Chief Economist Scott Brown discusses current economic conditions.

Monetary and fiscal policy played a significant role in lessening the pandemic’s impact on the economy. The Fed has done its part, ensuring that there is plenty of liquidity in the financial system. Further fiscal support is needed, but has been difficult to achieve. As a consequence, growth is likely to slow into early 2021. However, growth should pick up as vaccines are rolled out. Beyond that, the new administration will have an ambitious agenda.

There’s been a lot of bad news during the pandemic, but one clear positive is that financial conditions did not deteriorate sharply. That wasn’t clear early on, as credit spreads widened sharply in early March. The Federal Reserve was quick to lower short-term interest rates and boost asset purchases (QE). The central bank re-launched credit facilities that it had employed in the 2008-09 financial crisis and created some new ones. While there are still concerns about the servicing of consumer and business debt, this did not develop into a financial crisis. The Fed’s goal here was to provide liquidity. None of what the Fed did would affect the virus.

Fiscal policy is more effective in a downturn. The amount of support was gigantic and helped to shore up consumer spending in the late spring and summer. We lost about 22 million jobs in March and April and have gained about 12 million through October. The hit to the consumer services was severe and many of these jobs are not going to come back right away. As part of the stimulus, unemployment benefits were expanded and enhanced. Those normally ineligible to receive benefits (the self-employed, part-time workers, those who has previously exhausted their benefits) could apply. The federal government added extra money to unemployment benefits ($600 per week), although that went away at the end of July. The increase in eligibility is set to expire at the end of the year.

The government’s funding authority ends December 11. It should be easy enough to agree on a Continuing Resolution to fund the government into the early part of 2021, but a government shutdown cannot be ruled out. Recall that we had a government shutdown for 35 days just two years ago (December 22, 2018 to January 25, 2019). Doing so in the middle of a pandemic would be irresponsible. Stimulus discussions are likely to get bogged down in the battle over spending.

The outlook in Washington depends critically on Georgia’s two run-off senatorial elections on January 5. If Democrats win both seats, the party would take control of the Senate 50-50 with Vice-President-elect Harris having the power to break ties. That doesn’t appear to be the likely outcome at this point, but stranger things have happened. If Republican’s maintain control of the Senate, we can expect it to be a hard check on President- elect Biden’s agenda.

Biden will focus on the pandemic and rolling out vaccines. Further fiscal stimulus will be an important task (if we don’t get anything in the remainder of this year. Beyond the pandemic, two key issues will be foreign trade and antitrust regulation.

Don’t expect Biden to roll back tariffs on China. The tariffs have raised costs for U.S. consumers and businesses, invited retaliation (tariffs on U.S. exports), disrupted supply chains, and added uncertainty in the last two years. Decreasing tariffs would actually help the recovery. However, bashing China plays well politically, especially in the Midwest, and Democrats will keep that in mind as the look ahead to the 2022 mid-term elections and the 2024 elections.

Antitrust enforcement is also on the agenda. The regulation of large tech firms has gotten a lot of media attention, but the bigger issue for the incoming administration will be the concentration of market power. Certainly, there are benefits from scale (reduced overhead costs, for example), but Democratic advisors believe that market power has grown more concentrated largely due to limited enforcement resources, “captured” regulators, and the judicial system. We can expect a push for new antitrust regulation and increased funding for the Federal Trade Commission and Antitrust Division for antitrust enforcement. The judiciary plays a vital role in antitrust and cases can be complex, costly, and lengthy. Republicans will certainly put up road blocks.

As with the incoming administration 12 years ago, the immediate task will be to right the ship, and that means (in the current context) focusing attention on the pandemic. It’s interesting to note that the 1918 pandemic was associated with many of the same debates going on now. There were battles over wearing face masks. Some cities fought the pandemic harder than others, with varying degrees of success (or failure). Yet, the one thing we learn from history is that nobody learns from history.

|

Household Pulse Survey Update Based on responses collected October 28 through November 9, the Household Pulse Survey estimates that:

|

Small Business Pulse Survey Update Based on responses collected November 9 through November 15, the Small Business Pulse Survey estimates that:

|

Source: Bureau of Census

Recent Economic Data

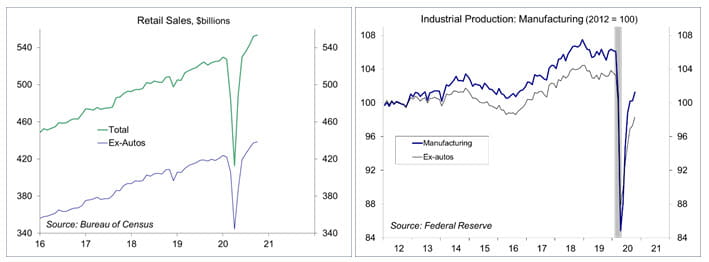

Retail sales rose 0.3% in the initial estimate for October, with upward revisions to figures for August and September, stronger than before the pandemic (up +4.9% from February). Sales rose 0.2% ex-autos (+4.4% y/y). Core sales, which exclude autos, building materials, gasoline, and food, rose 0.3% (+9.7% y/y). While sales of vehicles, home furnishings, home repair, and groceries have moved beyond pre-pandemic level, sales at clothing stores, department stores, gas stations, and restaurants remain depressed.

