December 11, 2020

Chief Economist Scott Brown discusses current economic conditions.

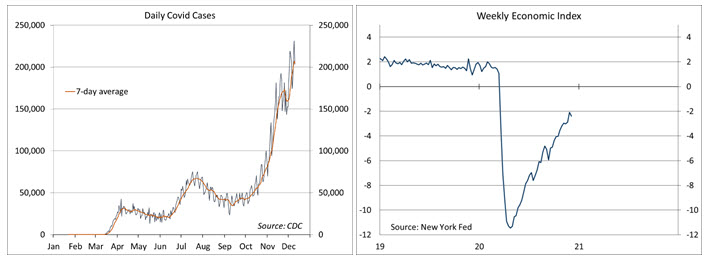

The news on vaccines has boosted optimism for the economy for 2021. In contrast, near-term developments have been unfavorable. COVID-19 cases have surged and in all likelihood will rise further in upcoming weeks. Lawmakers remain in a stalemate on further fiscal support as a number of benefit programs and eviction moratoriums are set to disappear at the end of this month. Investors appear willing to look beyond these concerns.

As we look back on 2020, the good news is that it could have been worse. Back in April, it wasn’t clear whether the pandemic would lead to a broad financial crisis and a snowballing of economic weakness.

The Fed responded by quickly cutting short-term interest rates, restarting emergency lending facilities that it had employed during the 2008-09 financial crisis (and creating some new ones), and boosting the size of its balance sheet. The Fed’s actions would not have any impact on the virus, but the central bank ensured that the financial system would have more than enough liquidity. Some of that liquidity surely found its way to the stock market.

Lawmakers in Washington responded to the crisis with massive fiscal support, boosting healthcare expenditures, providing aid to small businesses, sending out recovery rebate checks (or depositing funds directly into bank accounts), extending unemployment benefits, and providing support to the states (who have suffered from a loss in tax revenues). The fiscal support added to the federal budget deficit, but so what? Government borrowing costs are low (ten-year projections of government interest payments are lower now than before the pandemic). That support was a key factor in shoring up economic activity in the late spring and summer.

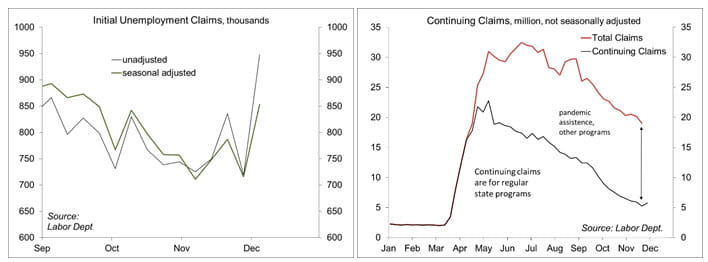

As with any economic crisis, and government efforts to counter the downturn, there are some excesses, fraud, and abuse. Large firms were able to tap into support that should have been reserved for small businesses. The extension of unemployment benefits to the self-employed, part-time workers, and those who had exhausted regular unemployment benefits before the pandemic, led to a massive surge in claims – over six million per week in early April. State unemployment systems were not set up to handle this. Frustrated, many individuals re-filed, often repeatedly. Fraud has been noted across states. The mailbox of an unrented apartment in California received dozens of unemployment checks with different names. People who hadn’t applied received benefits (scammers had likely hoped to get to their mailbox first). The weekly claims figures, while lower than in the spring, have remained relatively high by historical standards. However, it’s unclear how much they are inflated. The number of individuals receiving some sort of unemployment benefits totaled 19.0 million in mid-November, while the official number of unemployed was 6.7 million (according to the November Employment Report). Again, this type of stuff goes on in every downturn. In the aftermath of the 2008-09 financial crisis, there was a surge in Social Security disability. Still, none of this means that unemployed workers aren’t hurting.

Claims have long been one of the more reliable leading economic indicators. That’s no longer the case, as economists learned the hard way back in May, when the claims data had suggested millions in further job losses, while nonfarm payrolls instead rebounded by 2.7 million.

A lot of the economic data have been subject to distortions. The pandemic interfered with the usual sampling, but the data collection agencies adapted. Seasonal adjustment plays a significant role in a number of economic indicators. Those patterns have been altered this year. Seasonal adjustment for some of the data reports has been tweaked. For example, unadjusted retail sales normally jump in March, as winter comes to an end. The March/April lockdown should have resulted in a large seasonally adjusted decline, but that didn’t happen. Back to school sales in August were subpar, and the usual drop in September was more muted, resulting in a strong seasonally adjusted gain. Needless to say, one should take the November retail sales data (arriving December 16) with a grain of salt. The late Thanksgiving and the pandemic ought to have pulled forward sales from December, but the pandemic has accelerated changes in how people shop. Online shopping has been trending sharply higher for many years, while brick-and-mortar stores have generally struggled in recent years – the pandemic has amplified these trends.

