Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

It is easy to get caught up in the hype. Why let the facts ruin a good story, right? The statement, “bonds are doing poorly”, erroneously is mingled with, “stocks are doing poorly”. We are inclined to think competitively, and to outdo our opponent whether that is in a tennis match, in a card game or in the investment world. Misunderstanding the actual meaning of “bonds are doing poorly” may mislead an investor away from long-term plans.

I would expect that our readers are concerned about finances on a long term basis. Although it is fun to predict and gamble on the next market move and enjoy the instant gratification of investing in that stock where the price explodes on some extraordinary event or discovery, the reality is that sticking with a long term plan is more likely to grow our wealth than some astonishing speculation. Long term planning applies to all of our assets and maintaining an appropriate allocation balance may improve the likelihood of long term financial success.

For years bonds were doing well; however, what that means in finance speak, is that bond prices were going up and therefore yields were going down. Total return investors benefitted from bond price appreciation. The long term investor felt the security of positive market price statement results. The reality is that long term investors’ greater benefit was being locked into higher rates in a falling rate environment. The undesirable event was having money or cash flow that had to be reinvested into lower rates. It created portfolio imbalance when investors turned away from balanced allocations in search of higher returns.

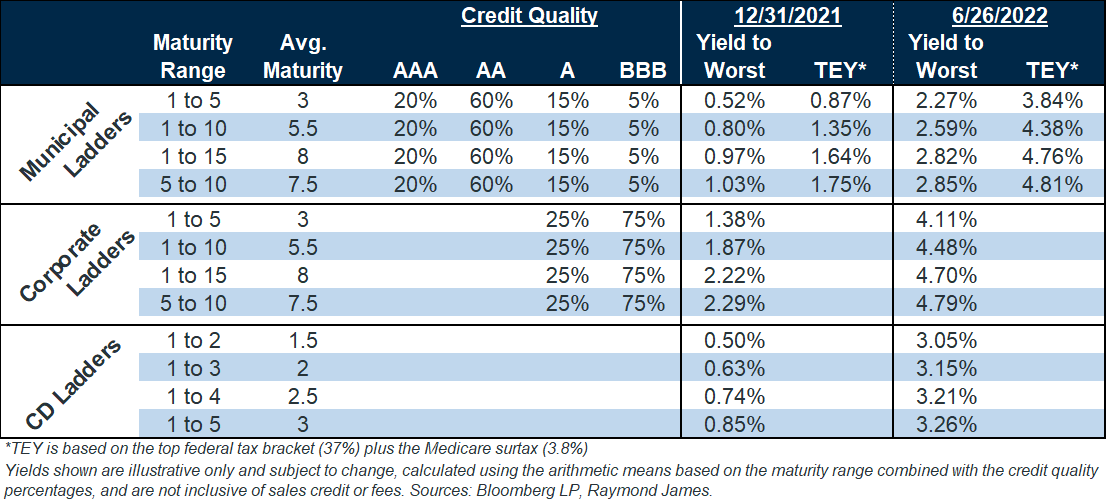

Now I hear the term “bonds are doing poorly”. I borrow a Bruce Willis expression in response, “yippee ki-yay!” I say this because of the excitement and emphasis that we investors should feel when you hear “bonds are doing poorly”. What that means is that yields are doing well. Reinvesting cash flows or new cash can now push portfolio yields upward. You can get buried in guessing when or if a recession is coming, whether inflation has peaked, timing the end of the Ukraine/Russia war or worried about the next pandemic type news and miss the opportunity right in front of investors. Yields have more than doubled since the start of the year, with 4.50%-5.00% yields that are obtainable portfolio additions. Think long term. Relish in the detail that bonds are doing poorly, meaning increased yields can improve portfolio income and cash flow. See the yield through the pricing hype. Buy and hold investors don’t benefit from monthly statements that report profitable market pricing but rather from the income generated by the holdings. This chart demonstrates basic laddered yield improvements from the start of the year to the present. Yields are a welcomed option for long term investors.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Securities Industry and Financial Markets Association’s Project Invested website and Investor Guides at www.projectinvested.com/category/investor-guides, FINRA’s Investor section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...