Chief Economist Scott Brown discusses current economic conditions.

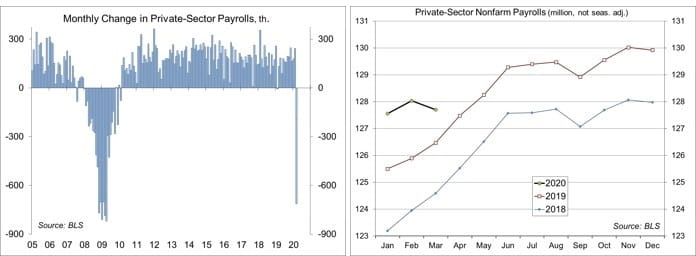

There’s always a story behind the economic data. The Employment Report understated the labor market deterioration in March, while seasonal adjustment amplified the level of job losses in the first half of the month. More importantly, claims for unemployment benefits doubled from the astronomical level of a week earlier. On a seasonally adjusted basis, nearly 10 million people, more than 6% of the labor force, have filed a jobless claim in just two weeks, more than in the first six months of the 2007-09 recession. The speed and magnitude of this decline are unprecedented, and we’re not close to being done yet.

The payroll survey covers the pay period that includes the 12th of the month, and so it is biased toward conditions in the first half of the month. In March, the total failed to capture the sharp weakness seen in the final two weeks. However, seasonal adjustment is also an issue. Prior to seasonal adjustment, nonfarm payrolls fell by 251,000. However, if not for COVID-19, we would have expected a gain of about 700,000. The seasonal adjustment turns that into a 701,000 decline. Most of the weakness was in restaurants, down 417,400 (-275,000 before adjustment). Temp-help payrolls fell by 49,500 (-22,700 before adjustment). Construction fell by 29,000 (+60,000 before adjustment). Hiring for the census was 17,000 (with more to come in April and May).

The concentration of weakness in the March employment report generated a number of anomalies. High job losses in lower-paying, fewer-hours industries lifted average hourly earnings (up 0.4% m/m, +3.1% y/y) and limited the decline in average weekly hours (34.2, vs. February’s 34.4).

Job losses were also more significant for younger workers. The unemployment rate for teenagers rose to 14.3% (vs. 11.0% in February) and the rate for young adults (aged 20-24) rose to 8.7% (from 6.4%). The unemployment report for prime-age workers (aged 25-54) rose to 3.6% (from 3.0%). For older workers (aged 55+), the rate rose to 3.3% (from 2.6%). The broad U-6 measure, which includes discouraged workers (not included in the labor force, but wanting a job) and those working part time but wanting full-time employment, rose to 8.7% (from 7.0%). Still, we can be sure that the April figures (to be reported on May 8) will be much worse.

Initial claims for unemployment benefits rose to 6.65 million in the week ending March 28, up from 3.31 million in the previous week. Before that, the record had been 695,000, set in 1982. To be fair, these are seasonally adjusted figures. The two-week unadjusted total of claims was “only” 8.75 million, or 5.3% of the labor force. But why quibble?

Bear in mind that not every laid-off individual can file a claim. Freelance workers and part-time workers can’t file in most cases, but that will change. The CARES Act broadens eligibility and (theoretically) shortens the waiting time to file a claim. We should see that effect in the weeks ahead. Unemployment benefits are distributed at the state level, and some states (we’re looking at you Florida!) have not exactly bathed themselves in glory in handling the onslaught of claims. There may also be issues incorporating federal eligibility changes. Getting the money into the hands that need it most could be a bumpy process.

The claims data suggest that we could easily see an unemployment rate greater than 10% in April. The Labor Department rarely provides much color commentary in the weekly claims report. However, the latest release noted that “nearly every state providing comments cited the COVID-19 virus” and that “states continued to identify increases related to the services industries broadly, again led by accommodation and food services.” However, “state comments indicated a wider impact across industries.” Many states continued to cite the healthcare, social assistance, and manufacturing industries, while “an increasing number of states identified the retail and wholesale trade and construction industries.” The impact of COVID-19 is broadening beyond restaurants and travel.

To be sure, the economic outlook depends on the spread of COVID-19 and the efforts to combat it. The longer social distancing lasts, the more likely that the damage to the economy will be permanent. In fact, it’s likely that we will see long-standing changes in consumer behavior and global trade once the virus has passed, which could be many months. The Federal Reserve has undertaken huge efforts to promote liquidity in the credit markets. The CARES Act has been labeled as fiscal stimulus, but that’s a misnomer. It’s really an aid package, something akin to disaster relief. It won’t generate a return to prosperity by itself, but it ought to lessen the economic impact of the virus and help in the eventual recovery. We are going to need more support, particularly for state and local governments in the months ahead.

The ISM surveys for March were not as bad as feared (manufacturing: 49.1, non-manufacturing 52.5), but virus-related delays in deliveries added 3 points to each index. The Bureau of Economic Analysis (the same folks that generate GDP figures) reported that unit motor sales fell 32% in March, to an 11.4 million seasonally adjusted annual rate (down from a 16.7 million pace in February). We can expect to see similar eye-popping double- digit percentage declines in a number of categories in the March retail sales report (due April 15).

Once the spread of the virus slows, we may relax some of the social distancing, but a return to normal (well, a new sense of normal) won’t occur until we get a successful treatment for those infected and suffering the worst. A vaccine is still at least a year away.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...