Chief Economist Scott Brown discusses current economic conditions.

The minutes of the January 25-26 Federal Open Market Committee meeting suggested no great haste in raising short-term rates. However, the minutes certainly left the door open for a faster pace of tightening if warranted. There are risks in tightening too slowly or too rapidly. However, for the financial markets, the Fed debate is secondary to the tensions in Ukraine.

The FOMC minutes showed Fed officials noting that “elevated inflation was persisting longer than they had anticipated, reflecting supply and demand imbalances related to the pandemic and the reopening of the economy.” More worrisome, “elevated inflation had broadened beyond sectors most directly affected by those factors, bolstered in part by strong consumer demand.” Real wage growth had exceeded productivity growth. Inflation in consumer services had picked up. Firms reporting that they were adapting to a higher inflation outlook, including raising output prices and utilizing cost-contingent contracts. Nevertheless, Fed officials “generally expected inflation to moderate over the course of the year as supply and demand imbalances ease and monetary policy accommodation is removed.” Some FOMC participants noted that “longer-term measures of inflation expectations appeared to remain well anchored, which would support a return of inflation over time to levels consistent with the Fed’s goals.”

In light of elevated inflation pressures and the strong job market, meeting participants judged that it would be appropriate to end net asset purchases soon. Most thought it appropriate to continue tapering the pace of asset purchases in line with what was decided at the mid-December policy meeting. However, a couple wanted to end asset purchases sooner, as a strong signal that the Fed was committed to bringing down inflation.

The discussion then turned to timing and pace of interest rate increases. In comparison to the previous tightening cycle (where the Fed mostly raised rates at ever other policy meeting, or once a quarter), officials recognized that “there is currently a much stronger outlook for growth in economic activity, substantially higher inflation, and a notably tighter labor market.” Consequently, “most participants suggested that a faster pace of increases in the target range for the federal funds rate than in the post-2015 period would likely be warranted, should the economy evolve generally in line with the Committee’s expectation.” Reductions in the balance sheet, expected to begin later this year, could be used in lieu of, or in addition to, increases in short-term rates.

Nothing has been decided upon, and the Fed will continue to employ risk-management considerations as it adjusts policy. However, “most participants noted that, if inflation does not move down as they expect, it would be appropriate for the FOMC to remove policy accommodation at a faster pace than they currently anticipate.” Some officials noted that “the risk that financial conditions might tighten unduly in response to a rapid removal of policy accommodation,” but a few remarked that “this risk could be mitigated through clear and effective communication of the Committee’s assessments of the economic outlook, the risks around the outlook, and the appropriate path for monetary policy.”

Many critics outside the Fed believe that the central bank’s easy policies have fueled excesses in the financial markets, which are bound to unwind in unpleasant ways. These critics note the dot-com boom and the housing boom, and fear that we are seeing the same thing in cryptocurrencies and non-fungible tokens. Letting air out of a bubble is never easy, but the Fed does not even try to judge whether there is a bubble. At the same time, it stands ready to clean up the mess if one bursts.

Financial market participants took the FOMC minutes as a sign that Fed rate increases will be gradual, but a direct reading shows an expectation to move faster than the last cycle and a potential to tighten more aggressively if the inflation outlook doesn’t improve as anticipated. Financial instability could lead to a more gradual path (but it depends on how much instability).

Tensions between Russia and Ukraine have continued, and we seem closer to a breaking point. Will this deter the Fed from tightening? The correct answer on Fed policy is always “it depends.” However, if the result is similar to Russia’s annexation of Crimea, there should be little impact on the U.S. economy. Higher oil prices could be a factor, but energy is a lot more neutral in its effect on the economy than in past decades. Higher gasoline prices would add to inflation and dampen consumer spending, but also encourage more exploration (boosting business investment). The Fed policy outlook is not very clear, but officials should communicate intentions clearly ahead of each policy meeting. Chair Powell’s semi- annual monetary policy normally happens in mid-February, but we have not seen a date set yet. (M22-4342584)

