January 15, 2021

Chief Economist Scott Brown discusses current economic conditions.

Judging by recent phone calls and email queries, inflation is a serious concern among investors this year. We can expect to see some reflation, a rebound in prices that were depressed during the pandemic, but a broad-based increase in underlying inflation is unlikely. Opinions may differ, even among Federal Reserve policymakers, but the central bank’s revised monetary policy framework suggests no need to take the foot off of the gas pedal anytime soon.

Large federal budget deficits do not cause inflation. We ran huge deficits (as a % of GDP) during the 1980s as inflation fell.

Accommodative monetary policy may lead to higher inflation. Last summer, the Fed signaled that, following a period of inflation below 2%, it would shoot for a period of above-2% inflation. That’s a sharp contrast to the previous view that the Fed should act preemptively (that is, raise rates in advance), to head off higher inflation. Officials are confident that they can get inflation higher, but the Fed has struggled to reach its 2% goal in recent years.

Inflation is a monetary phenomenon, but observed through pressure in resource markets. In the details of the December reports on producer prices and import prices, there is evidence of pipeline pressures in prices of raw materials. However, there is little evidence that firms are able to pass higher costs along. In the ISM surveys, supplier delivery times rose further in December. Normally, that would be a sign of demand outpacing supply. However, this increase is reflective of supply chain issues related to the pandemic. Manufacturers have adapted to the pandemic, but it hasn’t always been easy. Still, there is limited inflation showing up in finished goods. Import prices have begun to pick up, but increases are concentrated in oil and industrial inputs. There is little inflation in imported finished goods.

The labor market is the widest channel for inflation pressure. Average hourly earnings were reported to have risen 5.1% year-over-year in December. However, that increase reflects job losses at the lower end of the wage spectrum (which raises the average). The Employment Cost Index (4Q20 data due January 29) do not suffer from this compositional effect (and also include benefit costs) and are expected to have risen moderately. Overall, labor costs pressures are low. Firms are also finding that the trend of working remotely allows them to cast a wider net in looking for talent, restraining labor costs.

There are two general post-pandemic theories about higher inflation. One is that increased savings and pent-up demand will lead to a surge in demand once vaccines are widely distributed, driving prices higher. One lesson of the 1918 pandemic is that consumers will be eager to make up for lost time. However, supply should also pick up quickly. Certainly, we ought to see airfares and hotel fees rebound from pandemic lows, but these would be reflationary, transitive, and not indicative of a higher underlying trend. Currently, there are plenty of empty hotel rooms and idle airplanes, which can be brought into service as demand picks up.

There other theory of higher inflation states that forces that have held inflation down over the last couple of decades are coming to an end. Notably, globalization has put downward pressure on wages and prices, but appears to have stalled, or is at least poised to expand at a much slower pace than in recent decades. China’s working-age population began to decline in 2011. As a consequence, wage growth in that country should pick up. Yet, automation has been as important a factor as increased foreign trade in reducing inflation pressures. We can expect further advances over the next couple of decades, including driverless cars and trucks.

There are two key factors in modeling inflation: inflation expectations and a measure of slack in the economy. Inflation expectations can be survey- based or market based. Recent surveys of economists do not show a significant increase in inflation. For example, the Bloomberg’s December survey showed an expectation of 1.7% for the PCE Price Index for 2021 and 1.8% for 2022. Inflation compensation, the yield difference between inflation-adjusted Treasuries and fixed-rate Treasuries (not quite the same as inflation expectations, but close enough), have risen over the last couple of months, but are still low: about 2.09% for both the five- and ten-year outlooks. The Fed has succeeded in anchoring inflation expectations in recent decades and a shift away from 2% would indicate doubts about the Fed’s ability – that’s unlikely but it’s worth keeping an eye on inflation expectations.

Some may worry about a weaker dollar. We shouldn’t see a large drop in the dollar in 2021, but even if we did, the impact on consumer price inflation would be modest at best. Inflation is by far driven more by domestic factors.

