Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Last summer, the lower bound of the Fed Funds rate was at 2.25%. Six months after that, the Fed had lowered it down to 1.50%, and by March it had fallen to 0.00%.

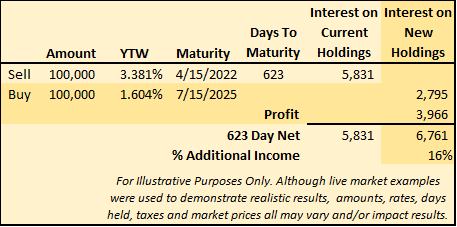

Why would I sell a bond yielding 3.381% only to have to reinvest the proceeds into today’s low interest rate environment? The answer is to pick up 16% gross return over hanging on to your bonds.

Click here to enlarge

Sources: TradeWeb Direct, Raymond James.

In order to simplify the rationale, we will run the numbers knowing that taxes, amounts, rates, days held and market prices all may vary and/or impact results but the point of the exercise is to illustrate a current market opportunity.

The suggested bond sell has a maturity within the Fed’s proclaimed period where they do not plan on raising short term interest rates. This matters because we have been told the Fed’s intentions and therefore have some assurance that waiting to reinvest at maturity is not likely to bear higher reinvestment yields. Also, the demand for high quality short-term investments is providing high bid prices.

Simple math: the chart displays the interest income that would be received if a bond was held to maturity ($5,831 interest income). So why sell and reinvest at a 1.604% yield ($2,795 interest income over the exact same number of days)? Because the market is also going to pay you $3,966 for the sold bond. The market is paying you 63% of the income (yield) waived via a profit, by selling now ahead of the stated maturity. The profit plus the interest earned over the exact same number of days will gross 16% more income ($6,761 vs. $5,831).

This is an extension swap. The new bond has a longer maturity than the bond sold (4.6yrs vs. 1.4yrs). The additional 3.2 years is a very modest extension in a rate environment realistically expected to stay very low for a very long time. If you thought interest rates would be significantly higher in April 2022 (the maturity date), you would not want to execute this trade but rather wait until maturity to redeploy the assets.

What makes this an attractive consideration counts on the Fed’s rate assertion and the aggressive demand for very short bonds. In some ways, this example may understate the benefits. The proceeds from selling this bond would allow a larger reinvestment (~$103k) which would produce more interest income than the example displays. Furthermore, there are story bonds, selective bonds whose true value has been discounted due to their struggling sectors, which could also increase the income benefits. It is difficult to find opportunities in this historically low rate environment, but conditions are ripe for this low hanging fruit to benefit many portfolios.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...