Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

In the active-management world that most market commentary comes from, the focus is often on trying to do something to outperform the market. Through the lens of a portfolio manager, the “market” is typically whatever index they have chosen to benchmark themselves to. In the fixed income space, an attempt to outperform the market can be done by actively trading while doing things such as overweighting or underweighting specific sectors or products, extending or shortening duration, or just simply trying to time the market (buy low, sell high). These trades and portfolio positioning are done based on some prediction as to what is going to happen in the future. If their guesses are correct, maybe they outperform. If they’re wrong, they underperform. If the market falls by 10% and your portfolio falls by just 8%, you “outperformed.” For the total return portion of your portfolio, you might consider this a victory. For the principal protection portion of your portfolio, this is not likely what you had in mind.

Are these the games you want to play with the portion of your portfolio intended to protect your hard-earned principal? For many investors, the answer is “No.” When it comes to the total return portion of your allocation, attempting to outperform might make sense. For the principal protection portion, simply “performing” might be enough. With a passive, buy-and-hold strategy in fixed income, yields are locked in from the day you purchase a bond until the day the bond is redeemed (barring a default and assuming you do not sell prior to redemption). Your portfolio will perform exactly as expected, regardless of what “the market” does. No outperformance, no underperformance, just performance.

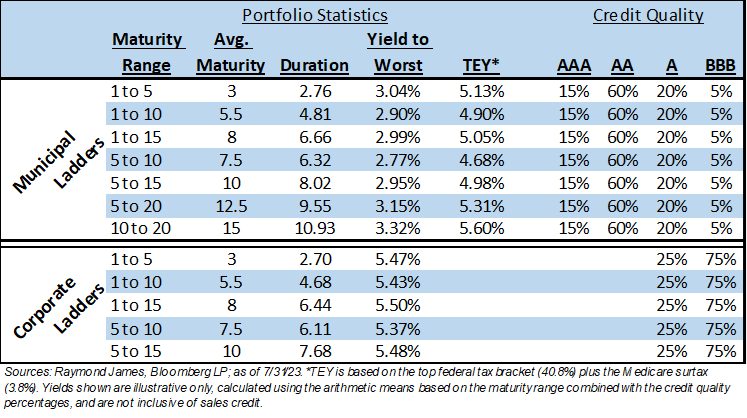

Luckily, the current market is offering yields that are more attractive than at most points over the past 15 years. The returns that can be locked in right now are enticing enough that many investors are realizing that they might not need to reach for outperformance. The chart below shows a range of hypothetical portfolios to provide some context into the yields that can be locked in today. With investment-grade portfolios providing annual returns well north of 5%, risking underperformance while reaching for outperformance might not make sense for the portion of your portfolio intended to preserve principal.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...