January 4, 2021

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

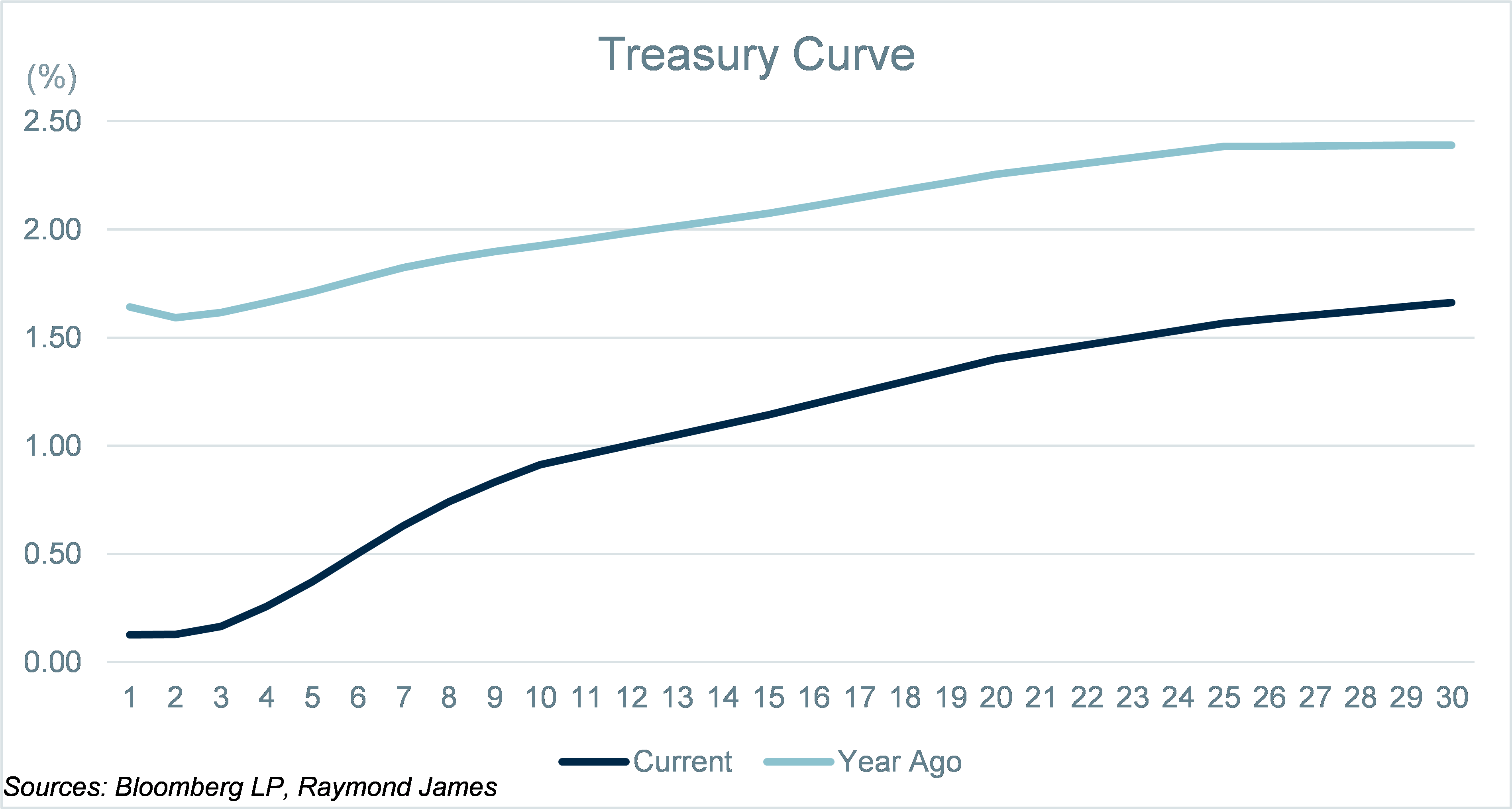

A flight to quality ensued as Fed Funds returned to a 0.00-0.25% range plus massive amounts of Quantitative Easing worked together to push Treasury yields lower. In early March, the benchmark 10-year Treasury yield fell below 1.00% for the first time ever, making it all the way down to 0.52% in early August. Treasury yields moved lower across the board, although the curve steepened over the course of the year, as short-term yields fell more than intermediate and long-term yields.

