February 22, 2021

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

Fixed income isn’t trying to hide anything. Most of the key attributes that attract investors to fixed income are spelled out in the name of the product. Fixed: as in the cash flow is fixed, the maturity date is fixed, the income is fixed, and the maturity price is fixed. Income: as in it provides income. It’s right there in the name.

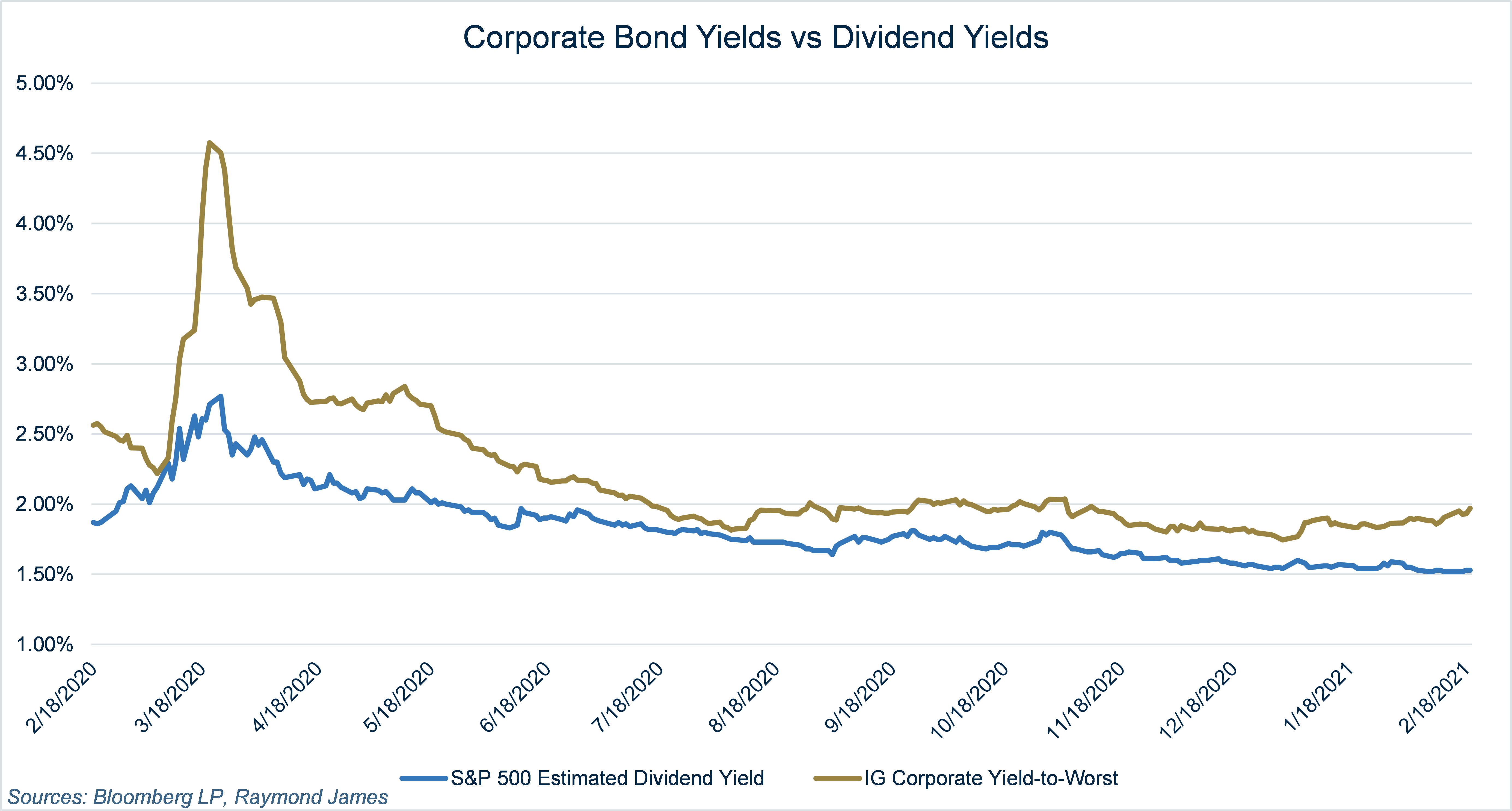

Today, I want to focus on the income portion of fixed income. Yes, overall interest rate levels have been trending lower since the early 1980s but that doesn’t mean that fixed income no longer provides income. Recently, we have been hearing from investors who are considering shifting the income producing allocation of their portfolio away from bonds and into equities because of the better income opportunity in equities. Oftentimes, this is due to a report or article that compares fixed income yields to equity dividend yields. The problem generally lies in that many of these comparisons are done using the 10-year Treasury yield versus dividend yields. This comparison can mislead investors, as fixed income portfolio composition is typically not made of Treasuries, but rather in spread products. I have had very few conversations with investors who are on the fence between building a Treasury ladder or an equity allocation for the income-producing portion of their portfolio. The fixed income side of this debate is generally either a corporate or municipal bond portfolio. With that in mind, a better comparison would be to use corporate bond yields as the fixed income side of the equation, which is what is done in the graph below.

This graph compares the yield to worst for investment-grade corporate bonds with the estimated dividend yield for the S&P 500 over the past year (see below for definitions). Observation number 1 is that at no point in the past year has the S&P 500 offered a higher yield than the IG corporate bond index. Observation number 2 is that since the start of 2021, the gap has been widening, meaning that IG corporate bonds are offering more yield relative to the S&P 500 than they were 7 weeks ago. In fact, the spread between the two has more than doubled year-to-date, increasing from ~17 basis points at the start of the year to a current spread of ~44 basis points. In addition to the relative value increase, IG corporate yields are also increasing on an absolute basis, as the YTW on the index has increased by about 20 basis points year-to-date.

So what does all of this mean? First, when looking for income in your investment portfolio, fixed income is likely a good place to start given the relatively attractive yields (not to mention much less downside risk historically, which we have covered in previous Bond Market Commentaries). And second, both relative and absolute yield levels have been increasing recently, so investors who have been sitting on the sidelines and waiting for an opportunity to enter or re-enter the market might be looking at a good entry point.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...