Chief Economist Eugenio J. Alemán discusses current economic conditions.

If there was a message the Federal Reserve (Fed) wanted to make clear after the end of the Federal Open Market Committee (FOMC) meeting on May 3, it was that it reserves the right to remain hawkish. That is, even though we think that May’s federal funds rate increase was the last one of this cycle and that the Fed is going to pause, the inflation environment remains skittish, to say the least. At the same time, we are expecting a rebound in monthly inflation once the April Consumer Price Index report (CPI) is released next week which could keep the year-over-year rate almost unchanged from the previous month’s year-over- year rate.

Furthermore, Thursday’s release of the Productivity and Unit Labor Cost report during the first quarter of the year added to last week’s Employment Cost Index report and reminded us, and Fed officials, of the still difficult road ahead to continue to bring down inflation. Last week we saw that the Employment Cost Index increased by about 1.2% during the first quarter of the year, quarter-over-quarter, and by 4.7% at a quarterly annualized rate. This week’s Productivity and Unit Labor Cost report showed that productivity declined by 2.7% at an annualized rate during the first quarter, pushing unit labor cost to an outsized rate of 6.3% during the quarter after it had weakened considerably during the previous quarters. Thus, at this rate of growth, labor costs remain one of the biggest threats to the ongoing disinflationary process that started in June of 2022.

Fed Chair Jerome Powell, during his press conference, was clear that a pause in rate increases had not been decided during the meeting of the FOMC and that the institution was going to be driven by incoming data, which is no different than what is always said. However, this type of response is, typically, not liked by markets as it continues to generate uncertainty on the path forward for interest rates. Before the meeting, markets were already predicting an incoming pivot by the Fed but if there is a possibility for the Fed to continue to raise interest rates going forward, this pivot is going to be delayed once again and we know that markets don’t like uncertainty. Markets look for certainty on the end to this tightening cycle, but the Fed has remained unmoved by their insistence on more clarity on a terminal rate.

Banking issues could put further pressure on bank lending

Nobody knows exactly how bad the banking issues are going to get and/or if they are going to lead to more contagion across the rest of the financial sector. However, what we know is that the FDIC and the Fed will be there to backstop and reduce the severity of bank runs and potential bank failures as it has done since the turmoil started back in mid-March and as it did in the 1980s with the savings and loan crisis and during the Great Recession.

Having said this, the banking sector remains in great shape as measured by banking sector reserves, which remain extremely high compared to pre-2008, when the Fed did not pay interest on bank reserves. Today, the Fed does pay interest on reserves, so banks are earning a decent rate for keeping reserves at the Fed, which allows the Fed to reduce the amount of liquidity and further helps to reduce credit available in the economy.

Thus, we should expect some further contraction in credit available to businesses and consumers, especially those that are already constrained by high debt ratios. That is, the continuation of banking issues is going to complement the job of the Fed, which has been increasing interest rates for more than a year to limit growth in credit.

How difficult will access to credit be?

It is clear that many businesses and consumers need access to credit today, either to invest and expand their businesses or to increase consumption, respectively. Consumers have been borrowing a lot in terms of credit cards, something the Fed is probably intending to limit with its rate increases because credit card borrowing is the most expensive type of credit for consumers and, at the same time, it is a big risk for banks issuing credit cards because it is non-secured debt and a potential recession with falling employment could make collecting on these debts difficult for banks.

