January 8, 2021

Chief Economist Scott Brown discusses current economic conditions.

Covid, covid, covid, politics, politics, politics. The new year has yet to show much of a break from 2020. The December Employment Report reflected an impact from the pandemic surge and further job losses in state and local government, but wasn’t bad otherwise. Democratic victories in Georgia’s run-off election mean a shift in Senate control (a 50-50 mix, but Vice President-Elect Harris will be the tie-breaker). There was an insurrection on Capitol Hill, as lawmakers were in the process of ratifying the November election results.

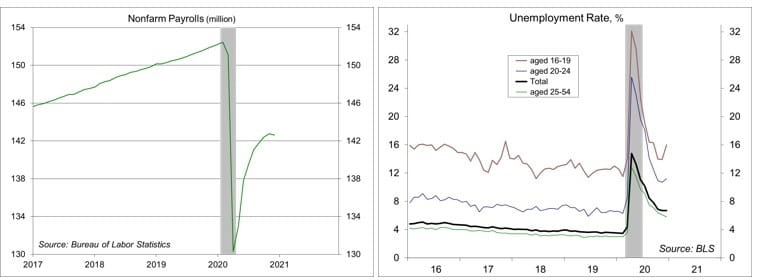

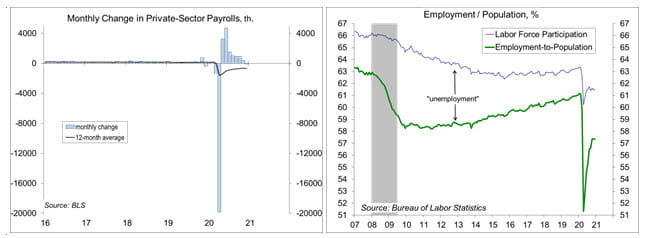

Nonfarm payrolls fell by 140,000, but with an upward revision of 135,000 to the two previous months. December weakness was concentrated in restaurants and bars (-372,000) and state and local government (-51,000). Otherwise, nonfarm payrolls rose by 232,000 and private-sector payrolls rose 277,000. Throughout the pandemic, face-to-face industries have remained depressed. State restrictions (as well as self-preservation) have stalled a rebound in restaurants and bars. With cases (and deaths) continuing to surge, the labor market outlook for early 2021 will remain mixed.

The unemployment rate held steady at 6.7%, but with the rate for prime-age workers (age 25-54) falling from 6.1% to 5.8%. Teenage unemployment rose from 13.9% to 16.0% and the rate for young adults (aged 20-24) rose from 10.7% to 11.2% (high school and college students often take temporary seasonal jobs in December).

The Democrats now have a narrow majority in the Senate (and they continue to control the House). Sixty votes are still required to get stuff done in the Senate, unless you go through budget reconciliation (which only requires a simple majority). However, you only get one bite at that apple per year. With such a narrow majority, each Senator becomes the critical marginal vote. Major legislative changes will be difficult to achieve – hence, the stock market’s acceptance of what is expected to be a (mostly) divided government. Still, the Biden/Harris administration will be active, especially in the first 100 days. The pandemic response will be the primary initial focus, but climate change, income inequality, and antitrust issues are on the menu.

Meanwhile, the pandemic surge will restrain overall economic improvement in the near term. Weakness remains concentrated in consumer services. Workers in these industries tend to be lower paid, while higher-paid white collar workers generally have the advantage of working from home and firms have grown increasingly comfortable with the situation. For example, with remote working, a firm can cast a wider net in hiring new talent.

Many of the lessons of the 1918 pandemic (debate about masks and social distancing) have been repeated in this pandemic. One result is promising. When the 1918 pandemic had passed, people were eager to make up for lost time. We can expect rapid growth once vaccines are widely distributed. Until then, it looks like more of the same.

RIP Tommy Lasorda

Recent Economic Data

The December Employment Report reflecting a pandemic-related decline in restaurants and bars and further job losses in state and local government. Otherwise, job growth remained moderate

Annual benchmark revisions to the household survey data (unemployment rate, labor force participation) were minor. The unemployment rate held steady at 6.7% in December, but would be reported at 9.3%, if labor force participation had remained on its pre-pandemic trend.

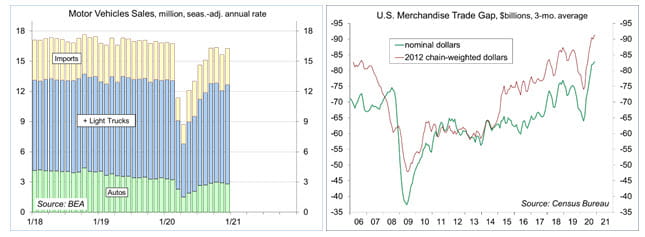

Unit motor vehicle sales rebounded to a 16.3 million seasonally annual rate in December, vs. 15.6 million in November and 16.8 million in December 2019.

The U.S. trade deficit hit a record monthly high in November. Exports, which had falling more sharply than imports in the early stages of the pandemic (widening the deficit), have rebounded more slowly than imports in the last several months (further widening the deficit, and putting some downward pressure on the U.S. dollar.

The ISM Manufacturing Index rose from 57.5 in November to 60.7 in December, while the Services Index rose from 55.9 to 57.2. However, both figures were boosted by a pandemic-related increase in supplier delivery times and comments from supply managers were more cautious, at odds with the survey data.

Gauging the Recovery

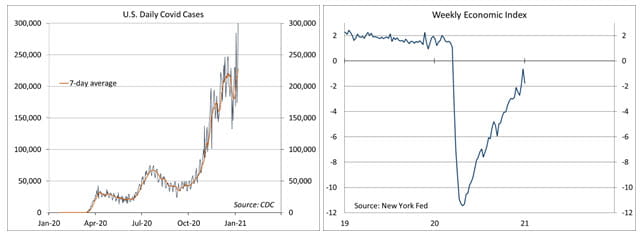

The number of new daily COVID-19 cases has continued to surge. Increased social distancing, whether state mandated or voluntary self-preservation, should slow the pace (and the economy), but we are likely to see the surge get worse before it gets better.

The New York Fed’s Weekly Economic Index fell to -1.76% for the week ending January 2, down from -0.65% a week earlier and a low of -11.45% at the end of April. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously). Note that the weekly figures are subject to revision.

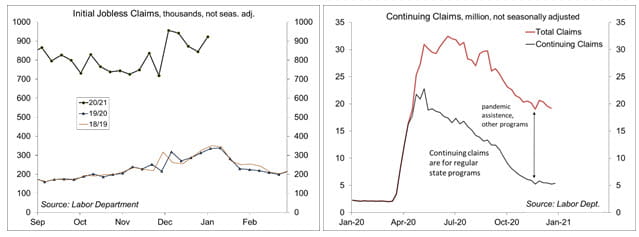

Jobless claims were little changed at 787,000 for the week ending January 2, down from 790,000 in the previous week. Figures tend to be choppy at the start of the year. Seasonal layoffs should be lower this year (as seasonal hiring was reduced), but claims remain elevated.

The University of Michigan’s Consumer Sentiment Index rose to 80.7 in the full-month assessment for December (the survey covered November 23 to December 20), vs. 81.4 at mid-month and 76.9 in November. The rollout of the vaccine was taken well, but the end of the pandemic is still a long way off in terms of a return to normal consumer behavior. Precautionary motives will continue to shape both economic and personal behavior.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...