Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

This year is proving to be one of the most volatile years ever, creating dramatic changes in fundamental economic statistics and in consumer behavior. Fixed income is often the portfolio allocation primarily serving to protect wealth. As such, fixed income strategy is typically a long term plan designed to achieve this goal.

These unexpected events are a catalyst triggering potential long term strategy adjustments for fixed income allocations. This morning we highlight some of the changes as they are reflected in the market and our economy. Later this week, we will follow up with specific fixed income ideas to help maximize long term planning strategies.

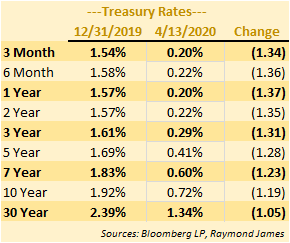

Treasury Yields dropped dramatically across the curve.

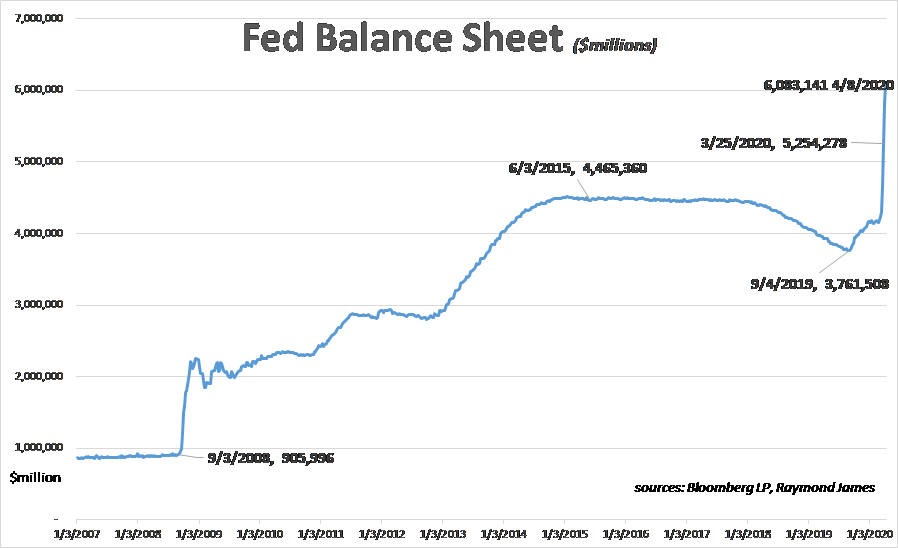

The Federal Reserve, the central bank of the U.S., has quickly reversed monetary policy. The Fed’s balance sheet had reached a record level after the Great Recession of 2008-2009 to just over $4.5 trillion by late 2014. Mainly through attrition, it fell to $3.7 trillion in September of last year.

In the last month, their balance sheet has exploded by over $1.8 trillion to reach $6.1 trillion. The significance is that they are flooding the economy with money that simply did not exist. From 2008 to 2014, this action did not create inflation in goods and services but arguably created asset inflation. In other words, it propped up the stock and bond markets.

Excess Reserves are the funds held at the Federal Reserve that banks hold over and above what is dictated by regulation. The Fed pays banks an interest rate to incentivize them to hold the money rather than push it out to individuals and businesses as that could be inflationary.

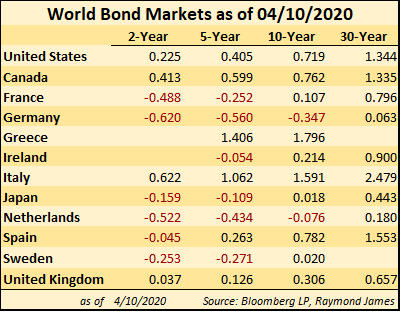

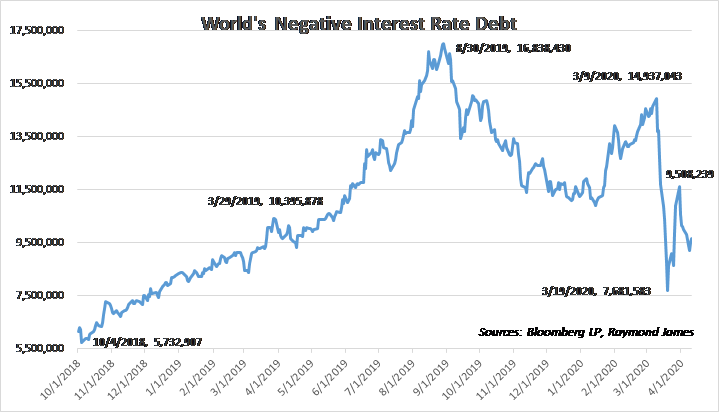

World Interest Rates continue to reflect much disparity. France, Germany and Japan are among the nations still reflecting negative interest rates. This is an indication that economies across the globe are struggling, creating an indirect drag on our economy.

World interest rate disparity, central bank intervention, negative yielding debt, lack of inflation on goods and services (asset debt inflation) have all contributed to how our economy has been shaped over the last decade. As we embrace what is almost certainly a current recession, overall asset allocation within our portfolios is that much more important in order to protect against overwhelming principal loss.

This commentary serves to frame the economic scenario. Note how the Treasury Curve has compressed since 2008. Later this week we will discuss strategies which may benefit fixed income long term allocations over the next reshaped decade.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...