Chief Economist Scott Brown discusses current economic conditions.

The June job market report and other indicators remained consistent with an unprecedented steep drop in economic activity in March and April, followed by a sharp-but-partial rebound in May and June. Many of these data were collected before the recent surge in COVID-19 cases. A return to a full lockdown appears unlikely, but self-imposed social distancing should contribute to a more modest pace of improvement.

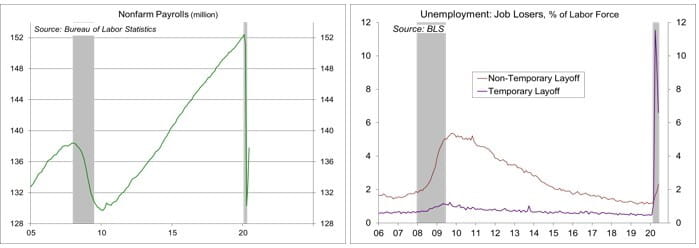

As state economies began to re-open, a rebound in jobs was anticipated. Gains came a little earlier and stronger than expected. Nonfarm payrolls were reported to have risen by 4.80 million in June, following a 2.70 million increase in May. These are record monthly increases. However, payrolls are still 14.64 million (-9.6%) below February’s level. Leisure & hospitality added 1.48 million jobs, with about 70% of those in restaurants. Retail added 740,000. Manufacturing rose by 356,000 (196,000 in motor vehicles). Yet, each of these sectors were far below year-ago levels (-39.8% in leisure & hospitality, -12.5% for retail, -8.6% in manufacturing). The payroll survey covers the pay period that included the 12th of the month, hence is weighted toward the first half of the month (when the number of new COVID-19 cases was around 20,000 per day – it’s now at 50,000).

The unemployment rate fell to 11.1% in June (from 13.3% in May and 14.7% in April). Those on temporary layoff should be counted as “unemployed, on temporary layoff,” but many were categorized as “employed” in the last few months. This classification issue led to an under- reporting of the unemployment rate by five percentage points in April (the unemployment rate should have been closer to 20%), three percentage points in May, and (according to the BLS) at most one percentage point in June. Details from the household survey showed a sharp (but partial) drop in those on temporary layoffs in June, while those on permanent layoffs have increased. That likely reflects a broadening of labor market weakness beyond those sectors immediately effected by the pandemic.

This has been a recession like no other. The pandemic led to a sharp decrease in economic activity. We should see a rebound as the pandemic passes. However, it’s clear that that passing won’t be anytime soon. The U.S. has been unsuccessful in containing the virus, which means that our re-opening is going to take a lot longer. None of that should be a surprise. We were warned. Europe countries have had some issues re-opening their economies, but they did a much better job in tamping down the number of new cases and have put in place procedures to trace contacts.

At their June 9-10 monetary policy meeting, Federal Reserve officials noted that “there remained an extraordinary amount of uncertainty and considerable risks to the economic outlook.” The Fed is prepared to do more to support the economy if needed. Congress, on the other hand, appears to be split on the need, with some lawmakers pointing to the May and June job gains. That is a seriously bad take, as we have a lot more ground to make up. There are plenty of stories about the undeserving receiving benefits, but there are just as many stories of those falling through the cracks – and importantly, many jobs won’t be coming back.

The nonpartisan Congressional Budget Office now estimates that Gross Domestic Product (GDP) won’t return to its pre-pandemic level until the middle of 2022. Moreover, the CBO doesn’t expect GDP to get back to potential until 2028.

Recent Economic Data

The daily number of new COVID-19 cases in the U.S. rose to over 50,000 for the first time. The Conference Board’s Consumer Confidence Index rose to 98.1, from May’s 85.9), but the survey was mostly before the recent rise in COVID-19 cases. Minutes of the June 9-10 FOMC meeting showed that Federal Reserve officials were concerned about the economy and were prepared to do more to support the recovery

The ISM Manufacturing Index rose to 52.6 in June, vs. 43.1 in May and 41.5 in April, with gains in new orders and production, but a further decline in employment. Comments from supply managers was positive.

Factory orders rose 8.0% in May (-15.8% y/y), rebounding from aircraft order cancellations in March and April. Orders for consumer durables rose 27.1% (still down 56.7% from a year earlier). The drop in orders and shipments in capital goods has been much smaller than during the financial crisis.

