Chief Economist Scott Brown discusses current economic conditions.

The answer to questions about monetary policy is always “it depends,” but the Fed doesn’t like to surprise the markets, so there’s usually little suspense in the short term. The Federal Open Market Committee is widely expected to leave short-term interest rates unchanged following its two-day policy meeting this week, but it is likely to hint at a hike at the next meeting, in mid-March. In his press conference, Fed Chair Powell is also expected to signal that balance sheet run-off will likely begin later this year. The federal fund futures market is pricing in a March rate increase, with another two or three hikes likely by the end of the year. However, the Fed may pause as the balance sheet unwind begins. Still, expectations are that monetary policy will remain accommodative (just less so) at the end of the year.

The Fed has a legislated goal of price stability, which it interprets as 2% inflation in the PCE Price Index. The Fed expanded on this objective in August 2020. Under the new framework, the Fed will tolerate higher inflation, but maintain a 2% goal on average. The Fed’s resolve in maintaining the new monetary policy framework is being tested. Following the Great Inflation of the 1970s and early 1980s, the Fed acted preemptively, raising short-term interest rates to head off inflation before it got going. The belief was that if higher inflation become rooted, it would be harder to regain control of it. Inflation was a lot higher in 2021.

The Fed also has a legislated goal of maximum sustainable employment. In its revised framework, the employment objective became “broad- based and inclusive.” There is no specific target for the unemployment rate. Instead, policy decisions are based on “assessments of the shortfalls of employment from its maximum level.” The Fed recognizes that “such assessments are necessarily uncertain and subject to revision.” The Fed considers a wide range of indicators. Currently, labor market appears tight. The unemployment rate is low (3.9% in December, vs. a 3.6% average for 4Q19), job openings are elevated, and quit rates are at record highs. An increase in labor force participation would change the outlook, but participation may be slow to improve.

While there are two legislated objectives for monetary policy, low inflation is viewed as a primary long-term goal. If inflation is low, the job market will be stronger over the long run. However, the two objectives may be at odds in the short term, in which case, the Fed “takes into account the employment shortfalls and inflation deviations and the potentially different time horizons over which employment and inflation are projected to return to levels judged consistent with its mandate.” In other words, the Fed must balance the two goals. Most Fed officials believe we are at or close to full employment, but inflation is far above 2%.

Inflation is widely expected to moderate in 2022. Supply chain disruptions, a factor in higher inflation in 2021, should abate. However, supply chain volumes have been strong. Inbound containers through the Port of Long Beach in 2021 were up 21.9% from 2019. COVID has disrupted supply chains, no doubt, but much of the strain in supply chains appears to be due to stronger demand. The pandemic has shifted spending from services to goods, but fiscal policy support added to demand for goods.

While higher labor costs are an issue for many businesses, price inflation has not been led by wage inflation. Higher wage inflation could reinforce price increases. However, wages for the typical worker haven’t kept pace with inflation.

This week, we’ll get the advance estimate of 4Q21 GDP growth, which is expected to be boosted by a return to inventory growth. Quarterly personal income and spending figures will be included in the GDP report, but December figures should help to gauge the strength of consumer spending into early 2022 (with some short-term disruptions from the Omicron wave). Direct deposits to households, extended unemployment benefits, and the expanded child tax credit boosted income last year. Those have gone away. Higher inflation has reduced real disposable income. Consumer spending, about 68% of GDP, is likely to slow. However, there is still some savings left from last year and motor vehicle sales, weaker in 2021, should rebound as production improves.

Despite the increase in inflation last year, the Fed does not need to slam on the brakes. A gradual approach should work, with a rate hike expected at every other Fed policy meeting. When balance sheet reduction begins, likely later this year, that will act like a rate hike, and the Fed may refrain from raising rates when that occurs (at least, in the initial step). Still, monetary policy is expected to be less accommodative, not tight in 2022.

