Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

We’ve been promoting the merits of asset allocation. But, is it working? Rather than theorize on the process and the benefits, let’s examine an actual portfolio and how it has performed over the last year.

Although the numbers are gathered from an actual proposal that was executed a little over a year ago, tax brackets, risk profiles, market conditions, availability, etc. are all subject to changes and we present this corporate bond portfolio for illustrative purposes only.

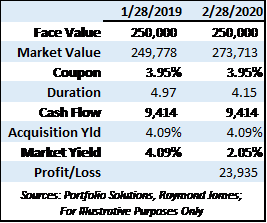

This $250,000 corporate portfolio was purchased a little over one year ago at a 4.09% yield. The 5 year Treasury yield was ~2.58% so this portfolio was spread 151bp above that. The stock market punch-in-the-gut has been prompted by coronavirus fears. So how has this investor’s fixed income portfolio been affected?

They bought the portfolio earning 4.09%. Today, it is earning 4.09%. The cash flow is consistent. The coupon is the same. The duration has dropped slightly as we would expect (all holdings roll down the curve or get closer to maturity). The market price has drastically changed reflecting a 2.05% market yield. Although this investor is still earning 4.09% they could potentially sell the entire portfolio for a $23,935 profit. Sell and earn a profit or do nothing and earn an above market yield. Not a bad choice.

However, the true benefit that this portfolio is providing is that it offset to the market last week. Equities that endowed investors with huge 2019 returns are suffering a large pullback so far in 2020. By example, the S&P 500 index had a 31% 2019 total return and year-to-date 2020 total return of -8%. The sample bond portfolio yielded 4.09% in 2019 and will continue to earn 4.09% in 2020 until bonds start to mature. At that point the investor will receive 100% of the face value of their bond.

Is it working? YES! What’s working today? These are long term strategies. The same principals apply. You can mitigate interest rate risk by laddering out maturities. This allows a more even distribution and reinvestment of funds that will average any market moves over time. Spreading out maturities avoids making a “bet” on timing or any particular part of the curve.

Still, investors want to know where the greatest values are (within the investment grade sector) to compensate for the lower interest rate environment. Corporate and municipal curves remain a bright spot as their curves have remained upward sloping. Here are actionable considerations:

- The corporate “sweet” spot is in the 5-9 year range (sufficient yield pick-up versus additional duration). BBB rated corporates steepened last week ~5bp as measured by the 1-10 year corporate slope.

- Although yields are falling hastily, corporate spreads have widened significantly to help offset some of the real yield lost to a lower rate environment. Last week, BBB rated investment grade corporates widened 18bp and A-rated corporates widened 15bp. A wider spread equals a higher purchase yield versus Treasuries.

- Sell weak corporate credits and durations that are too long. All market yields have been trampled in this rate environment. Lower yields mean higher dollar bids. This may be an opportune time to reduce credit risk or duration risk.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...