Industrial production rose 1.1% in October (-5.3% y/y). Manufacturing output rose 1.0% (-3.6% y/y), down 4.6% from February (all major industries remained below pre-pandemic levels).

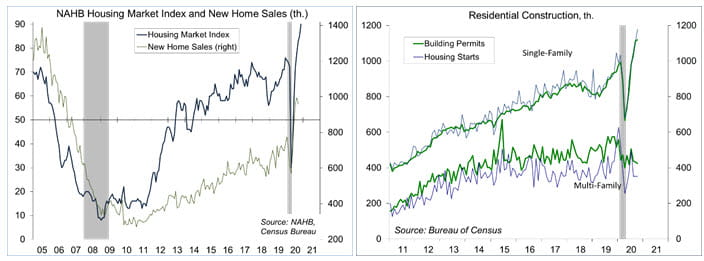

Homebuilder sentiment (the National Association of Home Builders Housing Market Index) hit another record high in November (90, vs. 85 in September).

Single-family building permits rose 0.6% in October (+20.6% y/y), up 7.4% from February.

Existing home sales rose 4.3% in October to a 6.85 million seasonally adjusted annual rate (+26.6% y/y). Strength came despite supply constraints (a limited number of homes for sales).

The Conference Board’s Index of Leading Economic Indicators rose 0.7% in October, with positive contributions led by ISM new orders and the decline in jobless claims. The figures were consistent with a moderation in GDP growth in the fourth quarter.

Gauging the Recovery

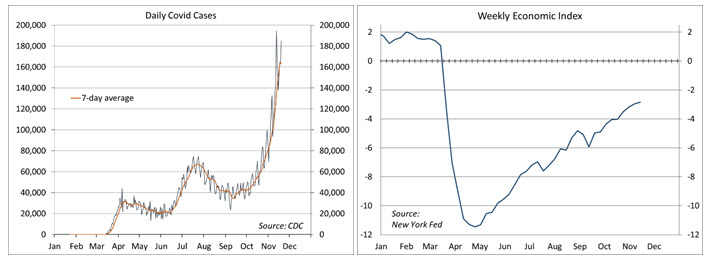

The number of new daily COVID-19 cases has continued to surge. Increased social distancing, whether state mandated or voluntary, should slow the pace (and the economy), but we could see family get-togethers for Thanksgiving add to the problem into December.

The New York Fed’s Weekly Economic Index edged up to -2.84% for the week of November 14, up from -2.96% a week earlier (revised from -2.68%) and a low of -11.45% at the end of April, consistent with a moderate pace of growth. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously). Note that the weekly figures are subject to revision.

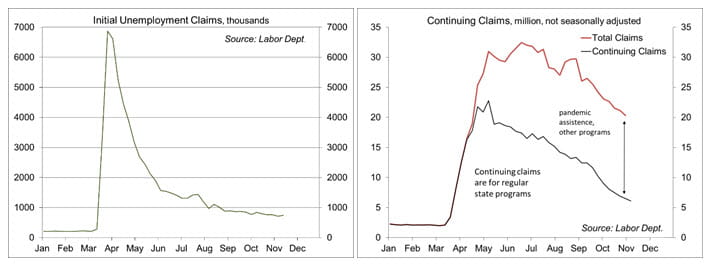

Jobless claims, a leading economic indicator, rose to 742,000 in the week ending November 14, up from the previous week’s total of 711,000. Figures tend to be choppy in the final two months of the year. The four- week average was 742,000 – still elevated. Continuing claims (for regular state unemployment insurance programs) fell by 429,000 (week ending November 7) to 6,372,000. It’s unclear whether the downtrend in continuing claims is due to people finding work or whether they have exhausted their benefits.

The University of Michigan’s Consumer Sentiment Index fell to 77.0 in the mid-month assessment for November (the survey covered October 28 to November 10), vs. 81.8 in October and 80.4 in September. Evaluations of current conditions were little changed, but expectations fell from 79.2 to 71.3, reflecting (according to the report) Republican disappointment with the election results and concerns about rising COVID-19 cases.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...