Recent Economic Data

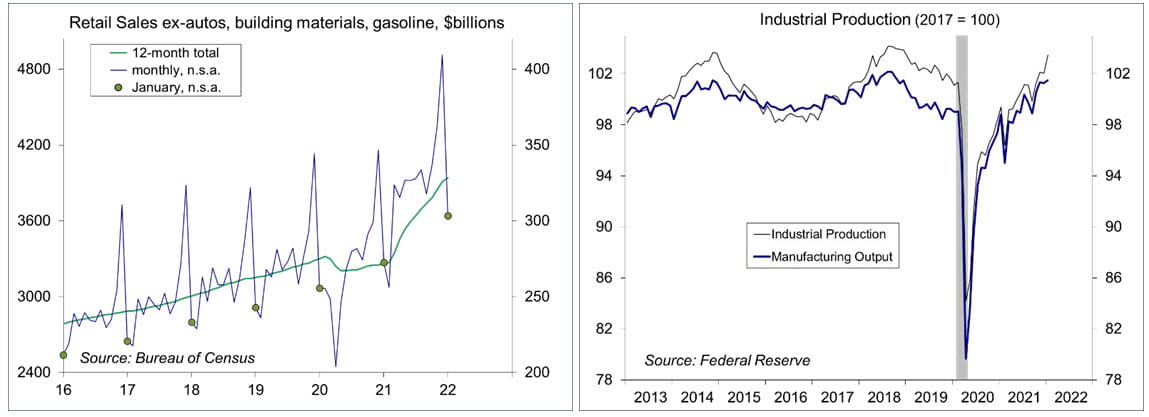

Retail sales jumped 3.8% in January, following a 2.5% decline in December, likely reflecting a changing seasonal pattern through the pandemic (unadjusted sales fell 18.5%, following a 9.1% gain in December). Ex-autos, building materials, and gasoline, sales rose 11.3% y/y and were up 21.1% from two years ago. Sales are roughly 15% above the pre-pandemic trend (a long-lasting shift in spending from services to goods).

Industrial production rose 1.4% in January (+4.1% y/y), boosted by a record 9.9% increase in the output of utilities (cold weather). Manufacturing output rose 0.2% (+2.7% y/y), with motor vehicle production down 0.9% (-6.2% y/y).

Homebuilder Sentiment edged down to 82 in February (vs. 83 in January). Supply constraints continue.

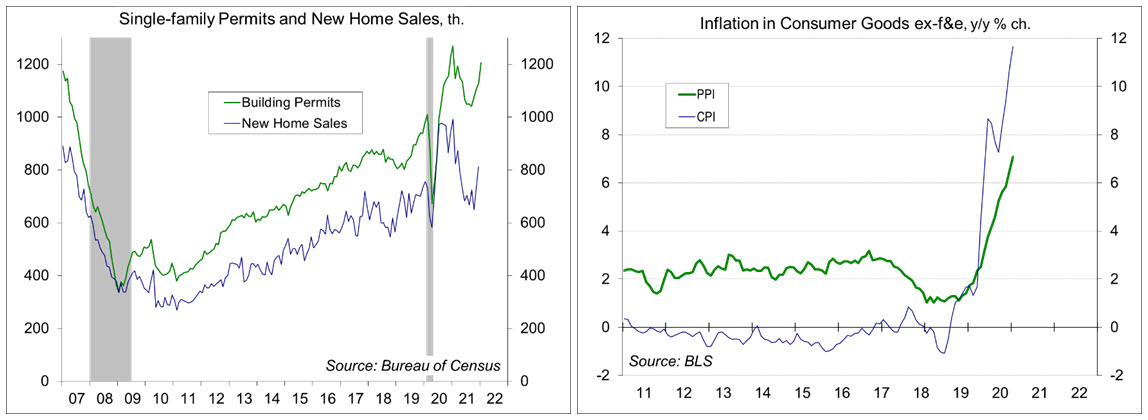

Residential construction figures were mixed in January. Building permits rose 0.7% (+0.8% y/y), with single- family permits up 6.8% (-5.0% y/y). Housing starts fell 4.1% (+0.8% y/y)

The Producer Price Index rose 1.0% in January, up 9.7% from a year ago (vs. +1.6% y/y in January 2021). Ex- food, energy, and trade services, the PPI rose 0.9%, up 6.9% y/y (vs. +1.9% y/y in January 2021). Ex-food & energy, the index for consumer goods (at the wholesale level) rose 7.1% y/y (vs. 1.8% y/y). In comparison, the goods component of the Consumer Price Index rose 11.7% y/y in January (vs. +2.1% in January 2021) – indicating that some of consumer price inflation is demand-pull (in addition to cost-push).

