Chief Economist Eugenio J. Alemán discusses current economic conditions.

We understand that markets have already decided for the Federal Reserve (Fed) regarding what it is going to do with rates during the July 25-26 Federal Open Market Committee (FOMC) meeting. Markets are betting 93.6% to 6.4% (as of 11:00 AM ET on Friday, July 14, 2023) that the Fed is going to increase the federal funds rate by 25 basis points (bps). However, we are still not convinced, and we may have to recognize that we were wrong… but we still have some time to prepare.

If the Fed is true to its long-professed ‘data-dependent’ mantra, and we hope it is, then it is very difficult to justify another increase in the federal funds rate at this time. This is because the largest contributor to the 0.2% increase in June’s core Consumer Price Index (CPI) was shelter costs, up 0.4% during the month, and since we know that shelter costs are going to start slowing down fast during the second half of the year, then this means that inflation is also going to slow down considerably during the second half of the year.

Perhaps the biggest risk, once again, is the potential for further increases in energy costs due to the recent increase in the price of petroleum, and that could help convince some Fed officials of the need to go for another 25 bps to try to preempt any acceleration in inflation going forward. However, if Fed officials are certain that core prices will continue to disinflate, then they should stay put and wait for more information down the road.

Having said this, Fed officials need to realize that this disinflationary process is occurring at the same time that the U.S. economy seems to be growing faster than potential growth, the rate of unemployment remains very low, and the labor market remains tight, but has started to show some signs of coming into balance. This should be enough for an institutional body that professes that it conducts monetary policy in a ‘data- dependent’ way.

Consumption and job growth

Government efforts during the COVID-19 pandemic to prevent an even more serious economic crisis produced one of the largest fiscal efforts in recorded history, perhaps only behind the fiscal efforts delivered during the Great Depression with the New Deal, and the efforts delivered during the Second World War, as the U.S. government ‘guided’ the U.S. economy in the production of war/military goods rather than consumer goods/services.

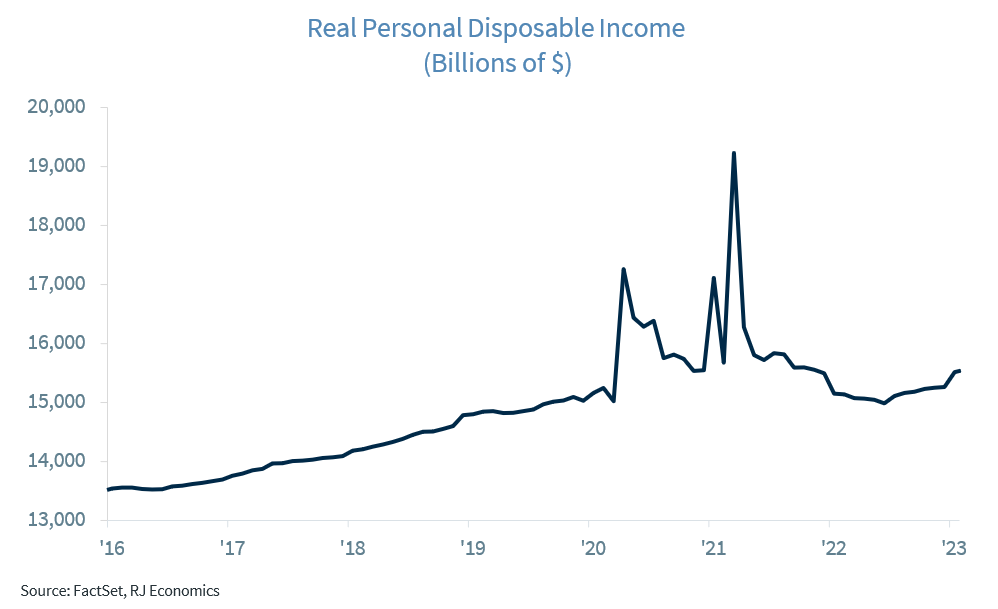

In this case, the U.S. government engineered an expansion in fiscal policy that gave direct subsidies (in the form of direct checks as well as extra monies for those collecting unemployment insurance) to individuals and businesses (in the form of PPP loans, i.e., grants). This fiscal expansion through income transfers produced an immense surge in disposable personal income during a time when consumers were limited in their mobility, generating an impressive accumulation of savings that consumers/businesses have been deploying since the end of the pandemic recession. However, these monies are being depleted and consumers/businesses are, once again, depending more and more on ‘old-fashioned’ increases in income from jobs/earnings from businesses to continue to spend going forward. Thus, the ability of the U.S. economy to growth during the rest of the year as well as into next year depends, fundamentally, on the ability of firms to continue to create jobs but more importantly, on their ability to keep those employed in their jobs.