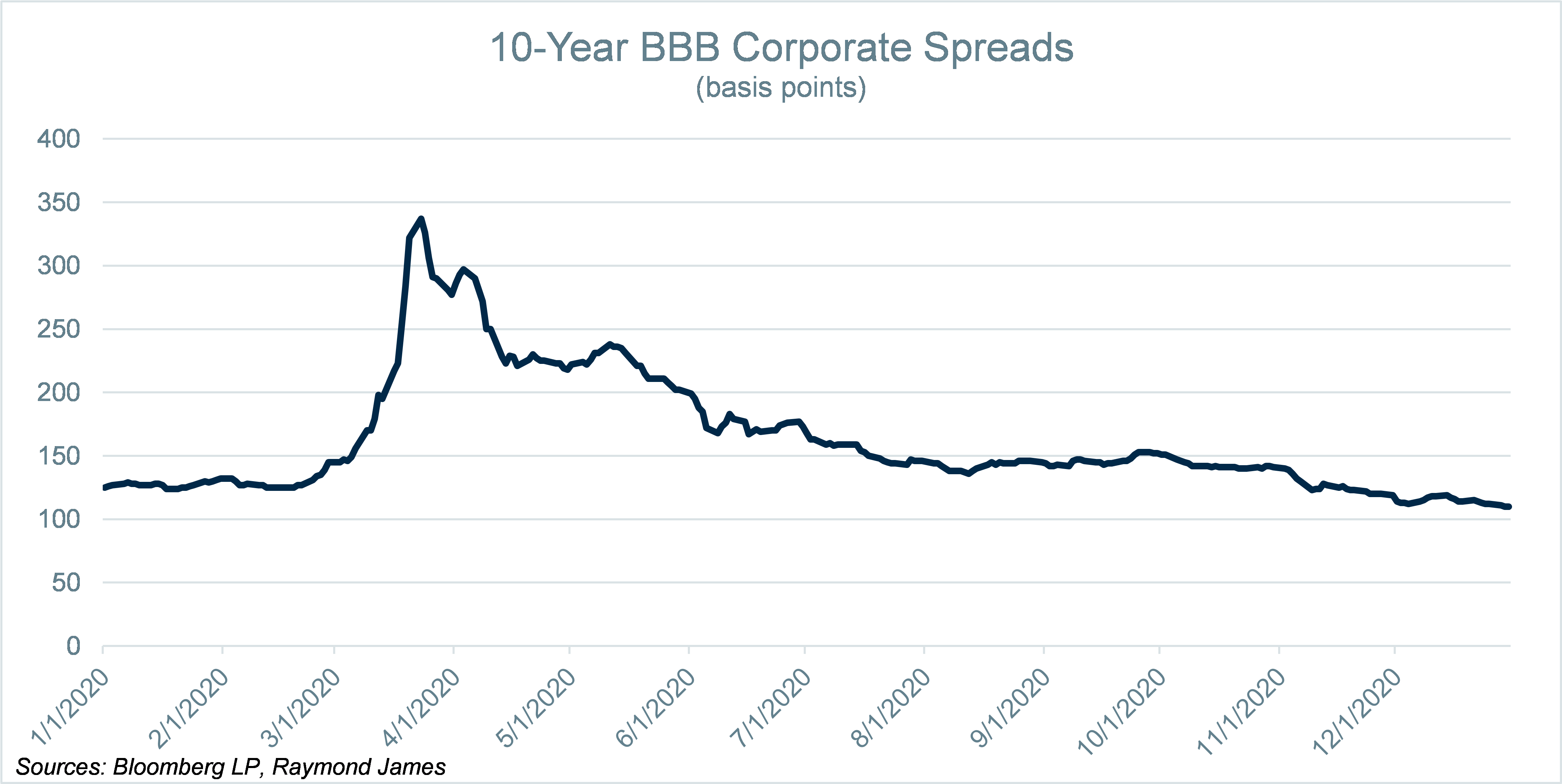

Corporate yields fell over the course of the year, along with the yields of every other major fixed income product, but the story in corporate bonds was the dramatic spread widening experienced early in the year. As the reality of the pandemic set it, taxable fixed income funds experienced record setting levels of outflows, forcing mass liquidations by fund managers at a time when there was very little demand in the market. This caused the sharp spread widening in the March-April timeframe seen in the chart above. This created a tremendous opportunity for investors who were ready and willing to put money to work, as since then, spreads have been moving steadily tighter (prices higher), returning to more normal levels.

