“The demand picture into the second half of 2020 should continue to improve,” says Energy Analyst Pavel Molchanov, “but it would not be realistic for demand to fully normalize in 2021.”

Key takeaways

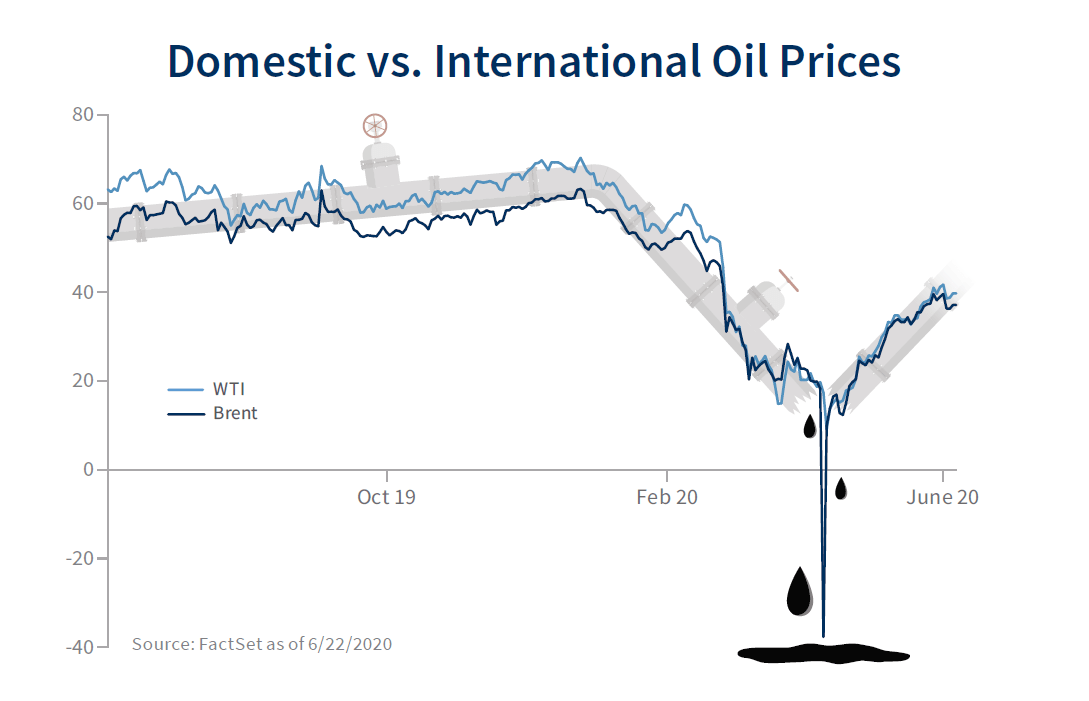

- We do not envision a return to negative prices, but if it were to happen again, investors should focus on Brent – the global benchmark – rather than WTI.

- The demand picture into the second half of 2020 should continue to improve as the various countries move along their reopening roadmaps, but it would not be realistic for demand to fully normalize in 2021.

- Alongside the recovery in demand, the production cuts being implemented by OPEC and Russia are also helping to bring the global supply/demand situation into balance. These cuts took effect in May and the plan is for them to continue, at gradually decreasing levels, into 2022.

It is a good bet that none of us will ever forget seeing West Texas Intermediate (WTI) oil prices at a negative $30 per barrel. Was that the bottom? In a word: Yes. The extraordinary sight of negative pricing marked the worst of the COVID-19 pandemic’s impact on global oil demand. While sub-zero prices are unlikely to be repeated, that does not mean that it will be all smooth sailing from here on out. Demand recovery to pre-COVID-19 levels is unrealistic until 2022, so supply will need to play a key role in rebalancing the market.

Negative oil prices

First, about those negative prices. That was a very short-lived phenomenon – just a few days in mid-April – and, to clarify, it was specific to WTI. WTI, the price most U.S. investors see, is not always indicative of global oil market fundamentals. In April, the overall oil market panic was compounded by a WTI-specific issue: storage in Cushing, Oklahoma (where WTI contracts are priced) was reaching capacity. This is what’s called oil-on-oil competition: literally, not enough room to put the extra barrels. Internationally, while the oil market was also under intense stress, prices did not go negative, because the storage issues were less pressing. We do not envision a return to negative prices, but if it were to happen again, investors should focus on Brent – the global benchmark – rather than WTI.

Supply and demand

We believe that the worst of COVID-19’s demand impact is in the rearview mirror, having peaked in April at upwards of 20 million barrels per day (bpd). The initial recovery since then reflects, above all, the timing of economic reopening decisions by governments. We have been tracking reopening policies in 80 countries, and here is the synopsis: of the 4.3 billion people who have been under a lockdown at some point since January, over 99% have some reopening, including 80% with what we define as reopening concluded. At this point, further reopening is purely a matter of ‘depth’ rather than ‘breadth’, whether using a sectoral approach or along regional lines. The positive read-through for transportation activity is confirmed by traffic congestion data, as well as commentary by refiners and other energy companies during the recently concluded reporting season.

The demand picture into the second half of 2020 should continue to improve as the various countries move along their reopening roadmaps, but it would not be realistic for demand to fully normalize in 2021. Not only will demand in 2021 still be affected by the post-crisis economic damage (high unemployment, business bankruptcies, etc.), but the pandemic has also caused a structural shift in travel patterns around the world. This includes more telecommuting and distance learning, as well as less travel (especially less flying) for both leisure and business purposes. In the absence of a vaccine, the way many people think about the health risk of getting on planes, cruise ships, or even buses will remain problematic. Gauging consumer psychology is more art than science, but our current assumption is that COVID-19’s impact will be 5 million bpd in 2021, disproportionately in aviation. For 2022 and beyond, assuming a vaccine is widely available by that point, thereby enabling a reversion in travel patterns to something closer to pre-COVID-19 levels, we think the impact will diminish to 1.25 million bpd.

Alongside the recovery in demand, the production cuts being implemented by OPEC and Russia are also helping to bring the global supply/demand situation into balance. These cuts took effect in May and the plan is for them to continue, at gradually decreasing levels, into 2022. Even more importantly, drastic cutbacks in the oil industry’s capital spending will weigh on global oil supply for years to come. Capital spending in 2020 is below its previous (2016) trough, and nowhere has it fallen more sharply than in the U.S. At current oil prices, there is no way to avoid U.S. production continuing to fall through all of 2021 and 2022. The industry would simply not be able to generate sufficient cash flow to enable spending to recover to maintenance levels, to say nothing of resuming growth. In addition to the U.S., other countries where organic field declines are likely to be hefty include China, Mexico, and Colombia.

To prevent drawdowns in global oil inventories from reaching unsustainably steep levels (thus leading to a future shortage), oil price recovery will need to be more robust, as well as more rapid, than what is implied by commodity futures. With the caveat that the level of uncertainty – for both demand and supply – has probably never been higher than it is currently, we forecast WTI prices recovering to $38 per barrel in 4Q20 and $50 as the average for 2021. For 2022 and beyond, our long-term assumption is $65.

Read the full July 2020

Investment Strategy Quarterly

Read the full July 2020

Investment Strategy Quarterly

All expressions of opinion reflect the judgment of Raymond James, and are subject to change. Investing involves risk including the possible loss of capital. Past performance may not be indicative of future results. Companies engaged in businesses related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...