Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

Every month, the Fixed Income Strategy team get together (while practicing social distancing) to talk about the latest trends and ideas across the fixed income landscape. One topic was investor application in terms of significant concepts and ideas. A summary is highlighted in the following bullet points.

First, let me set the stage. This discussion stems as a result of our economic situation and position in the economic cycle. Not what’s happened because of the coronavirus, but rather what’s happened over decades of time.

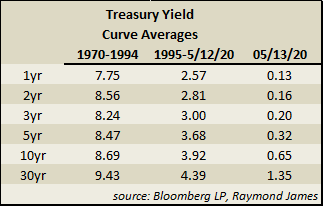

- Notice that between 1970 and 1994, the average 10 year Treasury rate was 8.69%. Over the past 2 ½ decades, it is 3.92%. This is a major alteration that is currently amplified by today’s mere 0.65% 10 year Treasury rate. This may mean more investors will be searching for yield.

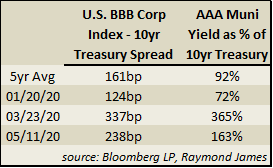

- Many investors hold spread products such as corporate and municipal bonds where yields equal the riskless rate plus some amount of spread. During the early stages of the pandemic, spreads widened out significantly, and although they are wider than 5 year averages, they have appreciably recessed from their highs.

- This is NOT a time to adjust your risk profile to suit your yield desire. In other words, do not reach for yield by sacrificing your primary purpose of protecting principal.

- No two investors are created the same. This is not an exercise in debate but rather an identification of opportunities that are appropriate for some risk profiles but not for others.

- Be careful about generalizing. For example, a request like this is not uncommon: “Create a national municipal portfolio but exclude all Illinois issuers.” Although the idea is to stay clear of the problematic politics and pension worries associated with Chicago, Cook County, etc., the parameter excludes wealthy and dependable issuers whose offerings may actually be wider than financially warranted because of the flawed association with actual troubled municipalities.

- The generalization or “group by association” may apply to the oil & gas sector within corporate offerings. The energy sector is trading at wider spreads than other corporate sectors. This is not surprising as oil futures are trading at ~$25-$30, the Saudi/Russia pricing war and the pandemic shutting down consumer/business demand. This being said, your advisor and background team of professionals can help to identify those companies best able to weather this crisis. It is likely that volatility and even credit downgrades occur over the next couple of quarters but this does not mean defaults. The real and perceived risks must be comprehended and acceptable before taking advantage of the higher yields.

- The transportation sector is also feeling the negative effects of this economic slowdown. There are investors that believe the demand for travel and flights will never recover. These investors need to avoid this sector altogether. There are other investors who see this as temporary slowdown. There is no right or wrong opinion but the difference of opinion may be an opportunity for some. Spreads are wide across the sector, therefore identifying issuers whose financial metrics allow them to withstand the crisis can provide higher yields.

- There are key ratios that can help to uncover a corporation’s financial strength. Credit rating agencies such as Moody’s and S&P provide research and educated ratings as a basis for evaluation. However, not all BBB rated corporations are identical in financial strength. Looking at a company’s ability to pay off incurred debt (debt/EBITDA) and knowing a company’s earnings versus interest payments (EBIT/Interest Expense) can contribute to an investor’s ability to evaluate risk and therefore comfort level. By no means are evaluations like these all-inclusive or all-telling, but they are meant to provide investors seeking more yield more information to assist in evaluation.

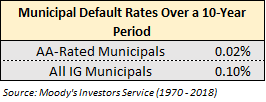

- The overall municipal default rate is extremely low. The current crisis will put more stress on municipalities and may or may not increase defaults. The high grade AA or higher rated municipals may be positioned better positioned to absorb revenue disruption.

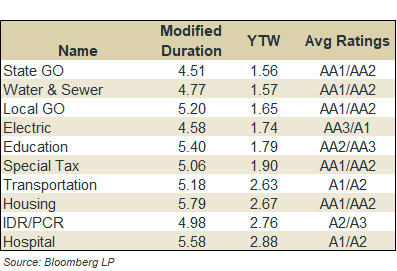

- Municipal sectors are also trading with various spreads.

- Several generalized municipal sectors boast wider yield pickups with strong-rated formidable financial positions. For example, not all toll road authorities are the same. Some possess superior balance sheets, have larger cash-on-hand positions and/or do not rely on state allocations to pay their debt.

- The healthcare industry displays wide variances. Multi-hospital, geographically diverse hospitals can be much better positioned to withstand the economic slowdown.

