Chief Economist Scott Brown discusses current economic conditions.

You can learn a lot by talking to people. The economy is “strong,” but also “terrible.” Higher inflation is “transitory,” but also “likely to persist.” Fed policy is “behind the curve,” but also “appropriately positioned.” In truth, the outlook for growth, inflation, and monetary policy is evolving.

The University of Michigan’s consumer sentiment survey currently shows an odd mix. Consumers generally feel good about their own personal finances, but they also think that the overall economy is doing poorly – worse, in fact, than during the April 2020 shutdown. There is always a political split in the sentiment survey results. Republicans currently rate the economy much lower than Democrats, just as Democrats rated the economy lower when Trump was in the White House. However, those of both parties (and independents) currently rate the economy poorly. Higher inflation is a big part of this. People hate inflation.

The argument for transitory inflation – Nonfarm payrolls are still down by more than four million since the start of the pandemic and we would have likely added more than three million jobs over the last 20 months if not for the pandemic. That’s a lot of slack. The unemployment rate was 4.6% in October, but we learned in the last cycle that labor supply is a lot more flexible than the unemployment rate would suggest. Higher consumer price inflation has been concentrated in restart pressures. Supply chains are slow to recover after every downturn. It’s a matter of time before they clear up. Long-term inflation expectations remain well anchored. Demand was boosted by large-scale fiscal support in 2021, but we won’t see federal checks and deposits or extended unemployment benefits in 2022. Household savings increased during the pandemic, but excess savings will be depleted over time.

The argument for longer-lasting inflation – More firms are reporting difficulties in finding and retaining workers. Job vacancies and quit rates are at or near record highs. Wage inflation follows rather than leads price inflation, but could reinforce higher price inflation (if firms are successful in passing higher costs long). While higher inflation has been concentrated in things like used motor vehicles, price increases appear to be broadening across categories. Supply chain issues have been more severe and have lasted longer than expected, and while there have been some signs of improvement, strains are expected to last into 2022. Moreover, it’s not just supply chain bottlenecks. There has been a marked shift from consumer services to goods, a trend which has continued even as the service side of the economy recovers. Retail sales are far above the pre-pandemic trend. While long-term inflation expectations remain consistent with the Fed’s long-term inflation goal, inflation expectations for the next five years have risen a lot in recent weeks. Shelter costs are rising. Owners’ Equivalent Rent (the rental value for homeowners), which accounts for 24% of the overall CPI and 30% of the core, has started to pick up. Other measures of rents are much higher and only one-sixth of the CPI’s housing population is updated each month. Pandemic-related pressure may recede in 2022, but larger OER increases are coming.

Consumer price inflation is widely expected to decline in 2022, but to where? There’s a big difference whether it settles at 2%, 3%, or 4%. Many economists have argued that the Fed should raise its long-term inflation goal from 2% to 3% (to give the Fed more room to cut rates in a recession), and this would be a good time to do that, but that seems unlikely. Clearly, the economy no longer needs the firehose of large-scale asset purchases, but stopping all at once could be problematic – hence, the taper (a gradual reduction in the monthly pace of asset purchases). In its November 3 policy statement, the Federal Open Market Committee indicated that it would reduce asset purchases by $15 billion per month, but could speed up or slow down the taper depending on economic conditions. Minutes from the FOMC meeting are likely to show that some Fed officials wanted to go faster.

For the lift-off in short-term interest rates, the Fed has set a goal of full employment. However, we have likely entered a phase where there is a trade- off between tighter job market conditions and higher inflation. In monetary policy, real (that is, inflation-adjusted) interest rates are what matters. An increase in inflation expectations means that real short-term interest rates are more negative and monetary policy is more accommodative. With a lot of improvement in the labor market behind us and inflation higher, rate hikes should start sooner. This isn’t a question of hitting the brakes. Rather, the Fed would simply be letting up on the gas pedal.

The economic outlook will evolve. Supply chains could see relief around the Chinese New Year (February 1), when trade traffic slows. However, it’s unclear whether consumer demand for goods will moderate and whether inflation expectations will fall back. In the meantime, COVID-19 cases have started to rise again.