Recent Economic Data

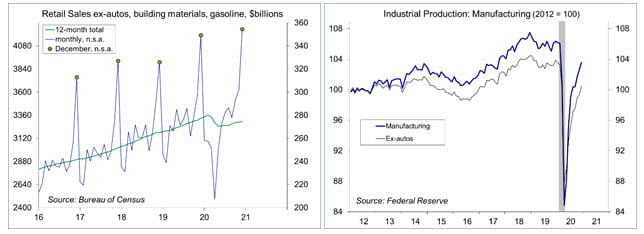

Retail sales fell 0.7% in December, with downward revisions to November (+2.9% y/y), down 1.4% (+1.1% y/y) ex-autos. Ex-autos, building materials, and gasoline, sales fell 2.4% following a 1.5% drop in November – however, the 4Q20 total was 3.5% higher than in 4Q19.

Industrial production rose 1.6% in December (-3.6% y/y), boosted partly by a 6.2% increase in the output of utilities (November was unseasonably warm). Manufacturing output rose 1.0% (-2.6% y/y), up 1.1% excluding motor vehicles (-3.2% y/y).

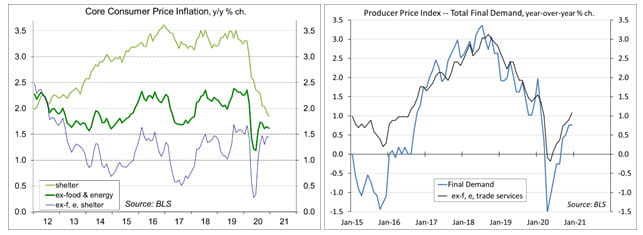

The Consumer Price Index rose 0.4% in December (+1.4% y/y), boosted by an 8.4% rise in gasoline (+3.4% before seasonal adjustment, -15.2% y/y). Ex-food and energy, the CPI rose 0.1% (+1.6% y/y). Homeowners’ equivalent rent (24% of the overall CPI and 30% of the core CPI) rose 0.1% (+2.2% y/y, vs. +3.3% in the previous 12 months).

The Producer Price Index rose 0.3% in December (+0.8% y/y), boosted by a 16.1% increase in wholesale gasoline prices (which rose 10.0% before seasonal adjustment, down 20.8% y/y). Ex-food, energy, and trade services, the PPI rose 0.4% (+1.1% y/y). Ex-food and energy, the price index for unprocessed intermediate goods rose 4.5% (+20.3% y/y), while the index for processed intermediate good rose 1.2% (+2.0% y/y).

Import prices rose 0.9% in December (-0.3% y/y), up 0.4% ex-food & fuels (2.0% y/y). Ex-fuels, prices of industrial supplies and materials rose 2.3% (+8.9% y/y). However, inflation in imported finished goods remained mild.

Gauging the Recovery

The number of new daily COVID-19 cases has continued to surge. Increased social distancing, whether state mandated or voluntary self-preservation, should slow the pace (and the economy), but we are likely to see the surge get worse before it gets better.

The New York Fed’s Weekly Economic Index rose to -1.70% for the week ending January 9, down from -1.90% a week earlier (revised from -1.76%) and a low of -11.45% at the end of April. The WEI is scaled to four- quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously).

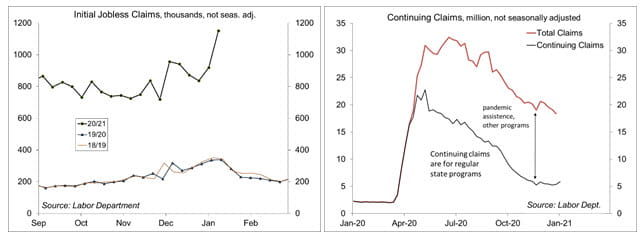

Jobless claims jumped to 965,000 in the week ending January 9 (1.151 million before seasonal adjustment), consistent with the weakness seen in the December Employment Report. Unadjusted claims normally spike at the start of the year, but we are likely seeing an impact from the pandemic surge.

The University of Michigan’s Consumer Sentiment Index edged down to 79.2 in the mid-month assessment for January (the survey covered January 2-13, vs. 80.7 in December and 76.9 in November. The report noted a “trivial” decline in early January “despite the horrendous rise in covid-19 deaths, the insurrection, and the impeachment of Trump.”

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...