- Not all airports are the same. The larger hubs will benefit from more traffic even during slowed times. Some airports are positioned with months or even years of cash surplus to absorb revenue cuts.

There is no right or wrong or clear vision of what will occur in the future, just opinions on the evaluation of information. The more information provided, the easier to formulate an opinion on any particular issue. This is not an endorsement on any specific issue but rather an endorsement to keep from falling prey to grouping or herd-mentality. These are ways to increase yield within the high quality space but only if you understand and are willing to accept the associated risks.

Every month, the Fixed Income Strategy team get together (while practicing social distancing) to talk about the latest trends and ideas across the fixed income landscape. One topic was investor application in terms of significant concepts and ideas. A summary is highlighted in the following bullet points.

First, let me set the stage. This discussion stems as a result of our economic situation and position in the economic cycle. Not what’s happened because of the coronavirus, but rather what’s happened over decades of time.

- Notice that between 1970 and 1994, the average 10 year Treasury rate was 8.69%. Over the past 2 ½ decades, it is 3.92%. This is a major alteration that is currently amplified by today’s mere 0.65% 10 year Treasury rate. This may mean more investors will be searching for yield.

- Many investors hold spread products such as corporate and municipal bonds where yields equal the riskless rate plus some amount of spread. During the early stages of the pandemic, spreads widened out significantly, and although they are wider than 5 year averages, they have appreciably recessed from their highs.

- This is NOT a time to adjust your risk profile to suit your yield desire. In other words, do not reach for yield by sacrificing your primary purpose of protecting principal.

- No two investors are created the same. This is not an exercise in debate but rather an identification of opportunities that are appropriate for some risk profiles but not for others.

- Be careful about generalizing. For example, a request like this is not uncommon: “Create a national municipal portfolio but exclude all Illinois issuers.” Although the idea is to stay clear of the problematic politics and pension worries associated with Chicago, Cook County, etc., the parameter excludes wealthy and dependable issuers whose offerings may actually be wider than financially warranted because of the flawed association with actual troubled municipalities.

- The generalization or “group by association” may apply to the oil & gas sector within corporate offerings. The energy sector is trading at wider spreads than other corporate sectors. This is not surprising as oil futures are trading at ~$25-$30, the Saudi/Russia pricing war and the pandemic shutting down consumer/business demand. This being said, your advisor and background team of professionals can help to identify those companies best able to weather this crisis. It is likely that volatility and even credit downgrades occur over the next couple of quarters but this does not mean defaults. The real and perceived risks must be comprehended and acceptable before taking advantage of the higher yields.

- The transportation sector is also feeling the negative effects of this economic slowdown. There are investors that believe the demand for travel and flights will never recover. These investors need to avoid this sector altogether. There are other investors who see this as temporary slowdown. There is no right or wrong opinion but the difference of opinion may be an opportunity for some. Spreads are wide across the sector, therefore identifying issuers whose financial metrics allow them to withstand the crisis can provide higher yields.

- There are key ratios that can help to uncover a corporation’s financial strength. Credit rating agencies such as Moody’s and S&P provide research and educated ratings as a basis for evaluation. However, not all BBB rated corporations are identical in financial strength. Looking at a company’s ability to pay off incurred debt (debt/EBITDA) and knowing a company’s earnings versus interest payments (EBIT/Interest Expense) can contribute to an investor’s ability to evaluate risk and therefore comfort level. By no means are evaluations like these all-inclusive or all-telling, but they are meant to provide investors seeking more yield more information to assist in evaluation.

- The overall municipal default rate is extremely low. The current crisis will put more stress on municipalities and may or may not increase defaults. The high grade AA or higher rated municipals may be positioned better positioned to absorb revenue disruption.

- Municipal sectors are also trading with various spreads.

- Several generalized municipal sectors boast wider yield pickups with strong-rated formidable financial positions. For example, not all toll road authorities are the same. Some possess superior balance sheets, have larger cash-on-hand positions and/or do not rely on state allocations to pay their debt.

- The healthcare industry displays wide variances. Multi-hospital, geographically diverse hospitals can be much better positioned to withstand the economic slowdown.

- Not all airports are the same. The larger hubs will benefit from more traffic even during slowed times. Some airports are positioned with months or even years of cash surplus to absorb revenue cuts.

There is no right or wrong or clear vision of what will occur in the future, just opinions on the evaluation of information. The more information provided, the easier to formulate an opinion on any particular issue. This is not an endorsement on any specific issue but rather an endorsement to keep from falling prey to grouping or herd-mentality. These are ways to increase yield within the high quality space but only if you understand and are willing to accept the associated risks.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...