Recent Economic Data

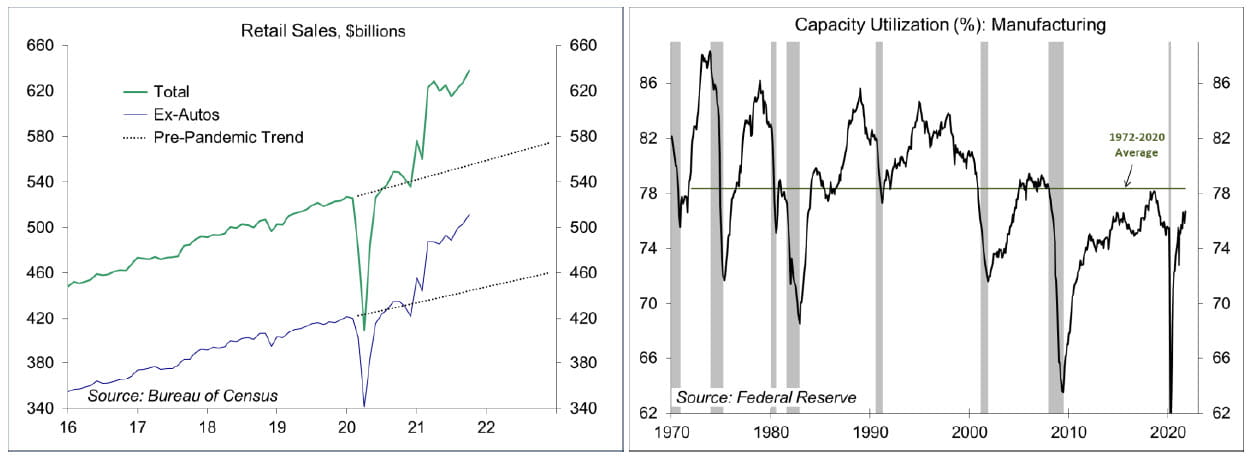

Retail sales rose 1.7% in October (+16.3% y/y), also up 1.7% (+17.6% y/y) ex-autos). Department store sales were up 2.2% (+27.6% y/y) and sales of electronics and appliances rose 3.8% (+18.4% y/y), suggesting earlier holiday shopping this year (likely a response to concerns about supply chains).

Industrial production rose 1.6% in October, following a hurricane-related 1.3% decline in September. Manufacturing output rose 1.3% (+4.9%) led by an 11.0% rebound in motor vehicle production (-3.6% y/y). Capacity utilization, a key indicator of inflation pressures during the 1970s, remains below its long-term average.

Homebuilder Sentiment rose to 83 in November, vs. 80 in October.

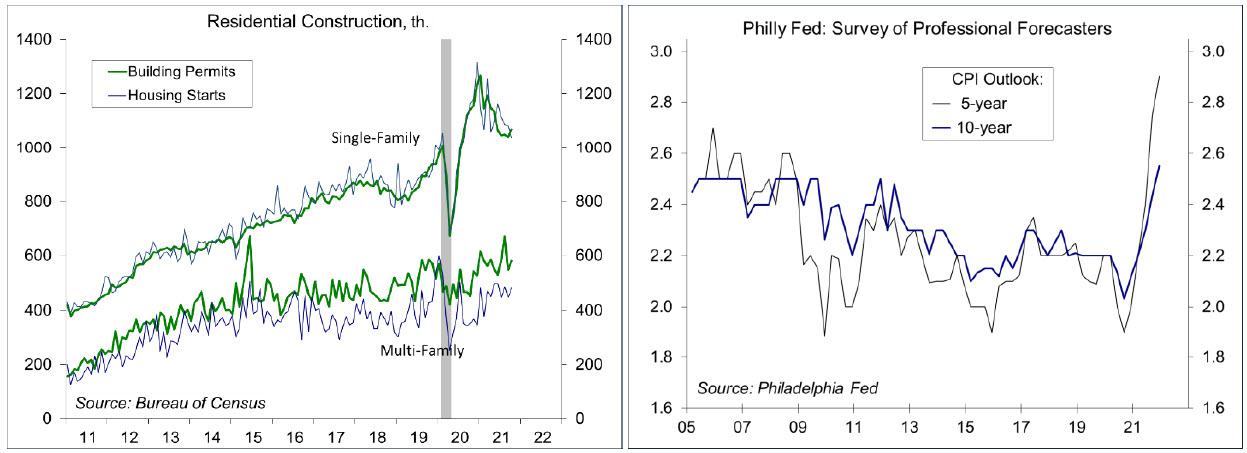

Single-family building permits rose 2.7%, down 6.3% from a year ago, but still above the pre-pandemic level.

The Philly Fed’s Survey of Professional Forecasters showed a 5-year inflation forecast of 2.9% and a 10-year outlook of 2.55% (which implies a 5-to-10-year outlook of 2.2%).

Import prices rose 1.2% in October (+10.7% y/y), up 0.3% (+5.0% y/y) excluding food & fuels. Most of the increase in import prices has been in industrial supplies and materials (+20.6% y/y ex-fuel), but inflation in imported autos and consumer goods, while still low, has been creeping higher.

The Conference Board’s Index of Leading Economic Indicators rose 0.9% in October, led by a large contribution from the drop in jobless claims.