That is, for individuals to continue to consume today they need to count on the flow of disposable personal incomes generated by having jobs. That is, the stock of monies accumulated during the pandemic are no longer available. Thus, going forward, the fate of the American consumer will be inextricably linked to the flow of incomes from jobs and less so to access to credit, as interest rates continue to go higher, and lending continues/starts to dry up.

However, what we saw with the June nonfarm payroll employment release was, perhaps, the first sign of weakness in employment creation that was masked by an increase of 60,000 new jobs at the government level, mostly created by state and local governments. Job growth in the private sector slowed down to ‘only’ 149,000, with almost half of those jobs created by the health care and social assistance sector (up 65,2000 jobs in June). This is a sector that, typically, does well during a weak economy. Furthermore, the leisure and hospitality sector, a sector that still lags compared to pre-pandemic levels, added another 21,000 jobs during the month of June, the same number as those added by the professional and business services sector while other services added 17,000 jobs.

But some of the most important service sectors, retail trade, transportation and warehousing, wholesalers trade, and temporary help services within the professional and business services sector, etc., subtracted jobs during the month and could be the first sign that the service sector, while not falling apart, is starting to slow. Furthermore, the weakness in consumer prices during June is probably another good indicator that the economy, especially the service side of the economy, is starting to slow, which is what the Fed has been looking to achieve for a while.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those of Raymond James and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur. Last performance may not be indicative of future results.

Consumer Price Index is a measure of inflation compiled by the US Bureau of Labor Statistics. Currencies investing is generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

Consumer Sentiment is a consumer confidence index published monthly by the University of Michigan. The index is normalized to have a value of 100 in the first quarter of 1966. Each month at least 500 telephone interviews are conducted of a contiguous United States sample.

Personal Consumption Expenditures Price Index (PCE): The PCE is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The change in the PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

The Consumer Confidence Index (CCI) is a survey, administered by The Conference Board, that measures how optimistic or pessimistic consumers are regarding their expected financial situation. A value above 100 signals a boost in the consumers’ confidence towards the future economic situation, as a consequence of which they are less prone to save, and more inclined to consume. The opposite applies to values under 100.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members.

GDP Price Index: A measure of inflation in the prices of goods and services produced in the United States. The gross domestic product price index includes the prices of U.S. goods and services exported to other countries. The prices that Americans pay for imports aren’t part of this index.

The Conference Board Leading Economic Index: Intended to forecast future economic activity, it is calculated from the values of ten key variables.

The Conference Board Coincident Economic Index: An index published by the Conference Board that provides a broad-based measurement of current economic conditions.

The Conference Board lagging Economic Index: an index published monthly by the Conference Board, used to confirm and assess the direction of the economy’s movements over recent months.

The U.S. Dollar Index is an index of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners’ currencies. The Index goes up when the U.S. dollar gains “strength” when compared to other currencies.

The FHFA House Price Index (FHFA HPI®) is a comprehensive collection of public, freely available house price indexes that measure changes in single-family home values based on data from all 50 states and over 400 American cities that extend back to the mid-1970s.

Import Price Index: The import price index measure price changes in goods or services purchased from abroad by U.S. residents (imports) and sold to foreign buyers (exports). The indexes are updated once a month by the Bureau of Labor Statistics (BLS) International Price Program (IPP).

ISM New Orders Index: ISM New Order Index shows the number of new orders from customers of manufacturing firms reported by survey respondents compared to the previous month. ISM Employment Index: The ISM Manufacturing Employment Index is a component of the Manufacturing Purchasing Managers Index and reflects employment changes from industrial companies.

ISM Inventories Index: The ISM manufacturing index is a composite index that gives equal weighting to new orders, production, employment, supplier deliveries, and inventories.

ISM Production Index: The ISM manufacturing index or PMI measures the change in production levels across the U.S. economy from month to month.

ISM Services PMI Index: The Institute of Supply Management (ISM) Non-Manufacturing Purchasing Managers’ Index (PMI) (also known as the ISM Services PMI) report on Business, a composite index is calculated as an indicator of the overall economic condition for the non-manufacturing sector.

Consumer Price Index (CPI) A consumer price index is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time.

Producer Price Index: A producer price index (PPI) is a price index that measures the average changes in prices received by domestic producers for their output.

Industrial production: Industrial production is a measure of output of the industrial sector of the economy. The industrial sector includes manufacturing, mining, and utilities. Although these sectors contribute only a small portion of gross domestic product, they are highly sensitive to interest rates and consumer demand.

The NAHB/Wells Fargo Housing Opportunity Index (HOI) for a given area is defined as the share of homes sold in that area that would have been affordable to a family earning the local median income, based on standard mortgage underwriting criteria.

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index measures the change in the value of the U.S. residential housing market by tracking the purchase prices of single-family homes.

The S&P CoreLogic Case-Shiller 20-City Composite Home Price NSA Index seeks to measures the value of residential real estate in 20 major U.S. metropolitan.

Source: FactSet, data as of 7/7/2023

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...