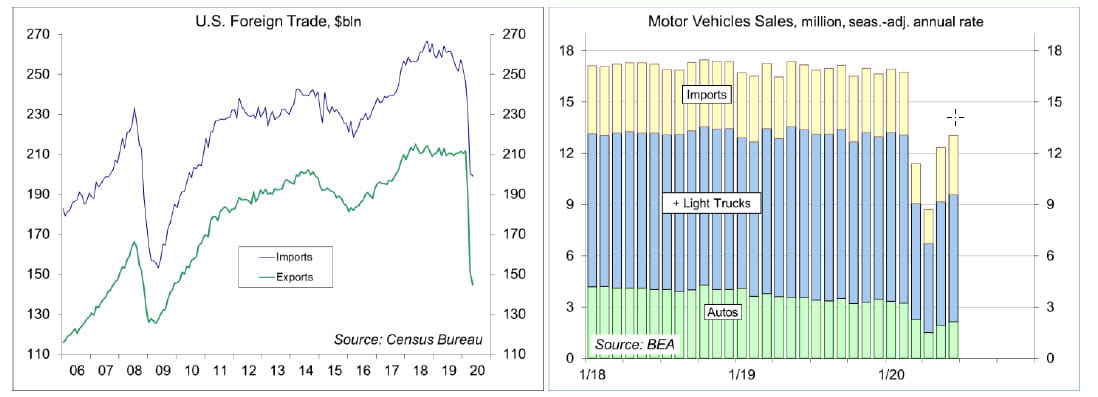

U.S. trade activity continued to contract in May, with merchandise exports down 5.8% (-35.3% y/y). Merchandise imports fell 0.8% (-22.8% y/y). The surplus in trade services continued to decline. Net exports are expected to subtract from GDP growth in 2Q20.

Unit motor vehicle sales rose to a 13.0 million annual rate in June, vs. 12.3 million in May and 8.7 million in April.

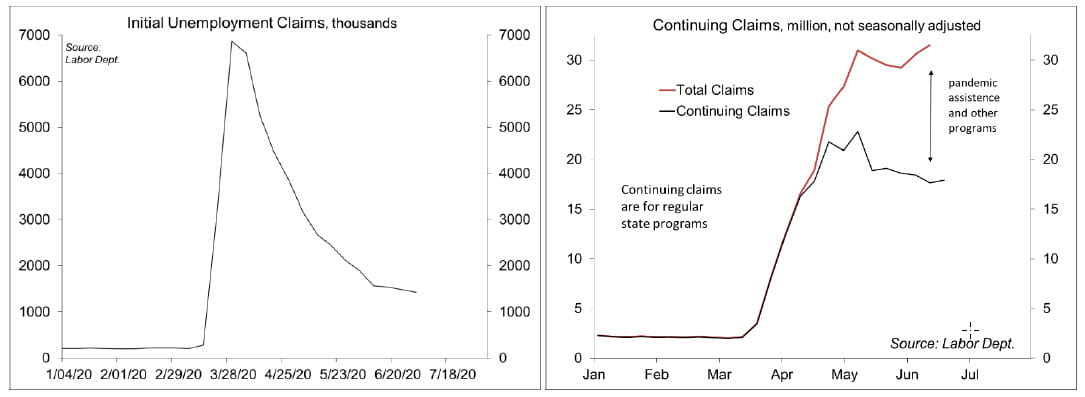

Gauging the Recovery

Jobless claims fell to 1.427 million in the week ending June 27, trending down, but still very high. Continuing claims fell by 59,000 in the week ending June 20, to 19.290 million (seasonally adjusted). The figures are for regular state unemployment insurance programs and do not include pandemic assistance and other programs. Total recipients, including all programs, were 31.492 million (not seasonally adjusted) for the week ending June 13 (up from 30.575 million in the week ending June 6). Pandemic assistance includes self-employed and part-time workers (who normally wouldn’t qualify for benefits), as well as individuals who had previously exhausted their unemployment benefits.

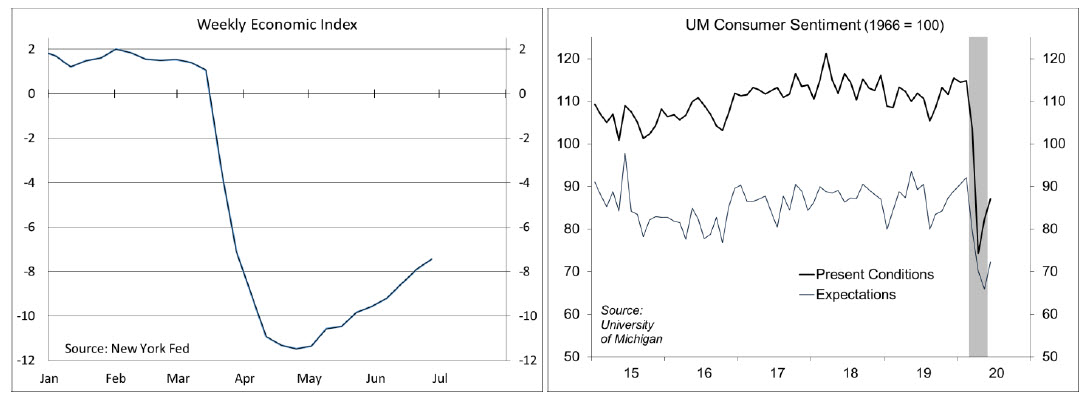

The New York Fed’s Weekly Economic Index rose to -7.44% for the week of June 27, up from -7.91% in the previous week and a low of -11.48% at the end of April. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously).

The University of Michigan’s Consumer Sentiment Index rose to 78.1 in the full-month assessment for June (the survey covered May 27 to June 22), up from 72.3 in May, but down from 78.9 at mid-month. Expectations remained weak. The report noted that “While most consumers believe that economic conditions could hardly worsen from the recent shutdown of the national economy, prospective growth in the economy is more closely tied to progress against the coronavirus.”

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...