The arrival of vaccines will contribute to a substantial recovery in consumer services. Other pandemic-related changes, such as working from home, shopping online, and watching movies at home, are likely to be long-lasting.

Still, the current surge in COVID-19 cases and the likelihood of failed fiscal support from Washington ought to generate more concern than we’ve been seeing. We were lucky that 2020 was an election year. Post-election, fiscal support has become difficult.

Recent Economic Data

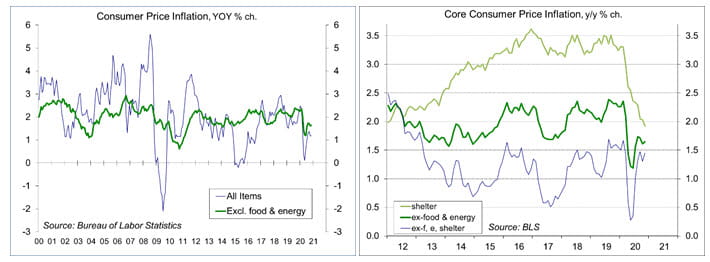

The Consumer Price Index rose 0.2% in November (+1.2% y/y). The index for food slipped 0.1% (+3.7% y/y). Energy rose 0.4% (-9.4% y/y), as a 0.4% decline in gasoline -19.3% y/y) was offset by increases in heating oil, electricity, and natural gas. Excluding food and energy, the CPI rose 0.2% (+1.6% y/y).

Note that the price of the home does not factor into the shelter component of the CPI. The BLS seeks to measure the cost of the service that housing provides, not the asset value, and so considers the rental equivalent for homeowners. Homeowners’ equivalent rent (24% of the overall CPI and 30% of the core CPI) rose 2.3% over the last 12 months, vs. 3.3% in the 12 months before that. Ex-food, energy, and shelter, the CPI rose 1.4% in the 12 months ending in November (vs. 1.6% over the 12 months ending November 2019).

Used car prices have behaved unusually this year, rising early in the pandemic, down more recently. Ex-food, energy, shelter, and used cars, the CPI rose 0.9% y/y (vs. 1.7% in the 12 months ending November 2019). Consumer goods ex-food, energy, and used cars rose 0.1% y/y (vs. +0.2% y/y in November 2019)

The Producer Price Index rose 0.1% in November (+0.8% y/y). Food prices rose 0.5%, following gains of 1.2% in September and 2.4% in October (up 1.2% y/y). Trade services (which measure margins received by wholesalers and retailers) fell 0.3% (+3.1% y/y). Ex-food, energy, and trade services, the PPI also rose 0.1% (+0.9% y/y).

Pipeline inflation pressure remained limited. Prices of raw materials (ex-food & energy) have generally rebounded from the worst of the pandemic, but there is little evidence of a pass-through to finished goods.

Gauging the Recovery

The number of new daily COVID-19 cases has continued to surge. Increased social distancing, whether state mandated or voluntary self-preservation, should slow the pace (and the economy), but we are likely to see the surge get worse before it gets better.

The New York Fed’s Weekly Economic Index edged down to -2.39% for the week of December 5, down from – 2.08% a week earlier (revised from -2.31%) and a low of -11.45% at the end of April, consistent with a moderate pace of growth in the near term. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously). Note that the weekly figures are subject to revision.

Jobless claims jumped to 853,000 in the week ending December 5, up from the previous week’s total of 716,000. Figures tend to be choppy around Thanksgiving, but this latest increase could reflect the impact of the COVID-19 surge. Claims have been distorted throughout the pandemic, reflecting multiple filings and some degree of fraud. The total number of individuals receiving some kind of unemployment benefit was 19.0 million in the week ending November 21 (in the employment report, the number officially “unemployed” was 6.7 million).

The University of Michigan’s Consumer Sentiment Index rose to 81.4 in the mid-month assessment for December (the survey covered November 23 to December 9), vs. 76.9 in November and 81.8 in October. The survey noted partisan splits after the election. Expectations improved on vaccine news, but the current surge in COVID-19 cases had no significant impact on evaluations of current conditions.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Retirement and Longevity October 18, 2024 The 2025 Social Security cost-of-living adjustment (COLA) has...

Markets & Investing April 01, 2024 Raymond James CIO Larry Adam reminds investors they need to be well...

Markets & Investing April 01, 2024 Market rally driven by a broadening of the market and optimism that...