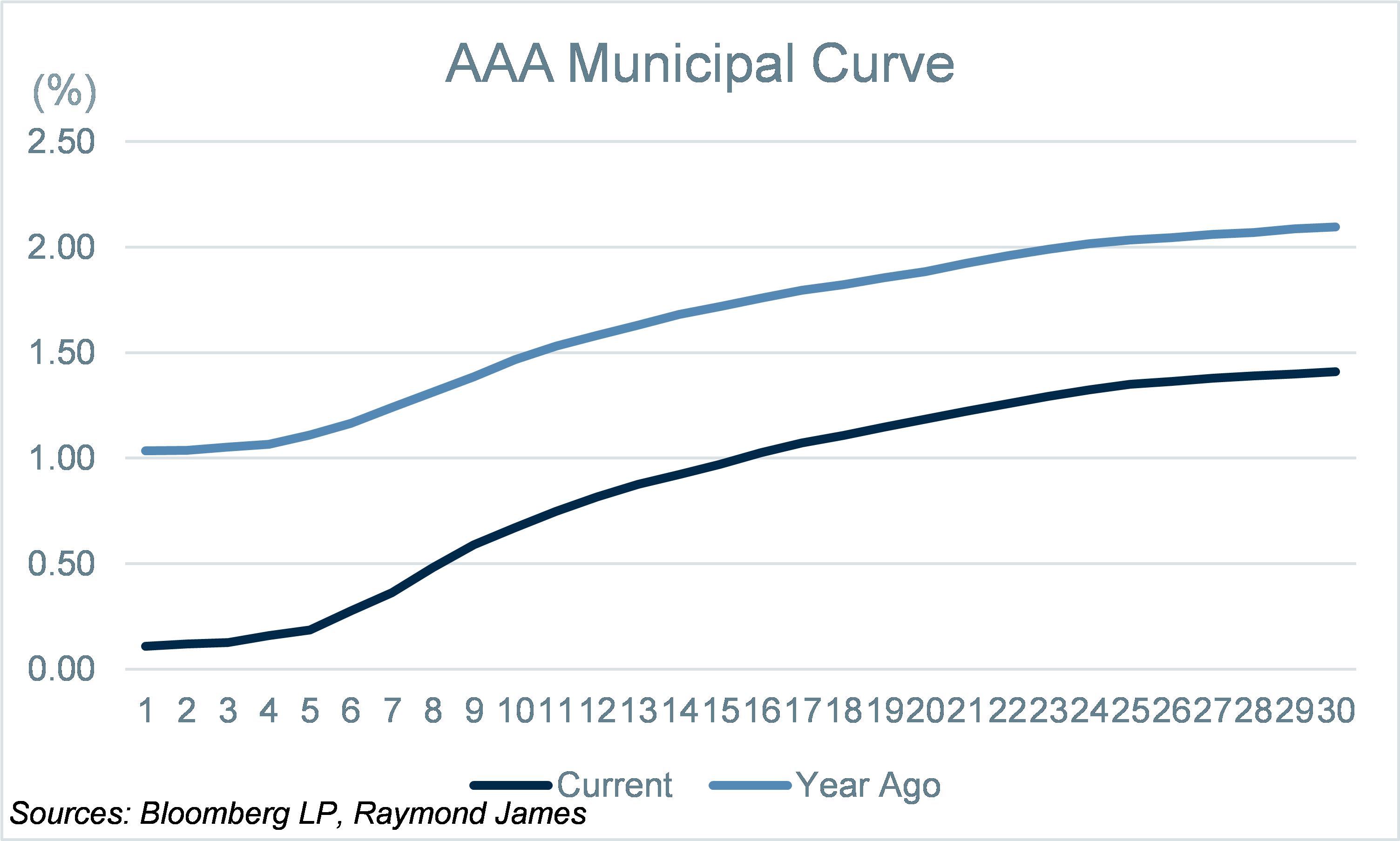

Municipal yields followed a similar path as corporate yields over the course of 2020. Yields spiked dramatically in March-April, presenting a similar opportunity as we saw in the corporate market over the course of a few weeks. Yet, the full story of the year is captured in the graph above, showing the municipal curve at the beginning of the year versus where it ended. The story for municipals was lack of yield, exaggerated to the extreme on maturities inside of 5 years. The intermediate part of the curve actually steepened, providing investors value in the 6-15 year range.

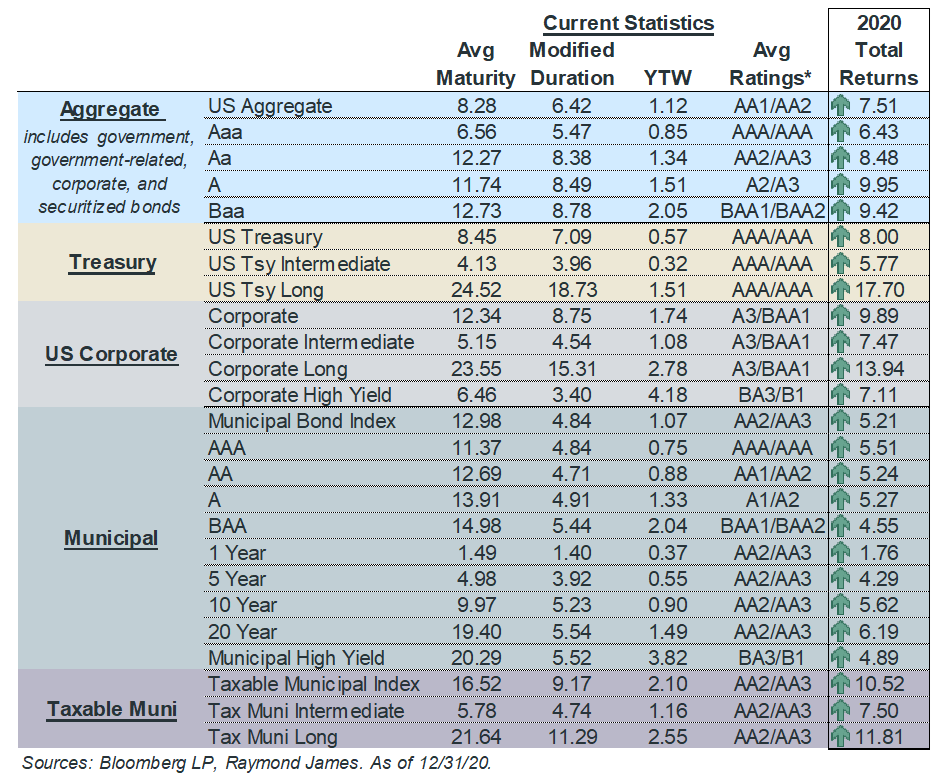

Falling yields means higher prices, which boosted total returns across the fixed income landscape for 2020. The chart above speaks for itself: positive total returns were abundant and easy to find. As we look forward to 2021, it is time to re-set your fixed income lens. With rates still hovering near all-time lows in many products, total return will likely be much harder to come by in the New Year. Recalibrate your thinking and remind yourself that objective # 1 for the fixed income portion of your portfolio is likely principal preservation. Objective # 2 can be maximizing yield and total return. Ensure that you stay within your risk parameters and don’t sacrifice your primary objective while reaching for a secondary one.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...