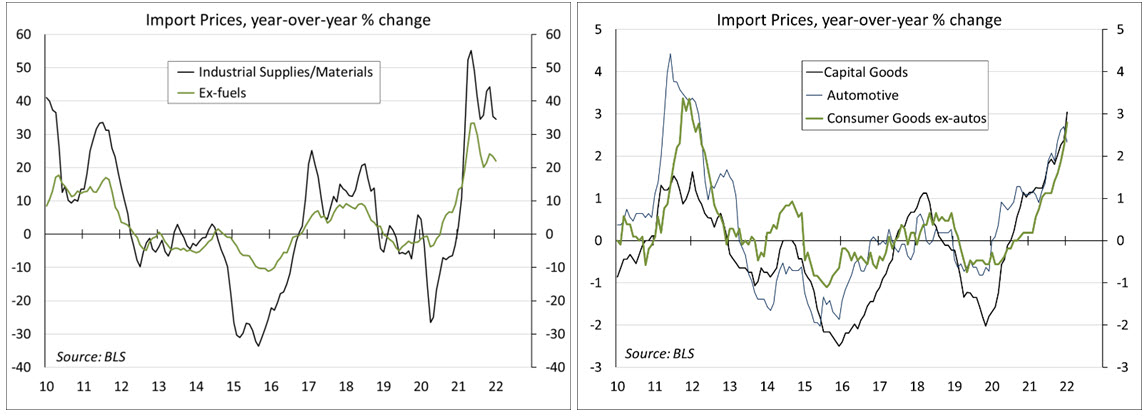

Import prices rose 2.0% in January (+10.8% y/y), partly reflecting a 9.5% increase in petroleum prices (+57.7% y/y). Imported food, feeds, and beverages rose 3.6% (+15.8% y/y). Ex-food & fuels, import prices rose 1.1% (+6.2% y/y), with industrial supplies and materials up 3.2% (+22.0% y/y).

The import price indexes for imported finished goods (capital goods, motor vehicles, and other consumer goods) have been rising at a moderate level – no longer a disinflationary force (as in the last 10 years).

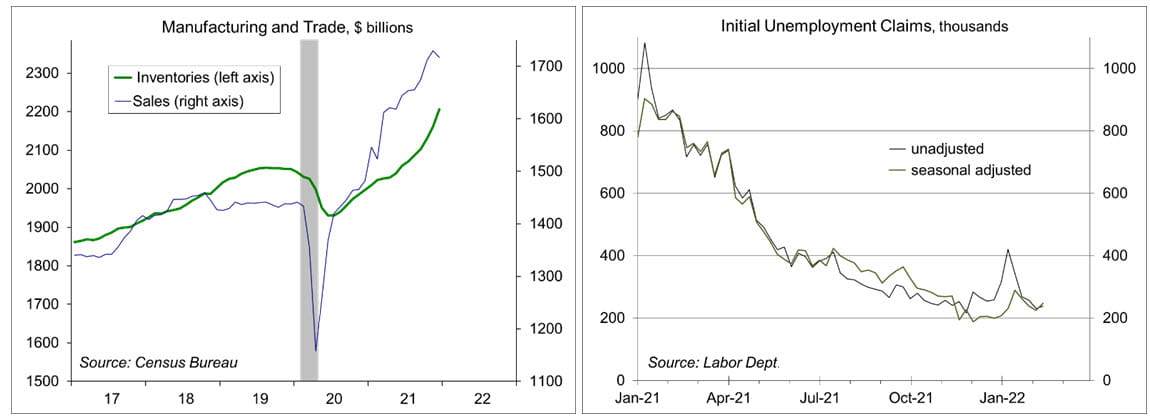

Business inventories rose 2.1% in December (+10.5% y/y). Most of the imbalance has been in retail autos (where inventories rose 6.8%). The inventory-to-sales ratio for retail autos was 1.16, up from a low of 1.07 in November, but it was 1.44 at the end of 2019.

Jobless claims rose by 23,000 in the week ending February 12, to 223,000. Seasonal adjustment is still a bit quirky in February, but the trend is down from early January (consistent with a tight labor market).

Existing home sales, which measure closings, rose 6.5% in January, to a 6.5 million seasonally adjusted annual rate (-2.3%% y/y). The number of homes for sales fell 2.3% (seasonally adjusted), down 16.5% y/y.

The Index of Leading Economic Indicators fell 0.3% in January (following +0.7% in December and +0.8% in November), with six of ten components making negative contributions (the largest from the increase in jobless claims, the drop in consumer expectations, and a lower stock market).

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...