Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

It’s been an exciting week in the fixed income world. We saw the 10 year Treasury reach an all-time low of 0.32% early Monday morning and by Friday morning it reached 0.97%, a swing of 65 basis points in 5 days. Combine the moves we have seen in the Treasury market with the wild back and forth moves in the equity market and it is easy to understand why many investors don’t know what to think. While the Treasury market has received most of the headlines, it is helpful to be aware of what is happening in the markets that most investors are actually invested in. Many investors allocate the fixed income portion of their portfolio to either corporate bonds or municipal bonds.

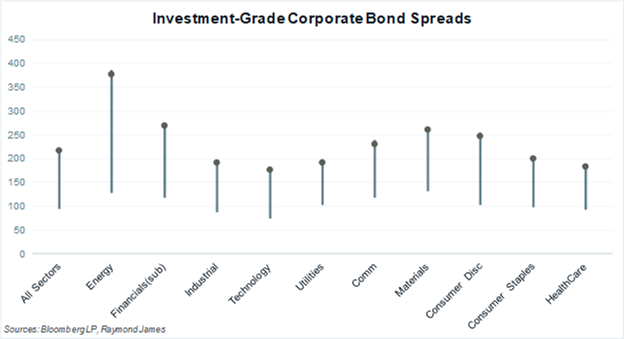

First, a little bonds 101: the yield on a corporate bond is a combination of the yield on a benchmark instrument (a Treasury of similar maturity) plus a spread (to compensate an investor for the real and/or perceived risk they are taking over the “risk-free” benchmark). What we have seen over the past few weeks is a sharp widening of spreads. To provide some context, the graph below shows the 52-week range of corporate bond spreads by sector (vertical line), along with the current spread (solid dot). Across the board, spreads are at or very near their peak for the past year.

Why have spreads widened and what does it mean to investors? The “Why” is twofold. The wider spreads (which materialized very quickly) were a result of an increase in perceived risk and a supply/demand dislocation. Some of the increase in risk premium can be specifically attributed to world events. Oil prices dropped to $31.13, a level not seen since February 2016. Oil and gas companies felt the consequences as equity prices dropped and bond spreads widened (prices fell). The COVID-19 pandemic put stress on certain other sectors and companies such as airlines, hotels, and transportation related businesses. In addition, the volatility and uncertainty created a mismatch in risk assessment side-lining traditional liquidity sources, thus intensifying the spread widening as the bid side of the market withdrew.

Many investors responded instinctively to negative headlines, evoking some knee-jerk reactions to liquidate everything. Blindly selling into a low-volume, spread gapping market is probably not in the best interest of most investors. When everyone is trying to sell at once, the economics of supply and demand suggest that prices will be driven down, often irrationally so. Secondly, an untimely full liquidation is probably not serving your long-term strategy. It is likely that most bonds continue to serve their purpose by providing known income, known cash flow, and known dates when the face value is returned to you (barring default).

Still, the markets are providing an opportunity for investors who have money to invest, or for those who are looking to take some risk out of their portfolio. Wider spreads have led to higher yields. Since the start of the week, the 10-year BBB corporate yield has increased from 2.30% up to 2.91%, an increase of 61 basis points (Bloomberg LP). Much of this yield increase is due to the dislocation of buyers and sellers. Each individual credit should be analyzed with a determination of suitability.

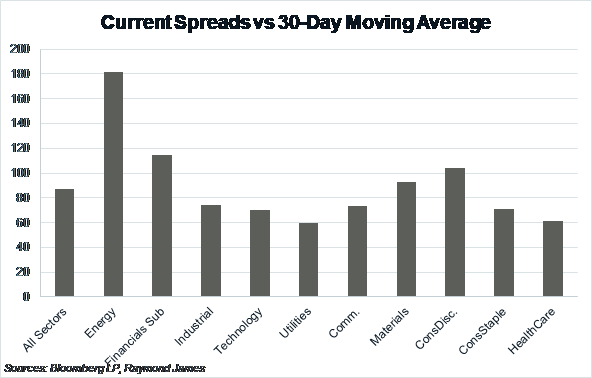

A shorter-term view of spread movement is displayed on this graph, which shows how high current spread levels are over their 30-day moving average. It tells a similar story as the first graph, yet it emphasizes how sharp the moves have been over a very short timeframe.

For investors looking to take some risk off the table, a short-to-intermediate (2-6 year) ladder of high-quality corporates will provide considerable yield pick-up over cash or money market rates, while providing staggered liquidity.

Opportunities exist for total return or tactical strategies by taking advantage of higher yielding credits and credits/industries under some stress. Regardless of the level of risk that is appropriate for you as an investor, now might be an opportune time to take advantage of what might be a short-lived yield increase.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...