Medicare open enrollment provides the opportunity to pair coverage with life’s changes.

The arrival of fall also marks the arrival of Medicare open enrollment from October 15 to December 7. During this time, you can change from Original Medicare to a Medicare Advantage plan or vice versa or switch from one Medicare Advantage plan to another. You can also join a Medicare Advantage or Medicare prescription drug plan for the first time or drop your drug coverage completely. The point is you’ve got options.

Open enrollment presents a great opportunity to make sure you’re getting the most from Medicare. Every year you should compare your current plan to other plans in your area in case one offers better health and/or drug coverage at lower prices or that better fits your needs.

Reevaluate your needs

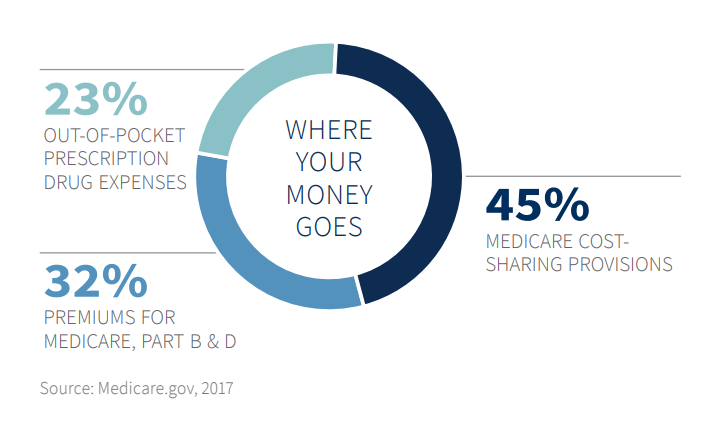

The coverage provided by insurance companies often changes each year and could result in paying more on out of pocket healthcare expenses throughout the year. Here are some tips to help you get started.

- Ask important questions. Have your needs changed? Is your current coverage adequate? Is the cost of your current plan going up? Are there comparable, lower-cost plans available?

- Review the annual notice of change from your current plan provider. You should receive this in September.

- If you have a Medicare Advantage plan, make sure your doctor will still accept your plan next year. If your doctor is out of network, you must choose a new plan or pay higher out-of-pocket costs.

- Carefully review your prescription drug coverage and what those copayment and coinsurance costs are.

- If you switch from a Medicare Advantage plan to Original Medicare, you may want to join a standalone Part D plan to get Medicare drug coverage.

- Compare plans using the Medicare Plan Finder at medicare.gov.

Know the risk

If you decide to drop drug coverage, you can rejoin in the future. But, if you go 63 days or more in a row without other creditable prescription drug coverage:

- You’ll have to wait for an enrollment period to sign up for coverage.

- You may have to pay a late enrollment penalty. Learn more at medicare.gov.

Medicare can be complicated, but your advisor can help. He or she has assessment tools to help determine the right coverage if you are transitioning to Medicare or if you are updating current coverage. The choices are numerous and are driven by many factors including personal health, choice of doctors, financial considerations and even ZIP codes.

Next steps

- Mark the Medicare open enrollment dates on your calendar.

- Review the annual notice of change from your current plan provider.

- Set aside time with your advisor to assess your current coverage and make adjustments.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...