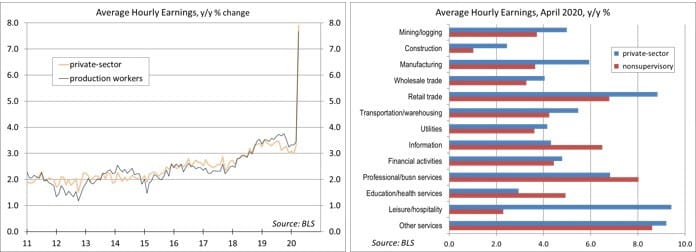

Average hourly earnings are lower in leisure & hospitality than in other industries (in February, $16.85 vs. $28.52 for the private sector as a whole). Hence, greater job losses in lower paying industries would boost the overall average. However, average wage gains picked up across a wide range of industries in April. It appears that lower-income workers fared the worst in general in April – not just in leisure & hospitality.

Many furloughed workers can expect to return to work at the economy opens up, but not all. The Payroll Protection Program, “recovery rebates,” and extended unemployment benefits should help to less the damage, but many will fall through the cracks and not every job will come back. There will be some permanent damage. How much is unclear.

Most of the economic data reports are backward-looking, but weekly jobless claims will remain the key real-time figure to watch. Claims have been coming down in recent weeks, but they have remained in the millions. Seeing claims falling a lot more would be a hopeful sign, but that may not happen anytime soon.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...