Gauging the Recovery

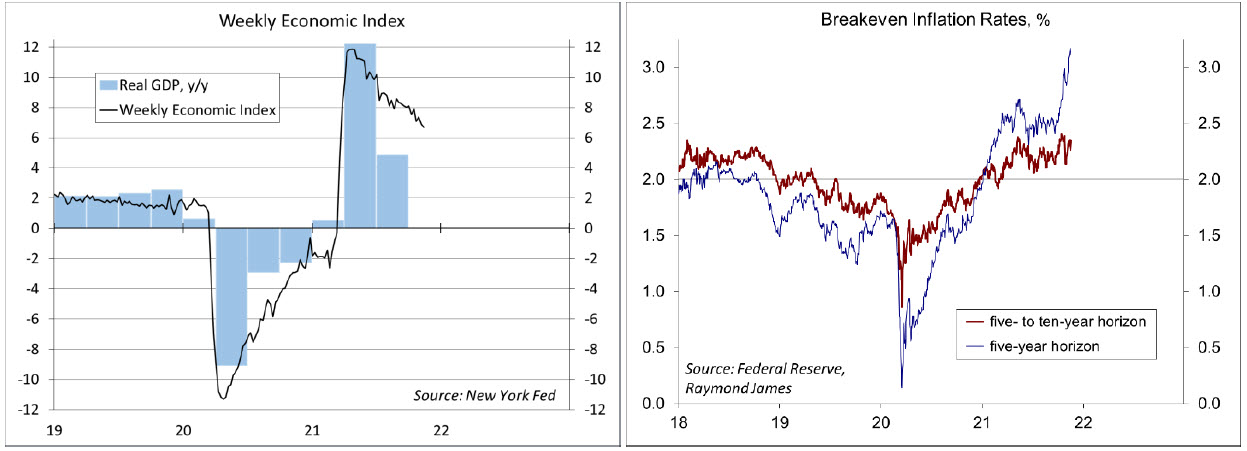

The New York Fed’s Weekly Economic Index fell to 6.67% for the week ending November 6, vs. +6.92% a week earlier (revised from 6.62%). The WEI is scaled to y/y GDP growth (+4.9% y/y in 3Q21).

Breakeven inflation rates (the spread between inflation-adjusted and fixed-rate Treasuries) continue to suggest a more elevated near-term inflation outlook. The 5- to 10-year outlook remains at a moderate level.

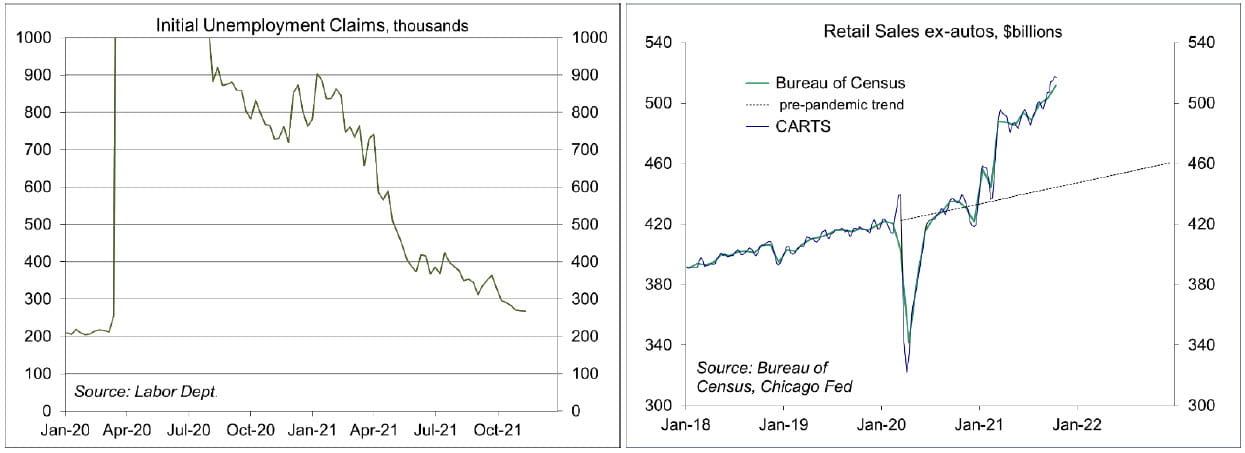

Jobless claims fell by 1,000, to 268,000 (another pandemic low) in the week ending November 13. Claims are approaching pre-pandemic levels, consistent with a tighter labor market.

Chicago Fed Advance Retail Trade Summary (CARTS): down 0.1% in the final week of October, following a 0.4% gain in the previous week and sharper gains at the start of the month. October retail sales (ex-autos) were projected to rise 2.6% from September (they rose 1.7%, with an upward revision to previous data).

The University of Michigan’s Consumer Sentiment Index fell to 66.8 in the mid-month assessment for November (vs. 71.7 in October and 72.8 in September), the lowest in a decade, reflecting higher inflation. Nominal income gains were widely reported, but half of all households anticipated lower real incomes next year.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...