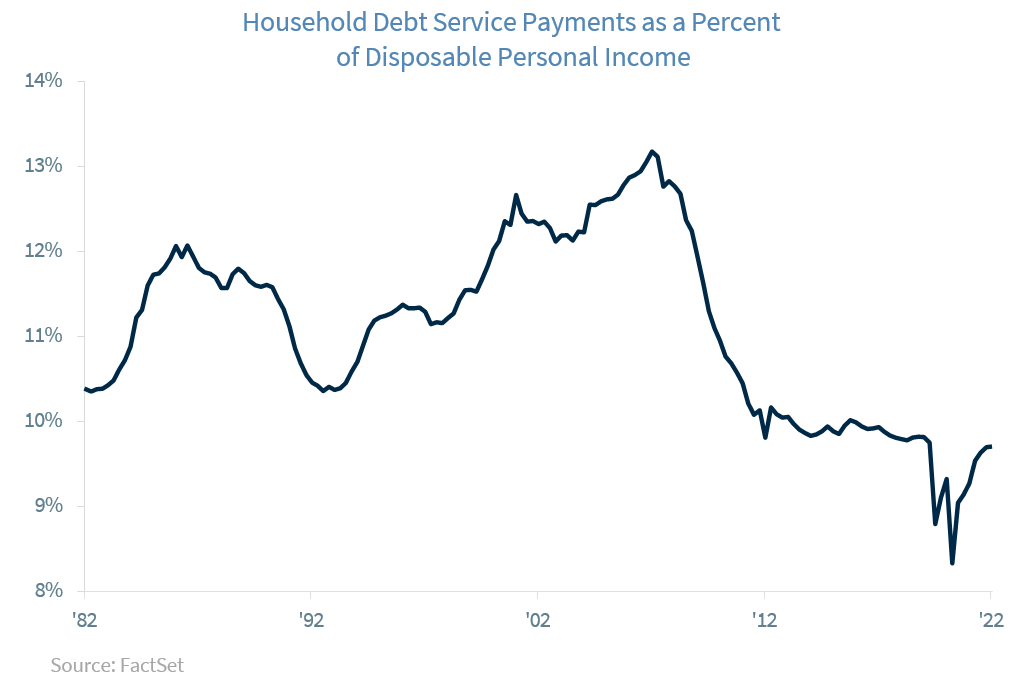

The good thing is that household debt service ratios are in very good shape compared to previous credit crunch episodes so any credit crunch will probably be limited to those parts of the lending market constrained by low incomes, have higher debt to income ratios, and are typically priced out of the credit market whenever interest rates increase.

Furthermore, there is a sector of the economy that actually does not need credit to grow because it still has excess capacity to expand its businesses. A large sector of the leisure and hospitality market, which is one of the leading service sectors in the economy today, is still expanding and trying to catch up to pre-COVID- 19 recession levels. The only thing that it needs to do is hire more workers, which is not a small thing in today’s tight labor market environment.

Many service sectors of the economy are not that sensitive to interest rate increases and many small businesses took PPP ‘loans’ during the pandemic, so they probably don’t need much credit to expand. At the same time, they have not overextended their borrowing during the recovery from the pandemic recession. Thus, as is the case with consumers, their debt situation is in better shape than during credit crunches in the past.

All this doesn’t mean that the economy is not going to suffer from a potential deterioration in the banking sector. However, we believe that there are other issues, like still very high inflation, that could have a larger effect on the economy, especially if the Fed is pushed to increase interest rates further.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those of Raymond James and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur. Last performance may not be indicative of future results.

Consumer Price Index is a measure of inflation compiled by the U.S. Bureau of Labor Statistics. Currencies investing is generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

Consumer Sentiment is a consumer confidence index published monthly by the University of Michigan. The index is normalized to have a value of 100 in the first quarter of 1966. Each month at least 500 telephone interviews are conducted of a contiguous United States sample.

Personal Consumption Expenditures Price Index (PCE): The PCE is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The change in the PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

The Consumer Confidence Index (CCI) is a survey, administered by The Conference Board, that measures how optimistic or pessimistic consumers are regarding their expected financial situation. A value above 100 signals a boost in the consumers’ confidence towards the future economic situation, as a consequence of which they are less prone to save, and more inclined to consume. The opposite applies to values under 100.

Leading Economic Index: The Conference Board Leading Economic Index is an American economic leading indicator intended to forecast future economic activity. It is calculated by The Conference Board, a non- governmental organization, which determines the value of the index from the values of ten key variables

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, Certified Financial Planner™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members.

GDP Price Index: A measure of inflation in the prices of goods and services produced in the United States. The gross domestic product price index includes the prices of U.S. goods and services exported to other countries. The prices that Americans pay for imports aren’t part of this index.

FHFA House Price Index: The FHFA House Price Index is the nation’s only collection of public, freely available house price indexes that measure changes in single-family home values based on data from all 50 states and over 400 American cities that extend back to the mid-1970s.

Expectations Index: The Expectations Index is a component of the Consumer Confidence Index® (CCI), which is published each month by the Conference Board. The CCI reflects consumers’ short-term—that is, six- month—outlook for, and sentiment about, the performance of the overall economy as it affects them.

Present Situation Index: The Present Situation Index is an indicator of consumer sentiment about current business and job market conditions. Combined with the Expectations Index, the Present Situation Index makes up the monthly Consumer Confidence Index.

Pending Home Sales Index: The Pending Home Sales Index (PHS), a leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos, and co-ops. Because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing-Home Sales by a month or two.

DISCLOSURES

Import Price Index: The import price index measure price changes in goods or services purchased from abroad by

U.S. residents (imports) and sold to foreign buyers (exports). The indexes are updated once a month by the Bureau of Labor Statistics (BLS) International Price Program (IPP).

ISM New Orders Index: ISM New Order Index shows the number of new orders from customers of manufacturing firms reported by survey respondents compared to the previous month.ISM Employment Index: The ISM Manufacturing Employment Index is a component of the Manufacturing Purchasing Managers Index and reflects employment changes from industrial companies.

ISM Inventories Index: The ISM manufacturing index is a composite index that gives equal weighting to new orders, production, employment, supplier deliveries, and inventories.

ISM Production Index: The ISM manufacturing index or PMI measures the change in production levels across the

U.S. economy from month to month.

ISM Services PMI Index: The Institute of Supply Management (ISM) Non-Manufacturing Purchasing Managers’ Index (PMI) (also known as the ISM Services PMI) report on Business, a composite index is calculated as an indicator of the overall economic condition for the non-manufacturing sector.

Source: FactSet, data as of 12/29/2022

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...