Recent Economic Data

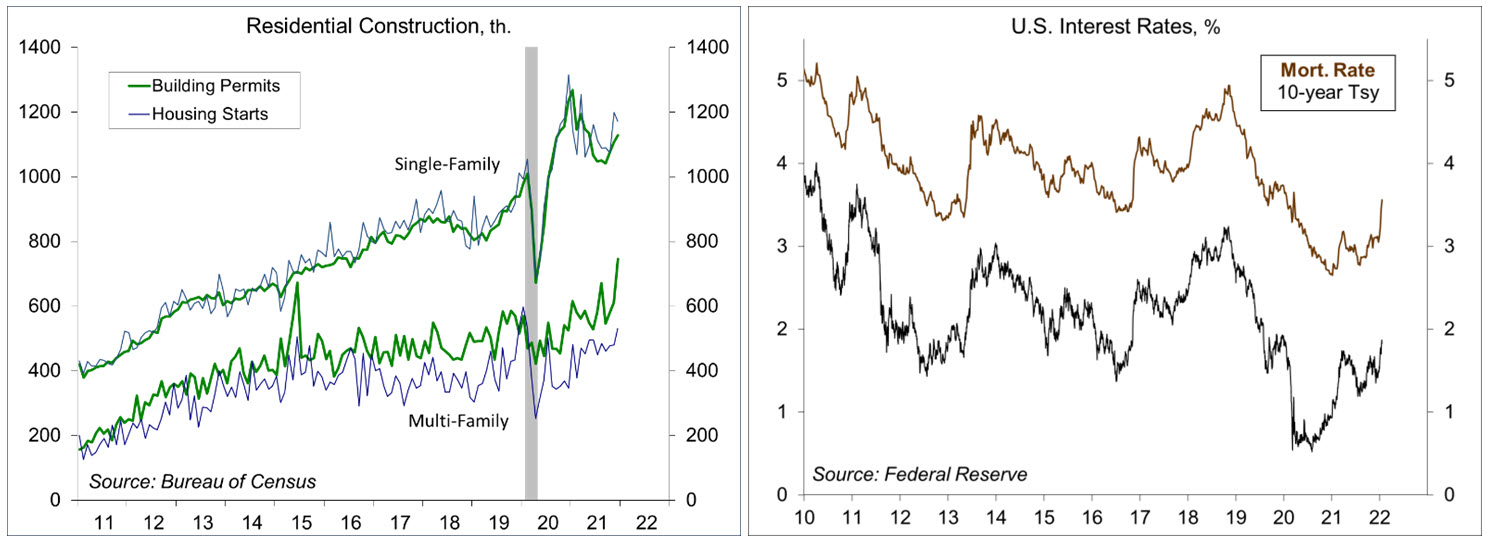

Single-family building permits rose 2.0% in December, down 8.5% y/y (total permits rose 9.1% m/m and 6.5% y/y). Housing starts rose 1.4% (+2.5% y/y), but single-family starts slipped 2.3% (-10.9% y/y).

Homebuilder sentiment edged down to 83 in January, little changed over the last three months. The 30- year mortgage rate has risen sharply in the last few weeks, still very low by historical standards.

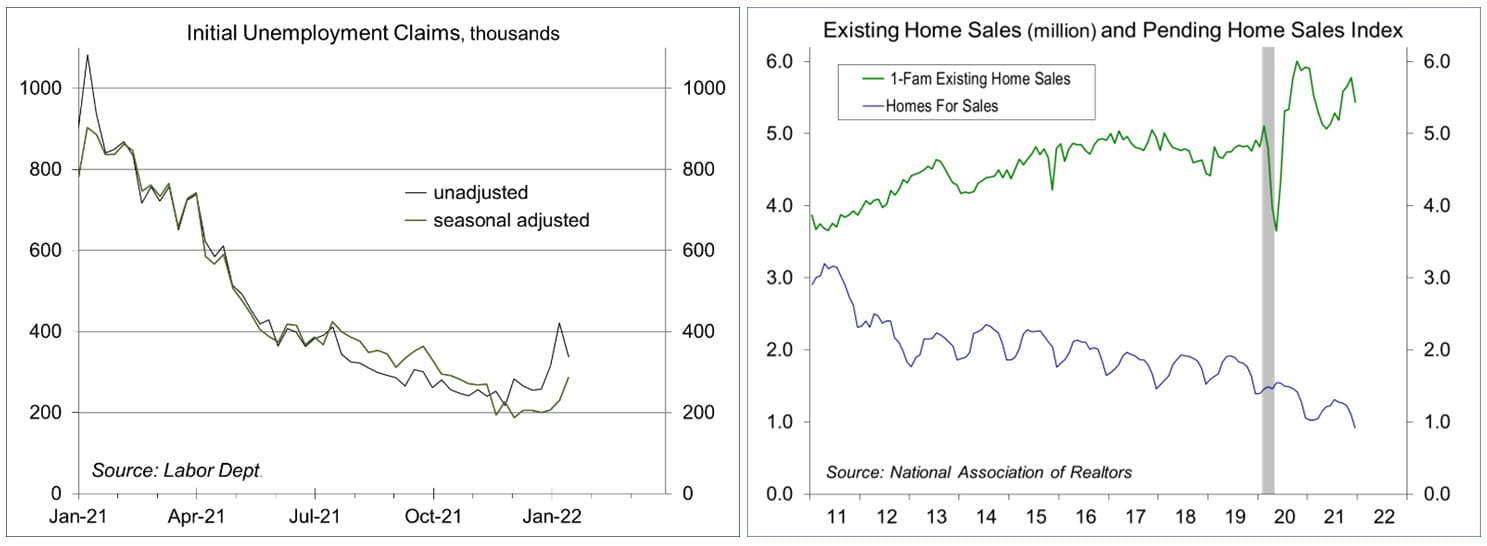

Jobless claims rose by 55,000 in the week ending January 15, to 286,000, the highest since mid-October. Seasonal adjustment is always suspect in January (unadjusted claims normally spike at the start of the year), but the increase likely reflects an impact from the Omicron variant.

Existing home sales fell 6.0% in December, to a 6.01 million seasonally adjusted annual rate (-8.3% y/y), reflecting a record low in the number of homes for sale.

The Index of Leading Economic Indicators rose 0.8% in December, with positive contributions led by the drop in jobless claims and a jump in building permits.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...